- United States

- /

- Insurance

- /

- NYSE:PRA

What Is The Ownership Structure Like For ProAssurance Corporation (NYSE:PRA)?

A look at the shareholders of ProAssurance Corporation (NYSE:PRA) can tell us which group is most powerful. Generally speaking, as a company grows, institutions will increase their ownership. Conversely, insiders often decrease their ownership over time. Companies that used to be publicly owned tend to have lower insider ownership.

ProAssurance isn't enormous, but it's not particularly small either. It has a market capitalization of US$1.1b, which means it would generally expect to see some institutions on the share registry. In the chart below, we can see that institutional investors have bought into the company. Let's delve deeper into each type of owner, to discover more about ProAssurance.

Check out our latest analysis for ProAssurance

What Does The Institutional Ownership Tell Us About ProAssurance?

Many institutions measure their performance against an index that approximates the local market. So they usually pay more attention to companies that are included in major indices.

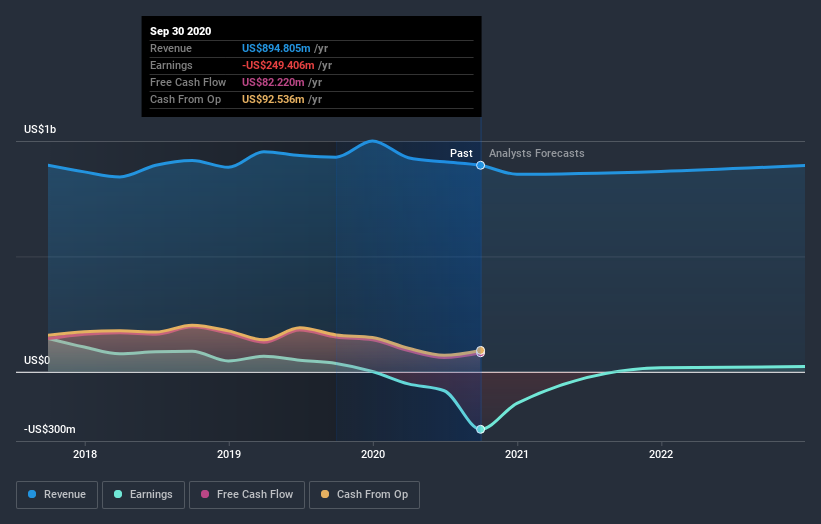

As you can see, institutional investors have a fair amount of stake in ProAssurance. This suggests some credibility amongst professional investors. But we can't rely on that fact alone since institutions make bad investments sometimes, just like everyone does. When multiple institutions own a stock, there's always a risk that they are in a 'crowded trade'. When such a trade goes wrong, multiple parties may compete to sell stock fast. This risk is higher in a company without a history of growth. You can see ProAssurance's historic earnings and revenue below, but keep in mind there's always more to the story.

Institutional investors own over 50% of the company, so together than can probably strongly influence board decisions. We note that hedge funds don't have a meaningful investment in ProAssurance. BlackRock, Inc. is currently the largest shareholder, with 15% of shares outstanding. In comparison, the second and third largest shareholders hold about 10.0% and 4.6% of the stock.

We did some more digging and found that 10 of the top shareholders account for roughly 51% of the register, implying that along with larger shareholders, there are a few smaller shareholders, thereby balancing out each others interests somewhat.

While it makes sense to study institutional ownership data for a company, it also makes sense to study analyst sentiments to know which way the wind is blowing. Quite a few analysts cover the stock, so you could look into forecast growth quite easily.

Insider Ownership Of ProAssurance

The definition of an insider can differ slightly between different countries, but members of the board of directors always count. Management ultimately answers to the board. However, it is not uncommon for managers to be executive board members, especially if they are a founder or the CEO.

Most consider insider ownership a positive because it can indicate the board is well aligned with other shareholders. However, on some occasions too much power is concentrated within this group.

I can report that insiders do own shares in ProAssurance Corporation. It is a pretty big company, so it is generally a positive to see some potentially meaningful alignment. In this case, they own around US$15m worth of shares (at current prices). If you would like to explore the question of insider alignment, you can click here to see if insiders have been buying or selling.

General Public Ownership

The general public, with a 15% stake in the company, will not easily be ignored. While this group can't necessarily call the shots, it can certainly have a real influence on how the company is run.

Next Steps:

It's always worth thinking about the different groups who own shares in a company. But to understand ProAssurance better, we need to consider many other factors. Be aware that ProAssurance is showing 1 warning sign in our investment analysis , you should know about...

If you would prefer discover what analysts are predicting in terms of future growth, do not miss this free report on analyst forecasts.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

If you decide to trade ProAssurance, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NYSE:PRA

ProAssurance

Through its subsidiaries, provides property and casualty insurance, and reinsurance products in the United States.

Acceptable track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives