- United States

- /

- Insurance

- /

- NYSE:PRA

ProAssurance (PRA): Profitability and Margin Gains Put Premium Valuation Narrative to the Test

Reviewed by Simply Wall St

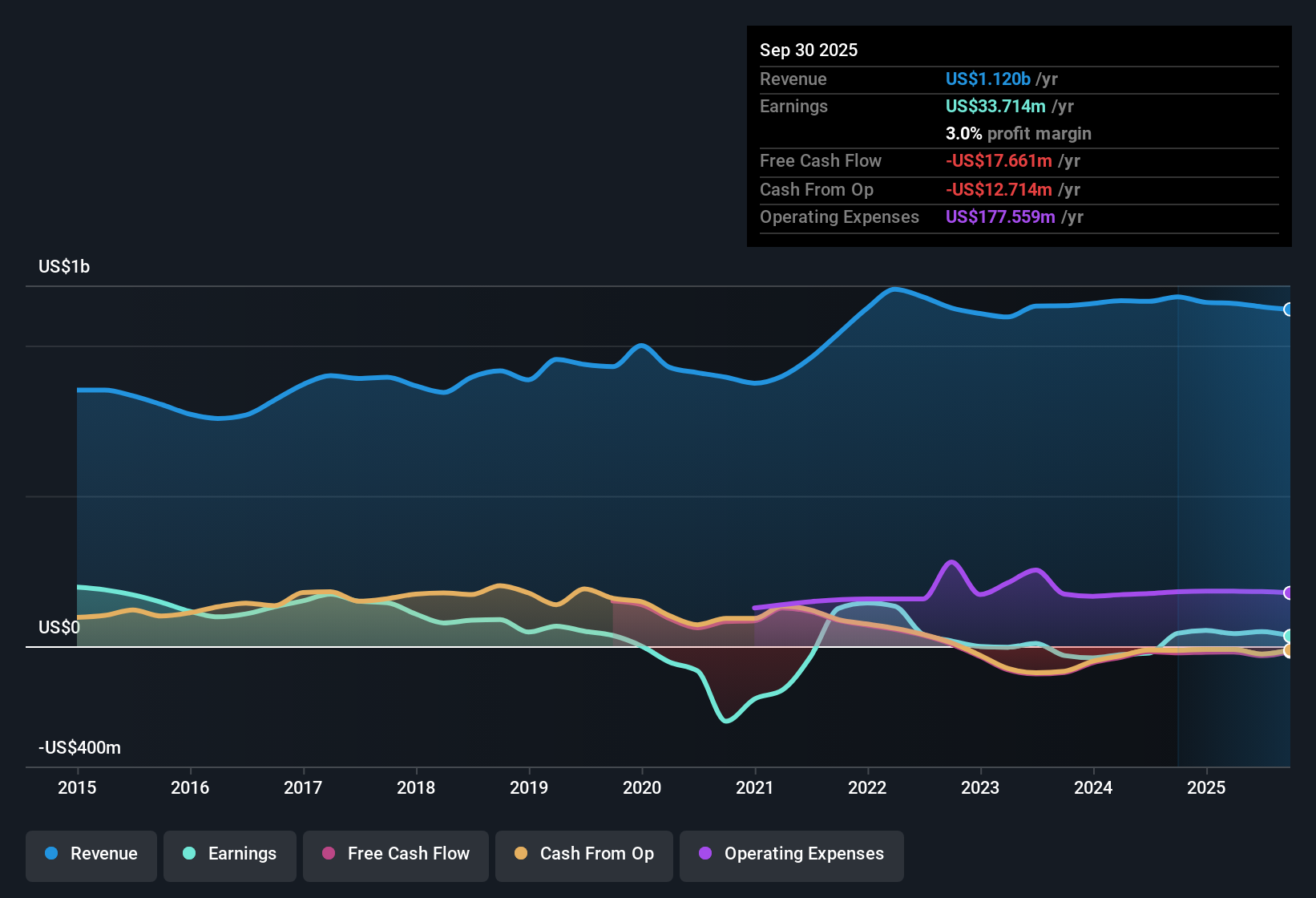

ProAssurance (PRA) has swung to profitability over the past five years, reporting an annual earnings growth rate of 37.3% and showing improved profit margins in its most recent results. Forward-looking projections see earnings climbing a further 20.7% per year, notably outpacing the broader US market expectation of 16% growth, even though revenue is anticipated to edge down by 1.6% per year. With high-quality earnings and persistent profit momentum, investor focus will be on whether strong bottom-line growth can outweigh modest revenue contraction and a premium valuation.

See our full analysis for ProAssurance.Next, we will put these headline numbers up against the market’s key narratives to see which stories are being confirmed and where assumptions might be put to the test.

See what the community is saying about ProAssurance

Profit Margins Targeted for Further Expansion

- Analysts project profit margins will rise from 4.3% today to 7.0% over the next three years, even as revenue is expected to decline by 2.5% on average each year.

- Consensus narrative highlights that strategic moves such as renewal premium increases and disciplined re-underwriting have already driven a significant improvement in loss ratios and are expected to further enhance profitability. However,

- challenging legal conditions and cost discipline could tug on margins, so the projected margin expansion faces real headwinds if expenses trend higher than planned.

- the company's investments in AI tools and analytics are designed to drive efficiency, supporting this more ambitious profitability target even if top-line revenue slips.

Valuation Stands Out Above Peers

- ProAssurance is priced at a 25.4x price-to-earnings ratio, noticeably higher than both the US insurance industry average of 13.7x and close competitors at 13.1x.

- What’s surprising in the analysts' consensus view is that this valuation premium persists despite forecasts for modest revenue declines. This

- suggests the market has considerable confidence in the company's ability to increase profit margins and sustain growth.

- It also raises the bar for future performance, since premium pricing relies on those higher profit goals actually being delivered over the next few years.

Analyst Target Price Implies Little Upside

- With ProAssurance trading at $24.03, the average analyst price target of $22.67 sits about 5.7% lower, which means analysts as a group see minimal near-term upside from current levels.

- The consensus narrative notes that projecting out to 2028, investors would have to believe not only in a profit jump to $73.1 million but also that the PE ratio will remain above industry averages. This

- creates tension for value-focused investors, since any stumbles in margin goals or a reset in valuation multiples could put pressure on the stock price.

- On the other hand, a bullish case might claim that strong execution on cost discipline and profitability could justify the higher multiple if delivered consistently.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for ProAssurance on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Interpret the data your way. In just three minutes, you can build your own perspective on ProAssurance's outlook, so make it yours now. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding ProAssurance.

See What Else Is Out There

Despite solid earnings growth, ProAssurance faces declining revenue and a valuation that appears stretched compared to industry peers. This raises concerns about future upside.

If you want to focus on companies trading at more attractive prices relative to their fundamentals, start screening with these 848 undervalued stocks based on cash flows to discover opportunities with greater potential value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PRA

ProAssurance

Through its subsidiaries, provides property and casualty insurance, and reinsurance products in the United States.

Moderate growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives