- United States

- /

- Insurance

- /

- NYSE:PGR

Progressive (PGR): Evaluating Valuation After Premium Growth, Regulatory Changes, and Strategic Buybacks

Reviewed by Simply Wall St

Progressive (PGR) recently reported increased premium growth and an improved combined ratio for the latest quarter. The company navigated major legislative changes in Florida and recognized a substantial policyholder credit expense tied to regulatory adjustments.

See our latest analysis for Progressive.

Progressive’s share price has taken a breather lately, falling 13% over the past month and down 13% so far this year. Much of this pressure stems from investors weighing slowing premium growth and the costs of regulatory change. At the same time, the company remains operationally strong and continues shareholder-friendly buybacks. Despite the recent dip, Progressive’s three-year total shareholder return stands at a striking 69%, showcasing its resilience and long-term growth momentum.

If Progressive’s strategies around market share and disciplined growth pique your interest, now is a great time to broaden your search and discover fast growing stocks with high insider ownership

With shares pulling back despite strong financial results and favorable analyst price targets, the key question now is whether Progressive is undervalued after the recent slide or if the market has already factored in its future growth potential.

Most Popular Narrative: 20% Undervalued

The prevailing narrative sets Progressive's fair value around $261 per share, comfortably above the last close of $208.94. This sets up a clear case for upside and captures market optimism even as recent results have spooked some investors.

Persistent growth in U.S. vehicle ownership, population, and rising vehicle complexity expand the addressable market and increase future demand for auto insurance. This should underpin sustained top-line revenue growth for Progressive.

Curious how analysts are incorporating future earnings and margins to reach that price? The math here is not just about growth; there is a bold assumption of strong margins and revenue expansion, even with sector headwinds. What exactly are they projecting? See for yourself in the full narrative.

Result: Fair Value of $261 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising competition and higher auto claim costs could challenge Progressive's growth outlook. This may potentially prompt further downward revisions to analyst expectations.

Find out about the key risks to this Progressive narrative.

Another View: Market Multiples Tell a Different Story

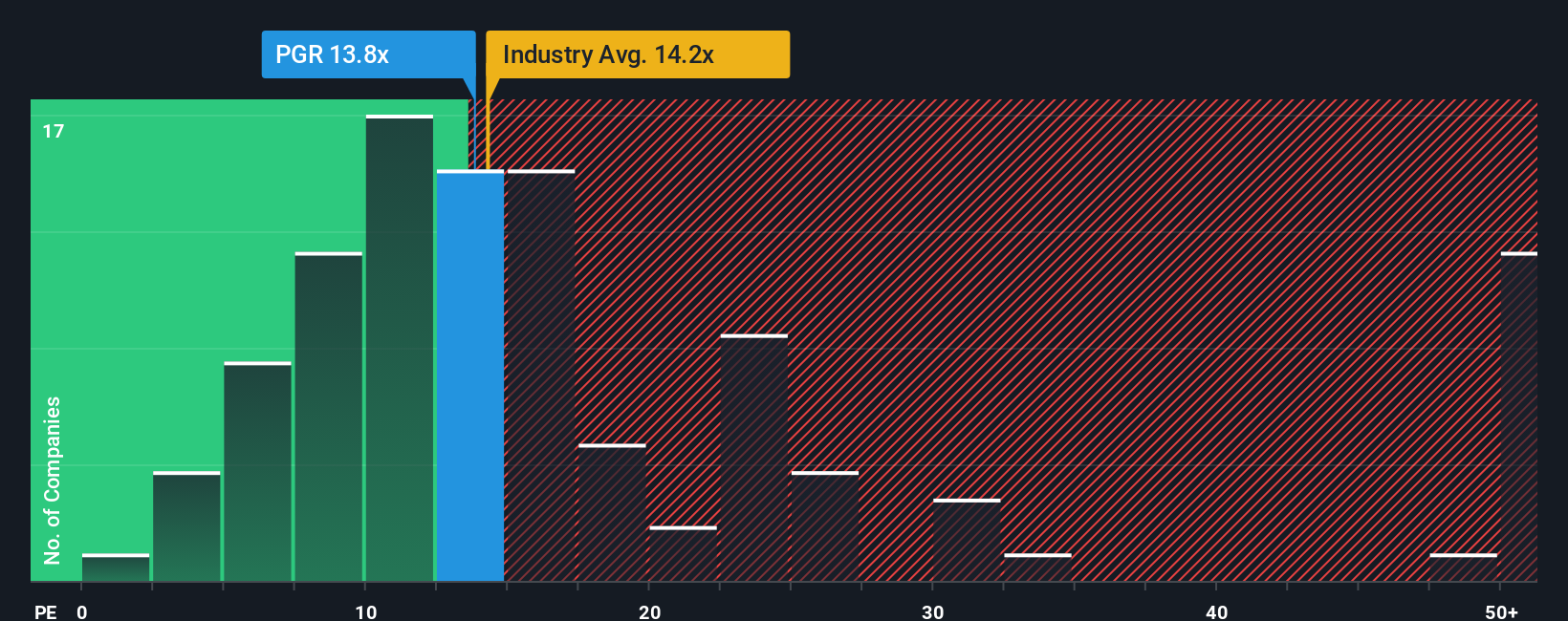

Looking through another lens, Progressive trades at 11.4 times earnings. This is higher than the market's fair ratio of 10.8 and above the peer average of 9.7. Even though it is cheaper than the broader US Insurance sector's 13.6, this gap highlights the risk of paying a premium for perceived quality. Is the market placing too much faith in Progressive's track record, or is there genuine long-term value?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Progressive Narrative

If you have your own view or want to dig into the numbers differently, you can craft a personalized narrative from scratch in just a few minutes. Do it your way

A great starting point for your Progressive research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never settle for just one angle. Make your next breakthrough by researching ideas you might have missed until now.

- Unlock growth potential by scanning these 25 AI penny stocks on the frontier of artificial intelligence, with companies transforming industries and creating tomorrow’s winners.

- Maximize your passive income by reviewing these 20 dividend stocks with yields > 3% for high-yield opportunities that can potentially boost your portfolio’s returns with reliable cash flow.

- Get ahead of the curve with these 81 cryptocurrency and blockchain stocks embracing disruptive trends in digital assets and blockchain innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PGR

Outstanding track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives