- United States

- /

- Insurance

- /

- NYSE:OSCR

AI-Driven Virtual Care Expansion Could Be a Game Changer for Oscar Health (OSCR)

Reviewed by Sasha Jovanovic

- Oscar Health recently announced the upcoming launch of affordable, tech-powered health plans and innovative services, including AI-driven support and a first-of-its-kind menopause offering, for individuals, families, and businesses across Southern Florida for the 2026 Open Enrollment period.

- This expansion broadens Oscar’s reach in key Florida markets and introduces personalized virtual care features such as the new Oswell health AI agent and targeted programs for chronic conditions and women’s health.

- We’ll examine how the rollout of Oscar’s AI-powered virtual care platform could influence the company’s investment narrative and long-term outlook.

Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

Oscar Health Investment Narrative Recap

For me, being a shareholder in Oscar Health means believing in the power of technology to transform health insurance and drive operational efficiencies, especially as the company expands in competitive markets like Florida. While the launch of new AI-powered plans and menopause-focused offerings showcases product innovation and market reach, it does not materially shift the most immediate catalyst to the investment case: Oscar’s ability to turn digital adoption and AI into cost reductions and margin improvement amid high losses. The core risk remains heightened uncertainty in claims costs due to changing risk pools and market-wide morbidity. Of all the recent developments, the introduction of Oswell, the AI health agent, is most relevant here, as it directly reflects Oscar’s push towards more personalized and potentially lower-cost virtual care. By making technology central to member engagement and support, Oscar aims to capture efficiency gains and enhance consumer experience, supporting its thesis for cost savings and sustainable growth. However, realizing these benefits at scale depends on continued adoption and disciplined execution across new markets. In contrast, investors should be aware that rapid membership growth and new product launches might...

Read the full narrative on Oscar Health (it's free!)

Oscar Health's projections target $12.4 billion in revenue and $245.4 million in earnings by 2028. This assumes annual revenue growth of 4.9% and a $406.6 million increase in earnings from the current level of -$161.2 million.

Uncover how Oscar Health's forecasts yield a $12.88 fair value, a 4% downside to its current price.

Exploring Other Perspectives

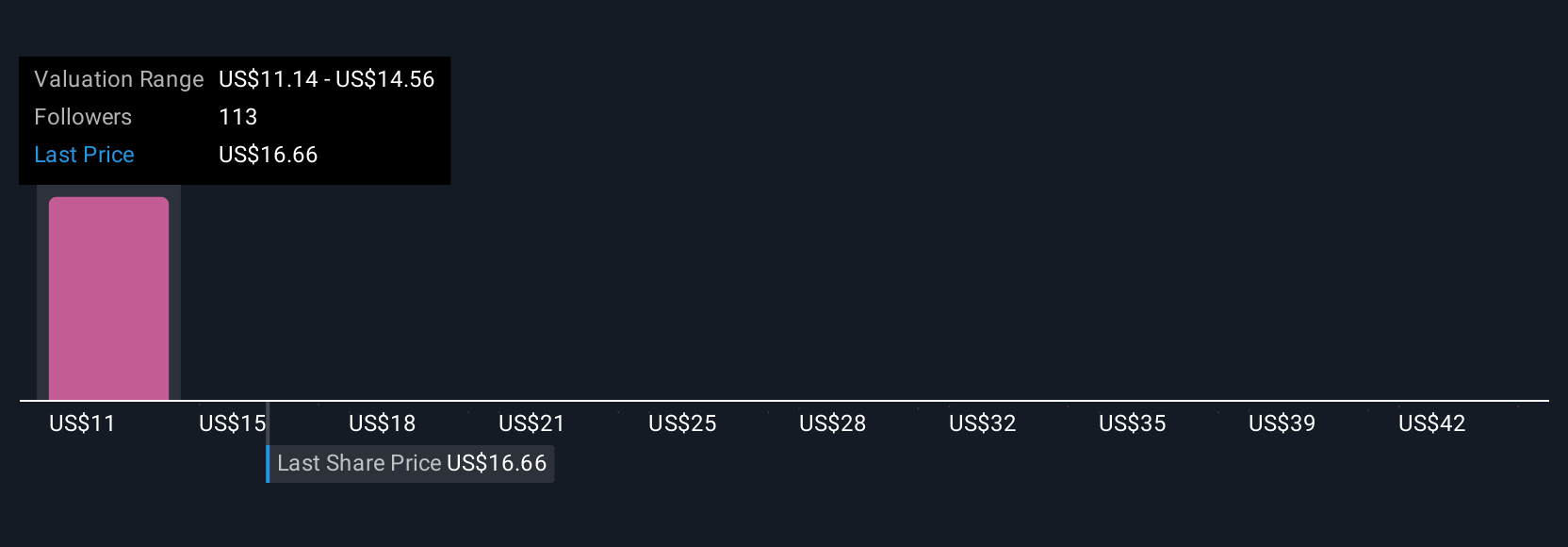

Twenty-three Simply Wall St Community members estimate Oscar Health’s fair value between US$11.52 and US$66, with opinions at both ends of the spectrum. With industry-wide morbidity trends pressuring future claims costs, these viewpoints remind you to weigh several possible outcomes for Oscar’s performance.

Explore 23 other fair value estimates on Oscar Health - why the stock might be worth 15% less than the current price!

Build Your Own Oscar Health Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Oscar Health research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Oscar Health research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Oscar Health's overall financial health at a glance.

Curious About Other Options?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OSCR

Oscar Health

Operates as a healthcare technology company in the United States.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives