- United States

- /

- Insurance

- /

- NYSE:ORI

How the Strong 2025 Rally Shapes Old Republic International’s Value After Recent Earnings Beat

Reviewed by Bailey Pemberton

If you are eyeing Old Republic International and wondering whether now is the right moment to buy, hold, or trim your position, you are not alone. This stock has been catching investors’ attention with some impressive moves lately. Over just the past week, shares climbed 3.8%, riding a wave of optimism that has seen gains of 7.2% in the last month and 20.4% since the year began. Zooming out, the story is even more compelling: up 36.3% year-over-year and a massive 298.9% over five years, Old Republic International has clearly been anything but a sleepy insurance play.

What is driving this momentum? Broader market developments have brought renewed interest in insurance and financial sector stocks, as investors reassess risk in a changing economic climate. Old Republic International’s steady history of capital stewardship and prudent underwriting has stood out during periods of uncertainty, helping shift risk perceptions and support its upward trajectory.

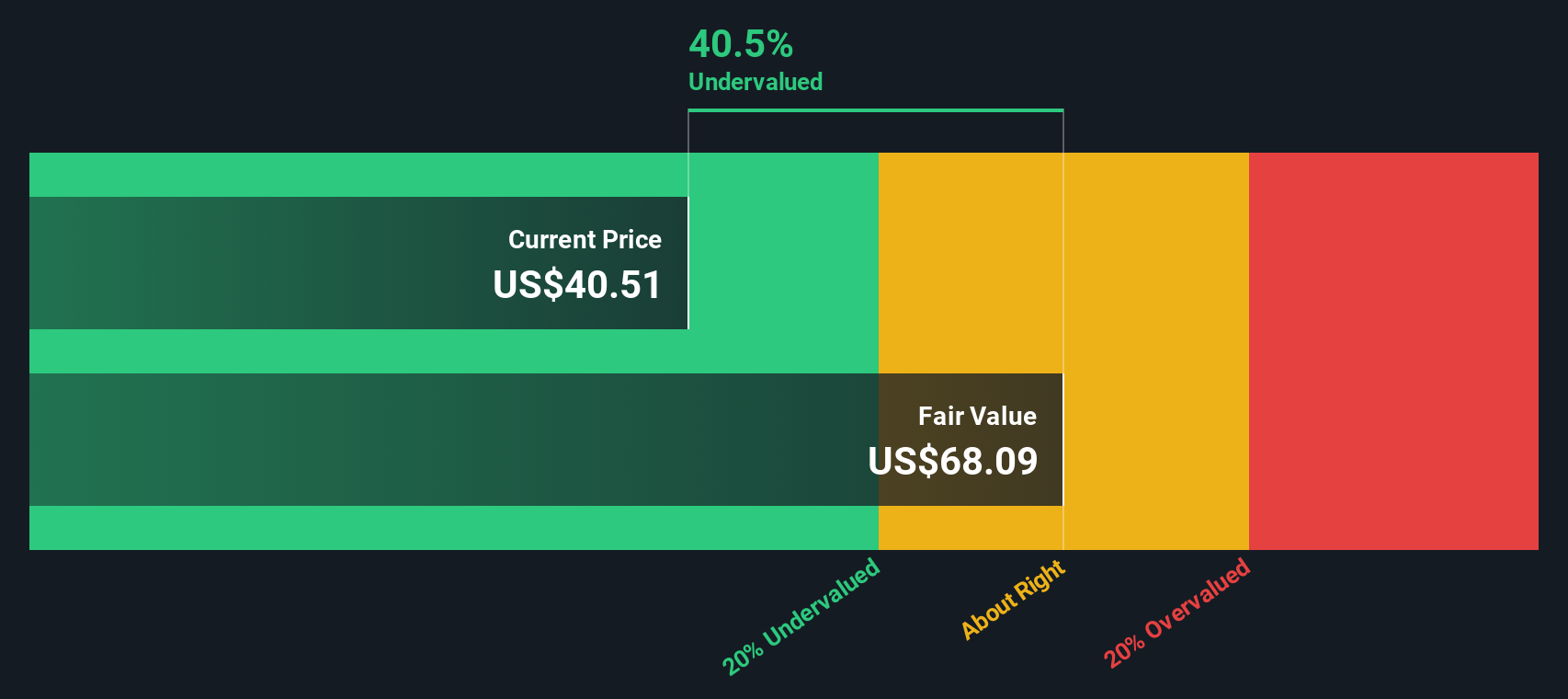

Of course, past returns are just one piece of the puzzle. Looking at value, the company earns a value score of 4 out of 6 based on major valuation checks, suggesting that it appears undervalued in most key respects, but not all. If you are wondering exactly what these 'checks' involve and how they measure up, you are in the right place. Next, we will break down the various valuation approaches investors use and see how Old Republic stacks up using each one. Stay tuned for an even more insightful way to view valuation at the end.

Approach 1: Old Republic International Excess Returns Analysis

The Excess Returns valuation model estimates a company’s true worth by evaluating how effectively it generates returns above its cost of equity. In other words, it focuses on how much value the business adds for shareholders relative to its invested capital over time, rather than just looking at earnings or assets alone.

For Old Republic International, several key metrics stand out:

- Book Value: $25.27 per share

- Stable Earnings per Share (EPS): $3.33 per share (based on the median Return on Equity from the past five years)

- Cost of Equity: $1.78 per share

- Excess Return: $1.55 per share

- Average Return on Equity over the past five years: 12.67%

- Stable Book Value: $26.31 per share (estimated by analysts)

Using these metrics, the intrinsic value calculated by this approach is $68.27 per share. With shares currently trading at a significant discount of 36.5% to this estimated value, the model suggests Old Republic International is strongly undervalued.

Result: UNDERVALUED

Our Excess Returns analysis suggests Old Republic International is undervalued by 36.5%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

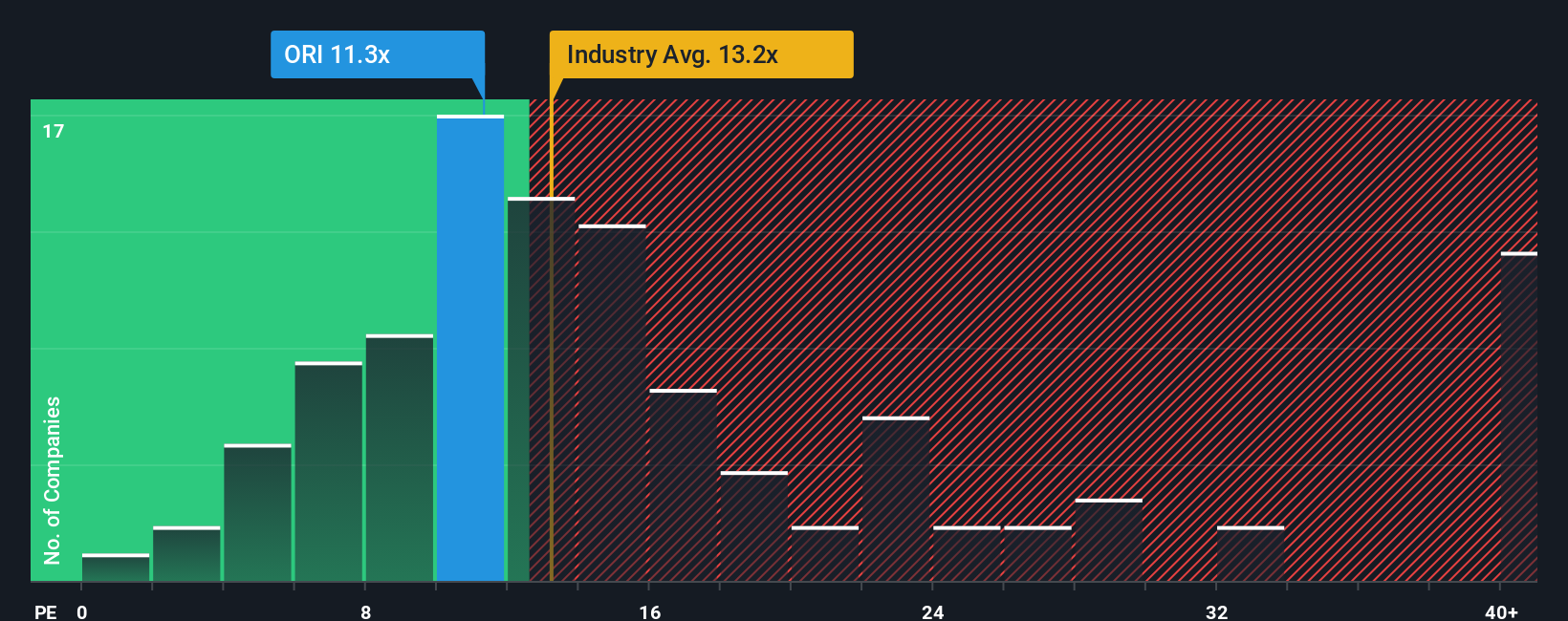

Approach 2: Old Republic International Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used metric for valuing profitable companies because it directly links the market price of a company's stock to its earnings power. For businesses with steady and positive earnings, like Old Republic International, PE offers investors a straightforward gauge of how much they are paying for each dollar of profit. This makes it especially relevant for established insurers operating in a mature market.

What is considered a "normal" or "fair" PE ratio often depends on both growth prospects and risk. Companies expected to grow faster or with less business risk tend to trade at higher PE ratios, reflecting investors’ willingness to pay more for future earnings. Conversely, slower growth or higher risk generally merits a lower PE.

Old Republic International’s current PE ratio stands at 11.81x. When compared to the insurance industry average of 14.24x and the peer average of 15.20x, the stock appears less expensive than many of its competitors. However, Simply Wall St’s proprietary “Fair Ratio” blends considerations such as Old Republic's growth outlook, profit margins, risk level, industry dynamics, and market cap to estimate a more precise benchmark, with the fair PE ratio calculated at 11.23x.

Relying solely on the industry's or peers’ averages can be misleading because they may overlook company-specific factors that impact true value. The Fair Ratio goes deeper by weighing what really drives a company’s sustainable worth in the current market.

Since Old Republic International’s actual PE is just 0.58x higher than its calculated Fair Ratio, the stock’s valuation is about in line with what would be considered fair for its profile today.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

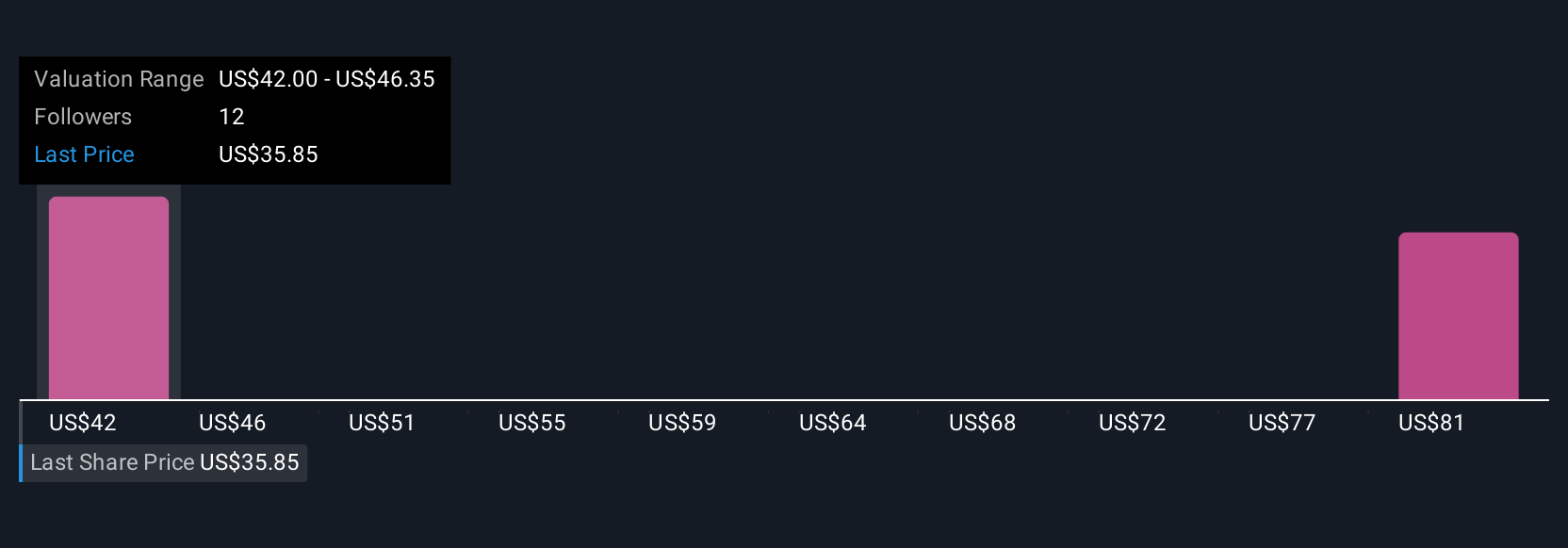

Upgrade Your Decision Making: Choose your Old Republic International Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative combines your unique perspective or the company's story with a financial forecast, linking real-world business developments to future estimates of revenue, earnings, and margins, and ultimately, to the fair value you believe is justified.

Narratives make investing more accessible by helping you connect qualitative insights with hard numbers, so your outlook is not just about feelings or headlines but is informed by your own forecasts. On Simply Wall St's Community page, millions of investors are already using Narratives to clearly lay out, update, and share their outlook on companies like Old Republic International, guiding their buy, hold, or sell decisions by comparing fair value to market price.

Importantly, Narratives are dynamic and automatically update as new news or earnings reports are released, ensuring your investment thesis can adapt quickly to new information. For example, using Old Republic International, one investor might craft a Narrative highlighting a bullish scenario with a fair value of $46 per share based on specialty insurance growth, while another focuses on risks in title insurance and sets a more cautious target at $42, demonstrating how Narratives reflect different viewpoints based on the same data.

Do you think there's more to the story for Old Republic International? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ORI

Old Republic International

Through its subsidiaries, provides insurance underwriting and related services primarily in the United States and Canada.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives