- United States

- /

- Insurance

- /

- NYSE:THG

If You Like EPS Growth Then Check Out Hanover Insurance Group (NYSE:THG) Before It's Too Late

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Hanover Insurance Group (NYSE:THG). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

View our latest analysis for Hanover Insurance Group

Hanover Insurance Group's Earnings Per Share Are Growing.

If a company can keep growing earnings per share (EPS) long enough, its share price will eventually follow. That makes EPS growth an attractive quality for any company. It certainly is nice to see that Hanover Insurance Group has managed to grow EPS by 28% per year over three years. If the company can sustain that sort of growth, we'd expect shareholders to come away winners.

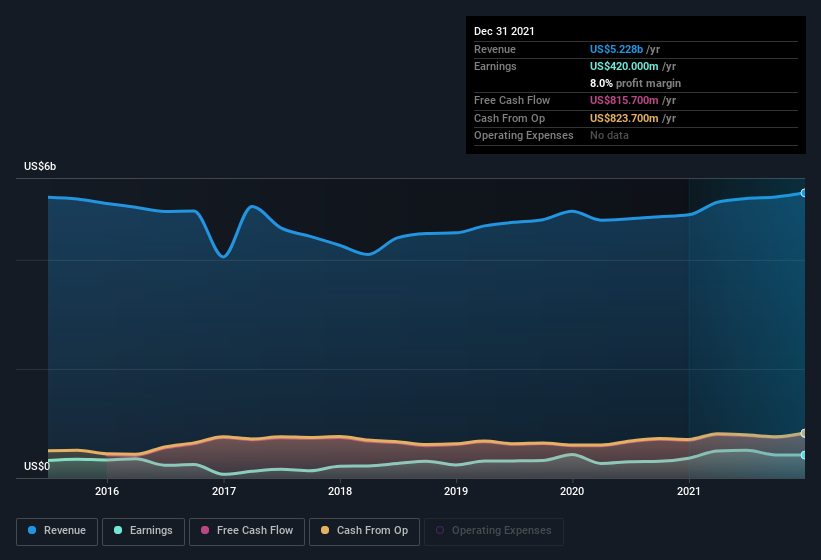

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. I note that Hanover Insurance Group's revenue from operations was lower than its revenue in the last twelve months, so that could distort my analysis of its margins. Hanover Insurance Group maintained stable EBIT margins over the last year, all while growing revenue 8.4% to US$5.2b. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

While we live in the present moment at all times, there's no doubt in my mind that the future matters more than the past. So why not check this interactive chart depicting future EPS estimates, for Hanover Insurance Group?

Are Hanover Insurance Group Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

While we did see insider selling of Hanover Insurance Group stock in the last year, one single insider spent plenty more buying. To wit, Executive VP & CFO Jeffrey Farber outlaid US$618k for shares, at about US$124 per share. That certainly pricks my ears up.

On top of the insider buying, it's good to see that Hanover Insurance Group insiders have a valuable investment in the business. Given insiders own a small fortune of shares, currently valued at US$51m, they have plenty of motivation to push the business to succeed. That's certainly enough to make me think that management will be very focussed on long term growth.

While insiders already own a significant amount of shares, and they have been buying more, the good news for ordinary shareholders does not stop there. That's because on our analysis the CEO, Jack Roche, is paid less than the median for similar sized companies. For companies with market capitalizations between US$4.0b and US$12b, like Hanover Insurance Group, the median CEO pay is around US$8.1m.

The Hanover Insurance Group CEO received US$6.8m in compensation for the year ending . That seems pretty reasonable, especially given its below the median for similar sized companies. CEO compensation is hardly the most important aspect of a company to consider, but when its reasonable that does give me a little more confidence that leadership are looking out for shareholder interests. I'd also argue reasonable pay levels attest to good decision making more generally.

Does Hanover Insurance Group Deserve A Spot On Your Watchlist?

Given my belief that share price follows earnings per share you can easily imagine how I feel about Hanover Insurance Group's strong EPS growth. The cranberry sauce on the turkey is that insiders own a bunch of shares, and one has been buying more. So it's fair to say I think this stock may well deserve a spot on your watchlist. Before you take the next step you should know about the 1 warning sign for Hanover Insurance Group that we have uncovered.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Hanover Insurance Group, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Hanover Insurance Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:THG

Hanover Insurance Group

Through its subsidiaries, provides various property and casualty insurance products and services in the United States.

Established dividend payer with adequate balance sheet.