- United States

- /

- Insurance

- /

- NYSE:RNR

Should You Be Adding RenaissanceRe Holdings (NYSE:RNR) To Your Watchlist Today?

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like RenaissanceRe Holdings (NYSE:RNR). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide RenaissanceRe Holdings with the means to add long-term value to shareholders.

View our latest analysis for RenaissanceRe Holdings

How Fast Is RenaissanceRe Holdings Growing Its Earnings Per Share?

RenaissanceRe Holdings has undergone a massive growth in earnings per share over the last three years. So much so that this three year growth rate wouldn't be a fair assessment of the company's future. As a result, we'll zoom in on growth over the last year, instead. In impressive fashion, RenaissanceRe Holdings' EPS grew from US$30.42 to US$68.48, over the previous 12 months. It's not often a company can achieve year-on-year growth of 125%. The best case scenario? That the business has hit a true inflection point.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Not all of RenaissanceRe Holdings' revenue this year is revenue from operations, so keep in mind the revenue and margin numbers used in this article might not be the best representation of the underlying business. The good news is that RenaissanceRe Holdings is growing revenues, and EBIT margins improved by 6.0 percentage points to 37%, over the last year. Both of which are great metrics to check off for potential growth.

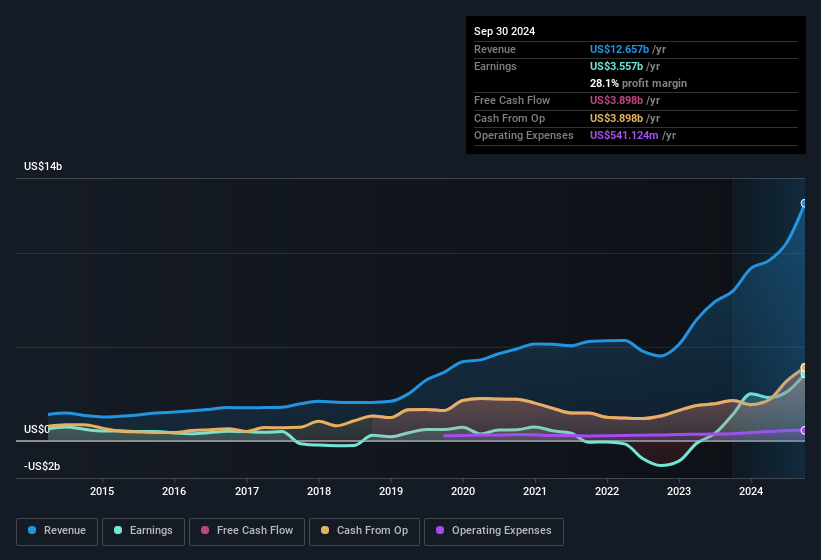

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for RenaissanceRe Holdings' future profits.

Are RenaissanceRe Holdings Insiders Aligned With All Shareholders?

Since RenaissanceRe Holdings has a market capitalisation of US$13b, we wouldn't expect insiders to hold a large percentage of shares. But we are reassured by the fact they have invested in the company. We note that their impressive stake in the company is worth US$251m. This suggests that leadership will be very mindful of shareholders' interests when making decisions!

Should You Add RenaissanceRe Holdings To Your Watchlist?

RenaissanceRe Holdings' earnings per share growth have been climbing higher at an appreciable rate. This level of EPS growth does wonders for attracting investment, and the large insider investment in the company is just the cherry on top. At times fast EPS growth is a sign the business has reached an inflection point, so there's a potential opportunity to be had here. So based on this quick analysis, we do think it's worth considering RenaissanceRe Holdings for a spot on your watchlist. Even so, be aware that RenaissanceRe Holdings is showing 1 warning sign in our investment analysis , you should know about...

Although RenaissanceRe Holdings certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with more skin in the game, then check out this handpicked selection of companies that not only boast of strong growth but have strong insider backing.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:RNR

RenaissanceRe Holdings

Provides reinsurance and insurance products in the United States and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success