- United States

- /

- Insurance

- /

- NYSE:PGR

Is Progressive’s Recent 14.7% Drop a Long-Term Opportunity in 2025?

Reviewed by Bailey Pemberton

- Wondering if Progressive is offering real value for its current share price? You are not alone, especially with all eyes on insurance stocks these days.

- While the stock has delivered a huge 149.6% return over the past five years, it is down 14.7% this month and nearly 13% year-to-date, leaving many investors questioning if this retreat is a buying opportunity or a warning sign.

- Recent headlines have focused on rising insurance premiums nationwide, as well as regulatory discussions that could impact the industry. Progressive, in particular, has seen increased attention after strategic decisions regarding product mix and geographic focus. This adds important context to recent price swings.

- On the valuation front, Progressive scores a 4 out of 6 using our standard value checks, suggesting the stock passes most but not all undervaluation tests. Let us break down how we arrive at that score using different valuation approaches, and hint at a better way to see the full value picture by the end.

Find out why Progressive's -13.8% return over the last year is lagging behind its peers.

Approach 1: Progressive Excess Returns Analysis

The Excess Returns valuation model is designed to measure how efficiently a company turns its investments into profits above what investors expect. By focusing on return on equity and growth, this approach gives a more nuanced look at whether a stock is truly adding value for shareholders in the long run.

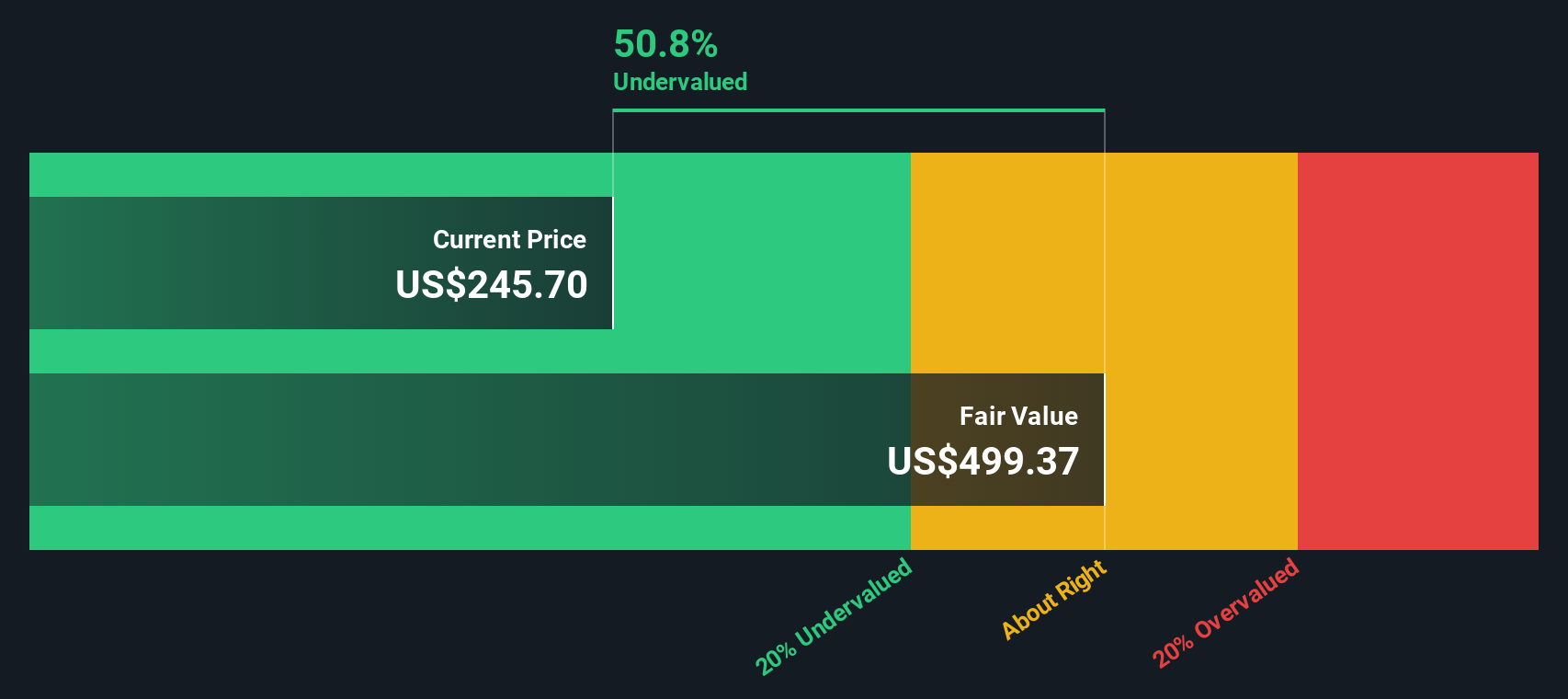

For Progressive, the key figures are telling. The current Book Value stands at $60.49 per share, and future projections estimate a Stable Book Value of $72.54 per share. Analysts expect Stable Earnings Per Share to reach $20.00, backed by a strong Average Return on Equity of 27.57%. With the Cost of Equity at $4.92 per share, that leaves Progressive delivering an impressive Excess Return of $15.09 per share. These calculations are based on weighted future Return on Equity estimates from 13 analysts and Book Value projections from 12 analysts, lending credibility to the outlook.

Based on this model, Progressive's intrinsic value implies a discount of 56.4% to the current share price, which suggests the stock is significantly undervalued from an excess returns perspective.

Result: UNDERVALUED

Our Excess Returns analysis suggests Progressive is undervalued by 56.4%. Track this in your watchlist or portfolio, or discover 840 more undervalued stocks based on cash flows.

Approach 2: Progressive Price vs Earnings

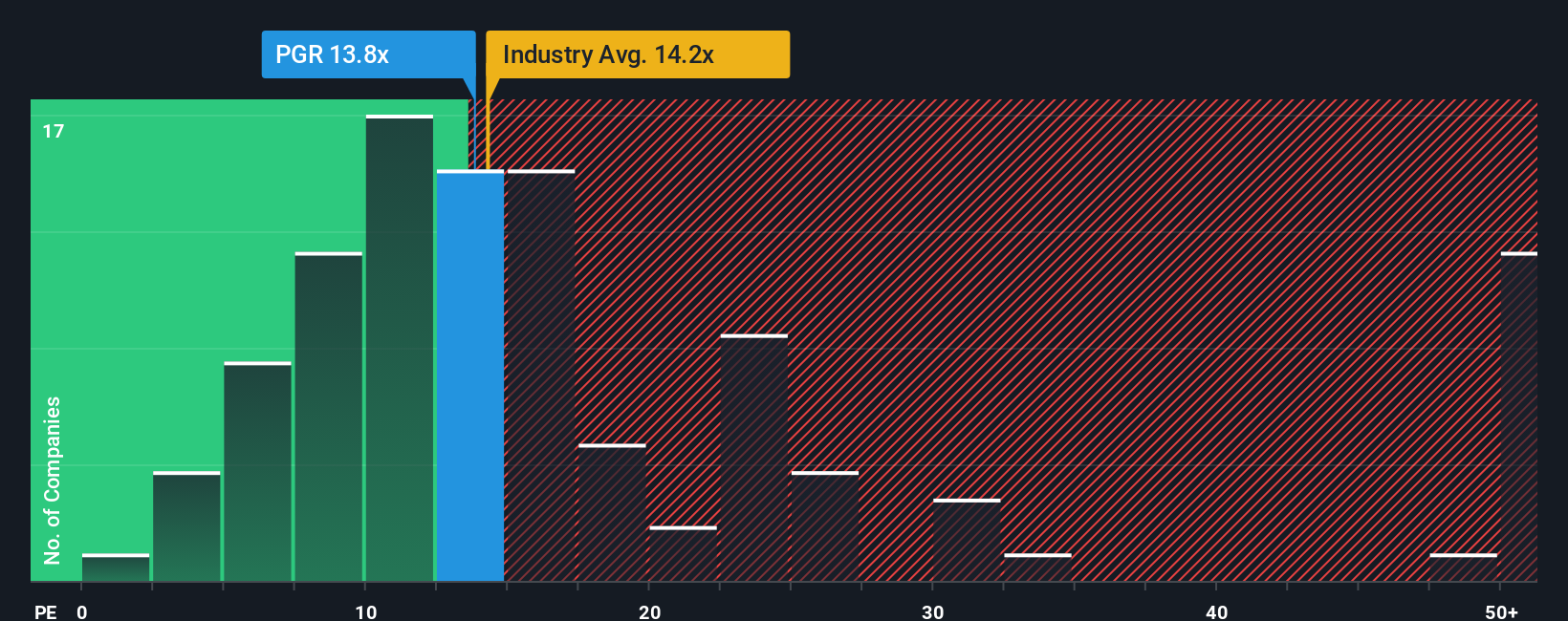

For profitable companies like Progressive, the Price-to-Earnings (PE) ratio is a widely recognized valuation metric. It helps investors understand how much they are paying for each dollar of earnings, making it useful for comparing companies with stable profits and growth trends. Since earnings reflect the company's performance after expenses, using the PE ratio provides a transparent lens to gauge value.

Growth expectations and risk levels both play a major role in determining what counts as a "normal" or fair PE ratio. Higher growth prospects typically justify a higher PE, as investors anticipate future profits will rise. Meanwhile, more risk or uncertainty should be balanced with a lower PE ratio since investors want compensation for the possibility of setbacks.

Progressive currently trades at a PE ratio of 11.47x. That is lower than the insurance industry average of 13.68x and also undercuts the peer average of 9.78x. However, Simply Wall St's proprietary "Fair Ratio", which is calculated to reflect Progressive's growth, profit margins, industry, market cap and unique risks, is 10.76x. Unlike a simple peer or industry comparison, the Fair Ratio is tailored to the company's precise circumstances, offering a more accurate benchmark that moves beyond one-size-fits-all averages.

With Progressive's current PE ratio just above the Fair Ratio, the stock appears to be about fairly valued according to this analysis.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1411 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Progressive Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your own informed story about where a company like Progressive is headed, combining your fair value estimate with personal expectations about future revenue, earnings, and profit margins. Rather than relying strictly on backward-looking metrics, Narratives connect the dots between what you believe about Progressive’s prospects and how that forecast translates to a realistic valuation. This turns your research and conviction into actionable numbers.

On Simply Wall St’s Community page, millions of investors use Narratives as an intuitive, hands-on tool that lets you compare your personal fair value for Progressive with the latest share price. As new news and earnings reports emerge, Narratives update automatically so your story always reflects fresh reality. For example, one investor might see Progressive’s tech advantage and stable margins, leading them to the highest analyst price target of $344. Another anticipates tougher competition and projects just $189, yet both share their investment stories and decisions seamlessly. Narratives empower you to buy or sell with confidence, using your own insights, not just consensus estimates.

Do you think there's more to the story for Progressive? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PGR

Outstanding track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives