- United States

- /

- Insurance

- /

- NYSE:RGA

Does Record Earnings and a New NYC Office Reinforce RGA’s Long-Term Growth Strategy? (RGA)

Reviewed by Sasha Jovanovic

- Reinsurance Group of America recently reported its third-quarter 2025 results, highlighting US$6.20 billion in revenue, US$253 million in net income, share repurchases totaling US$75 million, and the opening of its first New York City office in Midtown Manhattan.

- The company’s expansion into New York City's financial hub alongside record quarterly earnings reflects a commitment to both growth and operational excellence.

- We'll explore how record operating performance and the Equitable transaction’s positive impact may shift RGA’s broader investment outlook.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Reinsurance Group of America Investment Narrative Recap

To believe in Reinsurance Group of America, investors need to have confidence in the company’s ability to capitalize on global insurance growth and deliver consistent returns despite earnings variability tied to US individual life claims and volatility in healthcare excess. The recent New York City office expansion underscores long-term ambitions but does not materially shift the immediate catalysts, such as capital deployment or the positive contribution of the Equitable transaction, or the key risk of unpredictable claims experience.

The recently completed share repurchase program, totaling US$75 million for 406,337 shares in the third quarter, aligns directly with capital return strategies and near-term investor focus. This buyback complements ongoing efforts to strengthen shareholder value as new initiatives and transactions, like the Equitable block, come online.

Yet, in contrast to this robust capital allocation, investors should be aware that persistent volatility in US individual claims could still...

Read the full narrative on Reinsurance Group of America (it's free!)

Reinsurance Group of America's outlook anticipates $29.2 billion in revenue and $1.9 billion in earnings by 2028. This is based on a projected annual revenue growth rate of 10.3% and reflects an earnings increase of $1.13 billion from current earnings of $770.0 million.

Uncover how Reinsurance Group of America's forecasts yield a $236.89 fair value, a 24% upside to its current price.

Exploring Other Perspectives

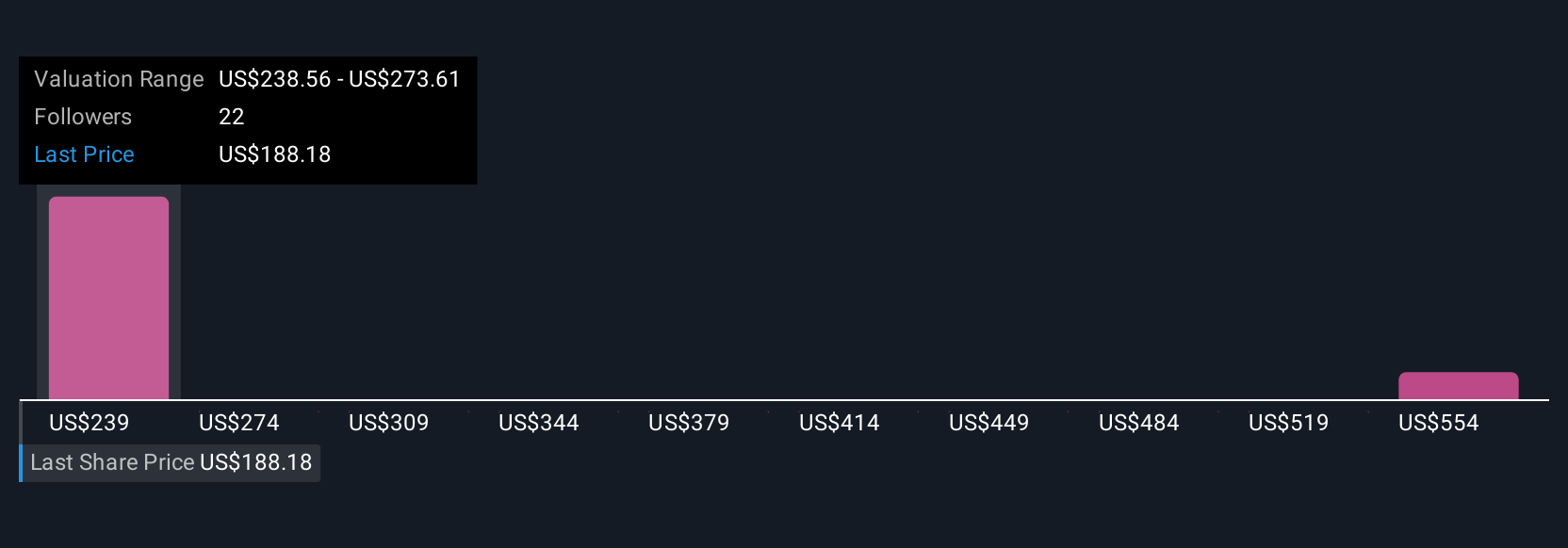

Simply Wall St Community members estimate Reinsurance Group of America’s fair value between US$195 and US$613 across three perspectives. While many expect continued global insurance demand, the wide range of opinions shows how views around future earnings and risks can lead to very different outlooks on the stock’s potential, see what others are forecasting and why they disagree.

Explore 3 other fair value estimates on Reinsurance Group of America - why the stock might be worth over 3x more than the current price!

Build Your Own Reinsurance Group of America Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Reinsurance Group of America research is our analysis highlighting 5 key rewards that could impact your investment decision.

- Our free Reinsurance Group of America research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Reinsurance Group of America's overall financial health at a glance.

Curious About Other Options?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RGA

Reinsurance Group of America

Provides reinsurance and financial solutions.

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives