- United States

- /

- Insurance

- /

- NYSE:RYAN

Assessing Ryan Specialty Holdings’s (RYAN) Valuation After New Analyst Coverage Spurs Investor Debate

Reviewed by Simply Wall St

Piper Sandler has just begun covering Ryan Specialty Holdings (NYSE:RYAN), assigning a Hold rating to the stock. The firm pointed to Ryan’s strong niche within specialty insurance, balanced by risks that could temper future gains.

See our latest analysis for Ryan Specialty Holdings.

After a challenging start to the year, Ryan Specialty Holdings’ share price recently bounced back with a 7.7% gain over the past month, trimming some of its year-to-date decline. However, its total shareholder return over the past year stands at -22.6%, while the three-year total return remains a robust 50%. This pattern suggests that although short-term momentum is turning positive, there is still a cautious undertone as investors digest new analyst coverage and sector challenges.

If you’re weighing what else is catching investor attention, it could be the perfect moment to broaden your outlook and discover fast growing stocks with high insider ownership

So with these factors in play, is Ryan Specialty Holdings a value opportunity still waiting to be recognized, or is the market fully reflecting its future growth prospects in the current share price?

Most Popular Narrative: 16% Undervalued

With Ryan Specialty Holdings last closing at $57.31 and the narrative’s fair value coming in at $68.46, the stage is set for a debate about how fast its profit engines can deliver.

The company's continued expansion into higher-margin specialty lines, especially through innovative product launches in alternative and complex risks, and acquisition of niche MGUs, should increase the contribution from diverse, less commoditized business, stabilizing and growing earnings even when traditional property pricing cycles are volatile.

What is the secret sauce behind this bullish valuation? The answer lies in a set of aggressive growth targets, backed by margin improvements and a transformation that is expected to influence analyst expectations. Ready to look into what kind of operational forecasts and earnings growth are behind that upside?

Result: Fair Value of $68.46 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, continued declines in property insurance pricing or delays in earnings from new investments could quickly challenge this upbeat outlook.

Find out about the key risks to this Ryan Specialty Holdings narrative.

Another View: Multiples Reveal a Pricey Proposition

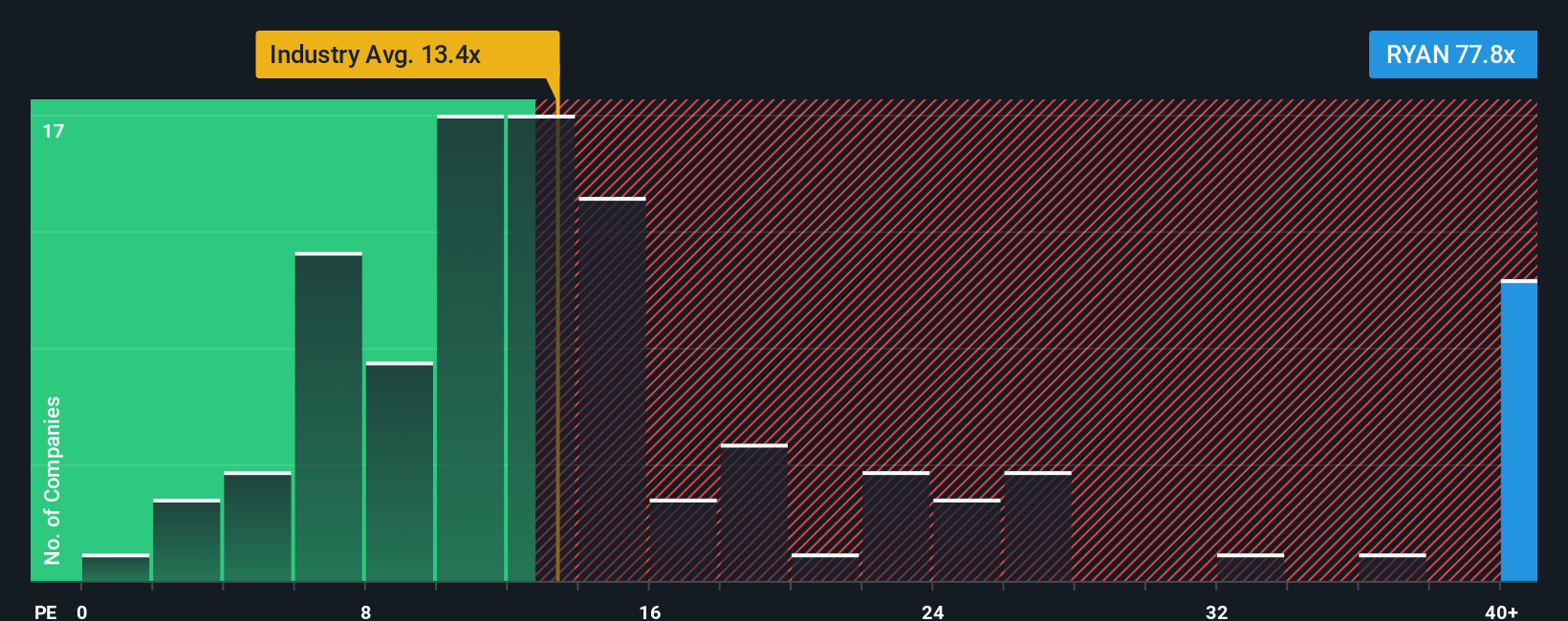

While the fair value approach suggests upside for Ryan Specialty Holdings, the price-to-earnings ratio tells a different story. At 104.7x, it stands well above both the peer average (30.6x) and the US Insurance industry average (13.2x). Even compared to its fair ratio of 67.9x, the stock appears expensive. This could expose investors to potential downside if sentiment shifts or market conditions tighten. Is the strength of its growth story enough to justify these lofty expectations?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ryan Specialty Holdings Narrative

If you see the story differently or want to test your own analysis against the market, you can easily build your own perspective on Ryan Specialty Holdings in just a few minutes. Do it your way

A great starting point for your Ryan Specialty Holdings research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors always keep an eye on fresh opportunities. Use the Simply Wall Street Screener to spot market movers before others catch on and broaden your investment playbook today.

- Tap into future breakthroughs and spot the next big thing by checking out these 26 AI penny stocks which are reshaping entire industries with artificial intelligence.

- Earn more from your portfolio by exploring steady income options among these 15 dividend stocks with yields > 3% offering high yields over 3%.

- Capture value where others are not looking and search for bargains with these 927 undervalued stocks based on cash flows that show untapped potential based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RYAN

Ryan Specialty Holdings

Operates as a service provider of specialty products and solutions for insurance brokers, agents, and carriers in the United States, Canada, the United Kingdom, rest of Europe, India, and Singapore.

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives