- United States

- /

- Insurance

- /

- NYSE:SPNT

SiriusPoint (SPNT) Taps Experienced CIO: Will New Leadership Reshape Its Investment Approach?

Reviewed by Sasha Jovanovic

- SiriusPoint Ltd. recently announced the appointment of Maria Tarhanidis as Chief Investment Officer, effective December 2, 2025, bringing more than 25 years of investment leadership experience from institutions such as Brighthouse Financial, MetLife, GM Asset Management, and Deutsche Bank.

- The addition of Ms. Tarhanidis signals a potential shift in how SiriusPoint could approach asset allocation, portfolio risk, and overall investment performance at a senior executive level.

- We'll explore how her extensive track record in alternative investments and risk management may shape the company's broader investment narrative.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

SiriusPoint Investment Narrative Recap

For shareholders in SiriusPoint, the underlying investment thesis rests on the company's ability to maintain premium growth and margin expansion through selective MGA partnerships and disciplined underwriting, while steadily improving investment returns. The appointment of Maria Tarhanidis as Chief Investment Officer could impact short-term sentiment given ongoing focus on optimizing portfolio yield, but does not materially shift the primary business catalyst of scaling higher-margin specialty lines or address the most immediate risk: potential underperformance from newly onboarded MGAs or competitive margin pressure in specialty underwriting.

Among recent company developments, the appointment of Andrew Pryde as Group Chief Risk Officer earlier in 2025 stands out as closely related to SiriusPoint’s leadership overhaul. His risk management experience, combined with the addition of an experienced CIO, reinforces management’s commitment to portfolio discipline, a theme tied to both the company’s growth initiatives through MGA partnerships and its ability to manage underwriting and investment risks.

In contrast, investors should also be aware of the possibility that new MGA relationships could underperform or fail to deliver expected growth if initial...

Read the full narrative on SiriusPoint (it's free!)

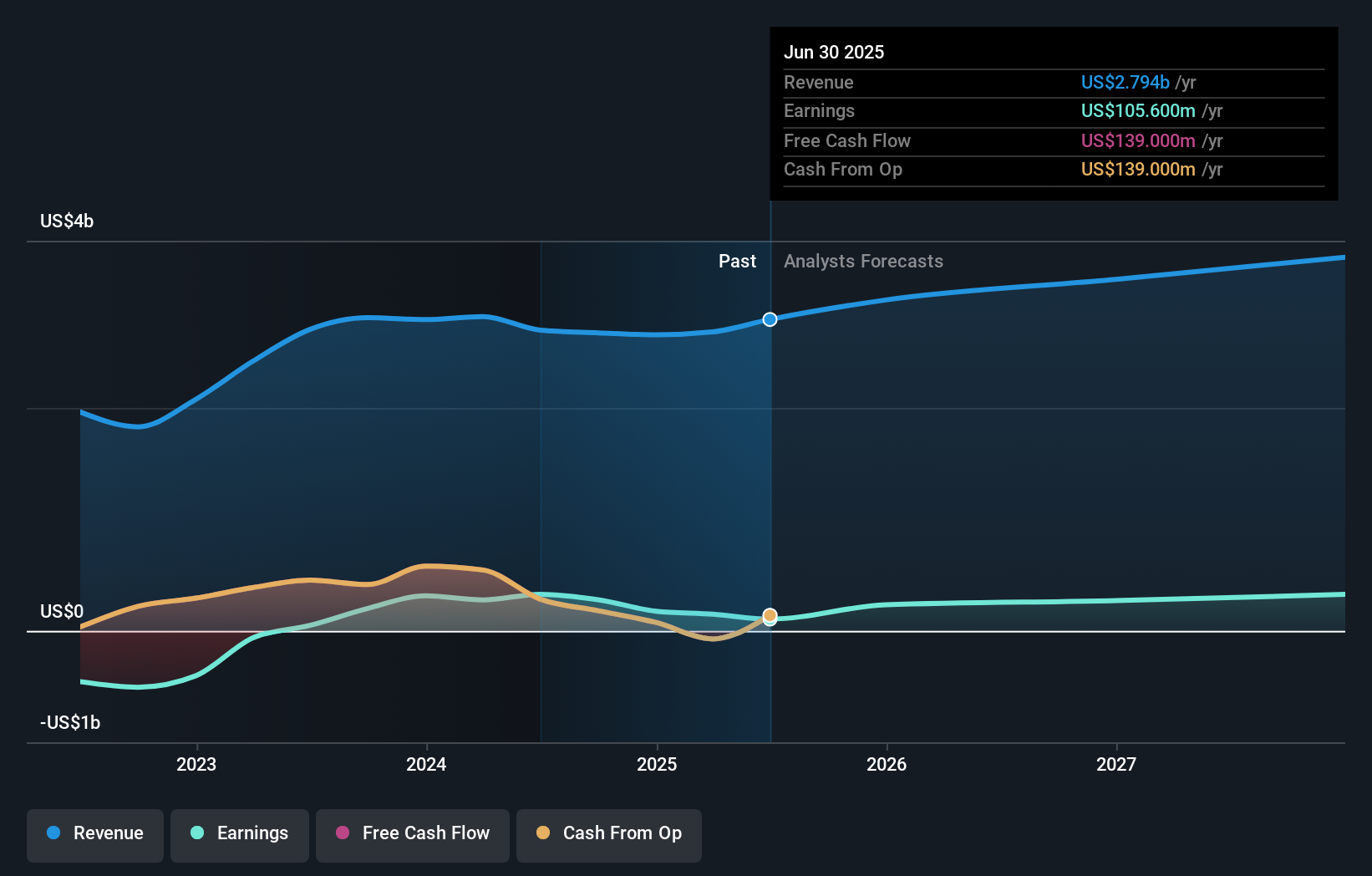

SiriusPoint's narrative projects $3.5 billion in revenue and $402.8 million in earnings by 2028. This requires 7.6% yearly revenue growth and a $297.2 million earnings increase from $105.6 million today.

Uncover how SiriusPoint's forecasts yield a $27.50 fair value, a 38% upside to its current price.

Exploring Other Perspectives

Retail investors in the Simply Wall St Community offer two fair value estimates for SiriusPoint, ranging from US$21.42 to US$27.50. While many see upside potential, several highlight that success relies on SiriusPoint’s ability to effectively manage newly formed MGA partnerships and maintain underwriting profitability.

Explore 2 other fair value estimates on SiriusPoint - why the stock might be worth just $21.42!

Build Your Own SiriusPoint Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your SiriusPoint research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free SiriusPoint research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate SiriusPoint's overall financial health at a glance.

Seeking Other Investments?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SPNT

SiriusPoint

Provides multi-line reinsurance and insurance products and services worldwide.

Adequate balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives