- United States

- /

- Insurance

- /

- NYSE:PGR

Is Progressive’s Share Price Drop a Chance for Investors in 2025?

Reviewed by Bailey Pemberton

- Ever wondered whether Progressive stock is actually a smart buy right now? With all the market noise, getting to the real value behind the price takes a closer look.

- While shares are down 5.7% year-to-date and 12.9% over the past year, longer-term holders have still seen stellar returns such as nearly 80% over three years and an impressive 187.5% over five years.

- Recently, Progressive’s share price has moved in response to industry headlines about changes in insurance premiums and evolving risk models. Market watchers are paying attention as insurers like Progressive adapt to shifting weather patterns and regulatory updates, fueling ongoing conversation about risk and pricing power.

- The company currently holds a valuation score of 3 out of 6, so there is plenty to unpack. We will not only walk through familiar valuation tools, but also touch on a more insightful approach by the end of this article.

Find out why Progressive's -12.9% return over the last year is lagging behind its peers.

Approach 1: Progressive Excess Returns Analysis

The Excess Returns model evaluates how efficiently Progressive generates profits above the required cost of capital, measuring how well management turns shareholder funds into value. It looks beyond simple book value to focus on earnings potential and efficiency.

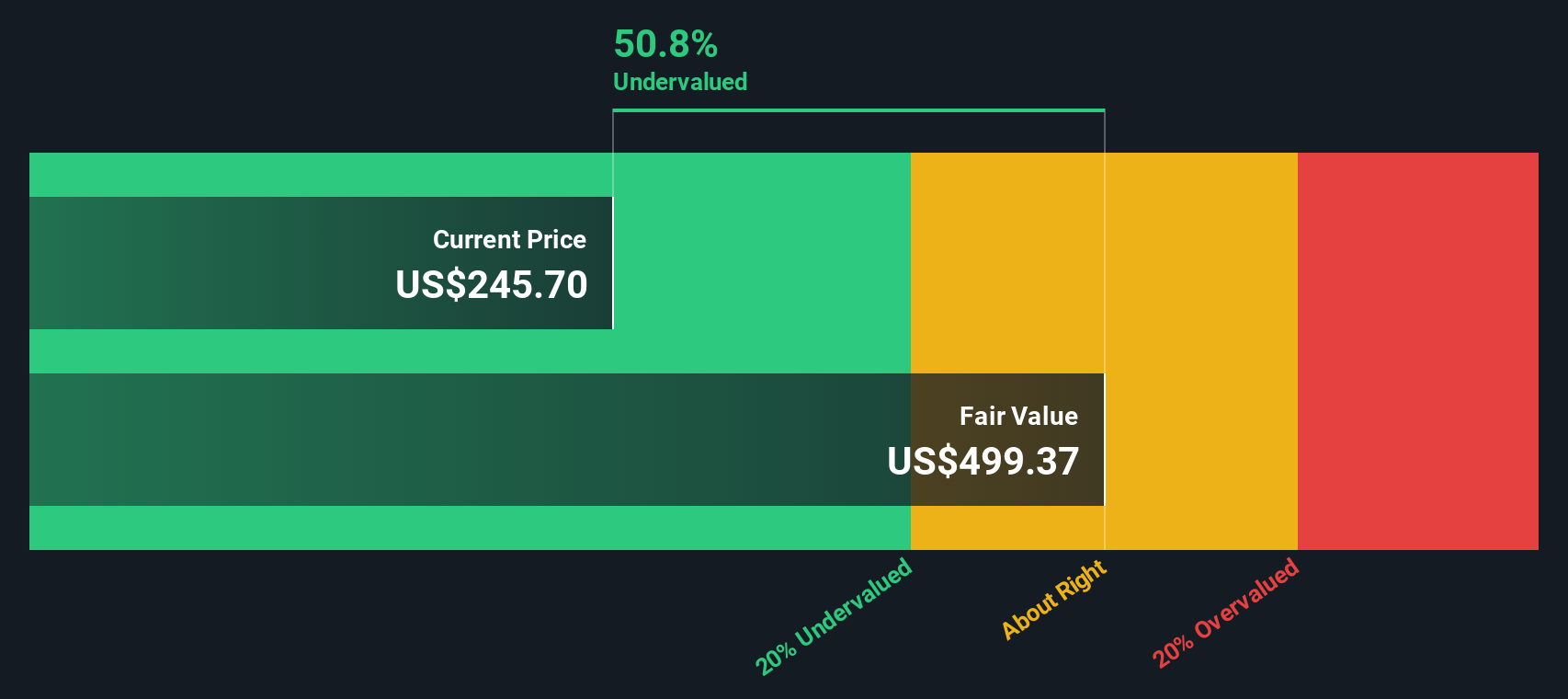

For Progressive, the numbers tell an impressive story. The company’s current book value is $60.49 per share, with a stable earnings per share (EPS) estimated at $20.37 according to projections from 12 analysts. Its average return on equity sits at a strong 28.08%, while the cost of equity is $5.04 per share. This means Progressive is expected to earn an excess return of $15.32 per share, which is well above its cost of capital. Looking ahead, the stable book value is projected to rise to $72.53 per share, based on future estimates from 11 analysts.

Putting it all together, the model calculates an intrinsic value that is 53.4% higher than the current share price. This suggests the stock is significantly undervalued by this methodology. Investors looking for efficient capital allocation and value creation will find these metrics compelling.

Result: UNDERVALUED

Our Excess Returns analysis suggests Progressive is undervalued by 53.4%. Track this in your watchlist or portfolio, or discover 921 more undervalued stocks based on cash flows.

Approach 2: Progressive Price vs Earnings

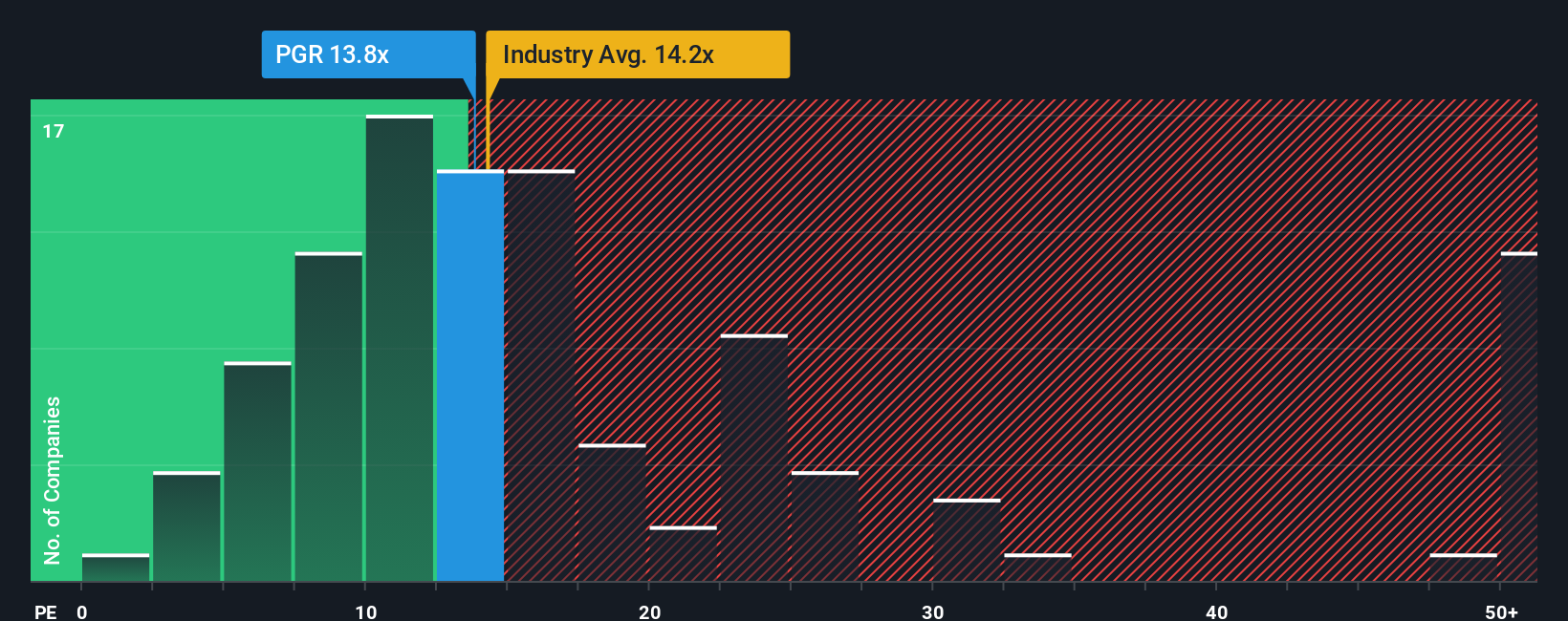

For profitable companies like Progressive, the Price-to-Earnings (PE) ratio is a popular valuation tool because it quickly shows how much investors are willing to pay for each dollar of current earnings. The PE ratio is especially useful when comparing companies that regularly generate positive earnings, as it highlights differences in investor expectations and perceived risks.

A company’s growth prospects and risk profile have a major impact on what is considered a “fair” PE ratio. Rapidly expanding firms with dependable earnings typically command higher PE ratios, while those facing earnings uncertainty or sector risks may trade at discounts. For Progressive, the current PE stands at 12.4x, compared with the average PE of peers at 9.6x and the wider Insurance industry at 13.2x.

Simply Wall St’s proprietary “Fair Ratio” takes the analysis a step further. Instead of simply matching Progressive to industry or peer averages, it incorporates growth, risks, profit margins, market cap, and sector influences for a more individualized benchmark. The “Fair Ratio” for Progressive is calculated at 10.8x. This metric offers a tailored yardstick for fair value, ultimately providing a better pulse on whether Progressive is attractively valued when accounting for all relevant company factors.

Progressive’s current PE of 12.4x is moderately above its Fair Ratio of 10.8x. This difference suggests the stock is slightly expensive relative to fundamentals, though not by a wide margin.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1442 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Progressive Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple, powerful tool that lets you give the story behind the numbers, your perspective on a company's future, including what you think is a fair value and your assumptions for revenue, earnings, and profit margins. Rather than just crunching past results, Narratives connect a company's ongoing story to a financial forecast and, ultimately, to a clear estimate of fair value.

On Simply Wall St's Community page, used by millions of investors, you will find Narratives already waiting for you. They make it easier than ever to compare your own views to those of market experts and fellow investors, all in one place. Narratives help you decide when to buy or sell by showing you how fair value compares to the current price, and they are updated automatically when big news or new results come in, keeping you ahead of the curve.

For example, with Progressive, some investors see its advanced data analytics and scale supporting outperformance, leading them to set a fair value as high as $344 per share, while others who focus on risks and market challenges find a much lower value around $189, making it clear how your own narrative shapes your investment decision.

Do you think there's more to the story for Progressive? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PGR

Outstanding track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success