- United States

- /

- Insurance

- /

- NYSE:STC

Stewart Information Services (STC): Evaluating Valuation as Rate Cut Expectations Spark Investor Optimism

Reviewed by Simply Wall St

Recent comments from New York Federal Reserve President John Williams have sparked interest among investors in Stewart Information Services. Many are eyeing the potential for lower interest rates, which could have a positive impact on Stewart’s bond holdings and business outlook.

See our latest analysis for Stewart Information Services.

After investors reacted to the Fed's comments, Stewart Information Services saw its share price climb 2.45% in a single day and a solid 6.88% over the past week, suggesting positive momentum is taking hold. With a 17.01% year-to-date share price return and impressive three- and five-year total shareholder returns of 98.14% and 109.95% respectively, Stewart’s story is one of steady gains, even as market attention shifts toward interest rate trends and recent industry conferences.

If you're interested in broadening your search beyond Stewart, this could be the perfect time to discover fast growing stocks with high insider ownership.

With shares surging and rate-cut hopes running high, investors are now asking whether Stewart Information Services is trading below its intrinsic value or if the market has already factored in its future growth. The question remains: does a true buying opportunity remain?

Most Popular Narrative: 3.7% Undervalued

Stewart Information Services is trading close to what the most-followed narrative sees as fair value, with a modest upside versus its last close of $77.03. Narrative drivers focus on new digital offerings and higher margins that could reshape earnings power.

The company is experiencing significant growth in its Title segment, specifically in commercial services and asset classes like retail and energy, which could positively impact revenue and pretax income. Strategic acquisitions in targeted Metropolitan Statistical Areas (MSAs) are anticipated to drive growth, increasing future revenue and earnings.

The real secret is buried in potential margin gains, future profit multiples, and aggressive expansion bets. Are those the numbers that underpin the optimism? Get behind the narrative and see exactly what’s fueling its fair value calculations.

Result: Fair Value of $80 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weakness in the housing market and higher operating expenses could quickly undermine the case for margin expansion and continued earnings growth.

Find out about the key risks to this Stewart Information Services narrative.

Another View: What Does the Market Multiple Say?

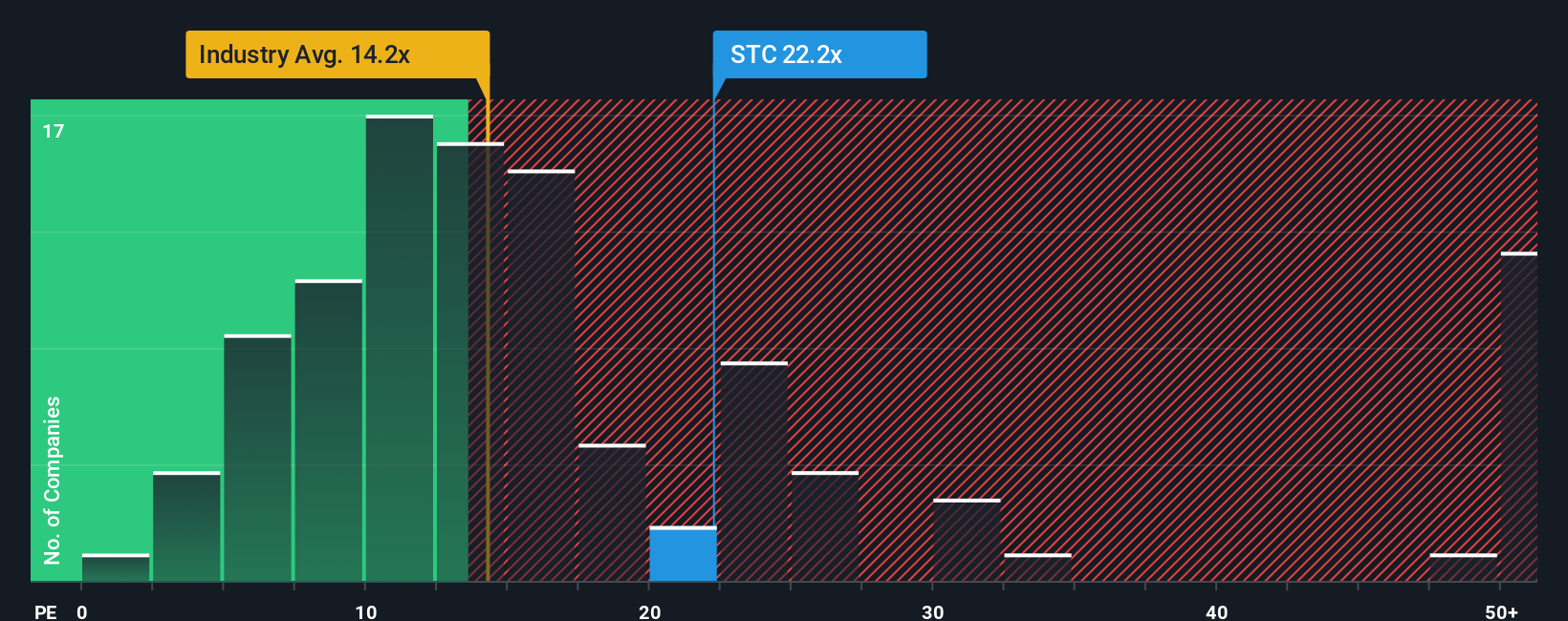

Looking at Stewart’s valuation through the lens of price-to-earnings, the shares trade at 21.2 times earnings. This is higher than the US Insurance industry average of 12.9 times, but roughly in line with its fair ratio of 21.5 times and well below peers at 39.1 times. This spread suggests there may be extra risk or opportunity depending on how profits evolve over time. Could the current pricing signal a fair shake, or is there value the market hasn’t priced in?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Stewart Information Services Narrative

If these numbers or narratives don’t quite fit your perspective, you can dig into the data and craft a story of your own in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Stewart Information Services.

Looking for more investment ideas?

Take action and give yourself an edge by tracking other promising opportunities curated by Simply Wall St’s powerful Screener. Don’t let a great prospect slip by. Uncover them now.

- Tap into potential long-term income with stable yields when you use these 14 dividend stocks with yields > 3% for finding leading dividend payers.

- Spot undervalued gems before the market catches on by starting your search with these 925 undervalued stocks based on cash flows, which is focused on solid cash flows.

- Ride the next innovation wave with these 26 AI penny stocks, featuring companies that are revolutionizing industries and redefining what’s possible in artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:STC

Stewart Information Services

Through its subsidiaries, provides title insurance and real estate transaction related services in the United States and internationally.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success