- United States

- /

- Insurance

- /

- NYSE:ORI

Does Old Republic International’s 21.7% Stock Surge Signal More Value in 2025?

Reviewed by Bailey Pemberton

- Wondering if Old Republic International is a savvy buy at today's price? Let’s unravel whether this insurance giant is still offering real value or has already been snapped up by the market.

- While the stock is up 5.2% in the last week and boasts an impressive 21.7% gain over the past year, there have been some twists. Returns dipped -4.2% in the past month but remain up 14.9% year-to-date.

- Old Republic’s share price action has recently been shaped by heightened investor interest in insurance sector stability, with news coverage highlighting the company’s conservative reserve practices and robust claims handling. Headlines also point to broader optimism around property and casualty insurers as markets digest shifting economic signals.

- On our valuation checks, Old Republic International earns a 4 out of 6, suggesting room for debate on its fair value. We’ll look at the common valuation methods first, but stick around for an even smarter approach at the end of this article.

Approach 1: Old Republic International Excess Returns Analysis

The Excess Returns valuation focuses on how efficiently a company uses shareholders' equity to generate profits above its cost of capital. By comparing the return on equity to the cost of equity, we can estimate a stock's real worth relative to the capital being invested by its owners.

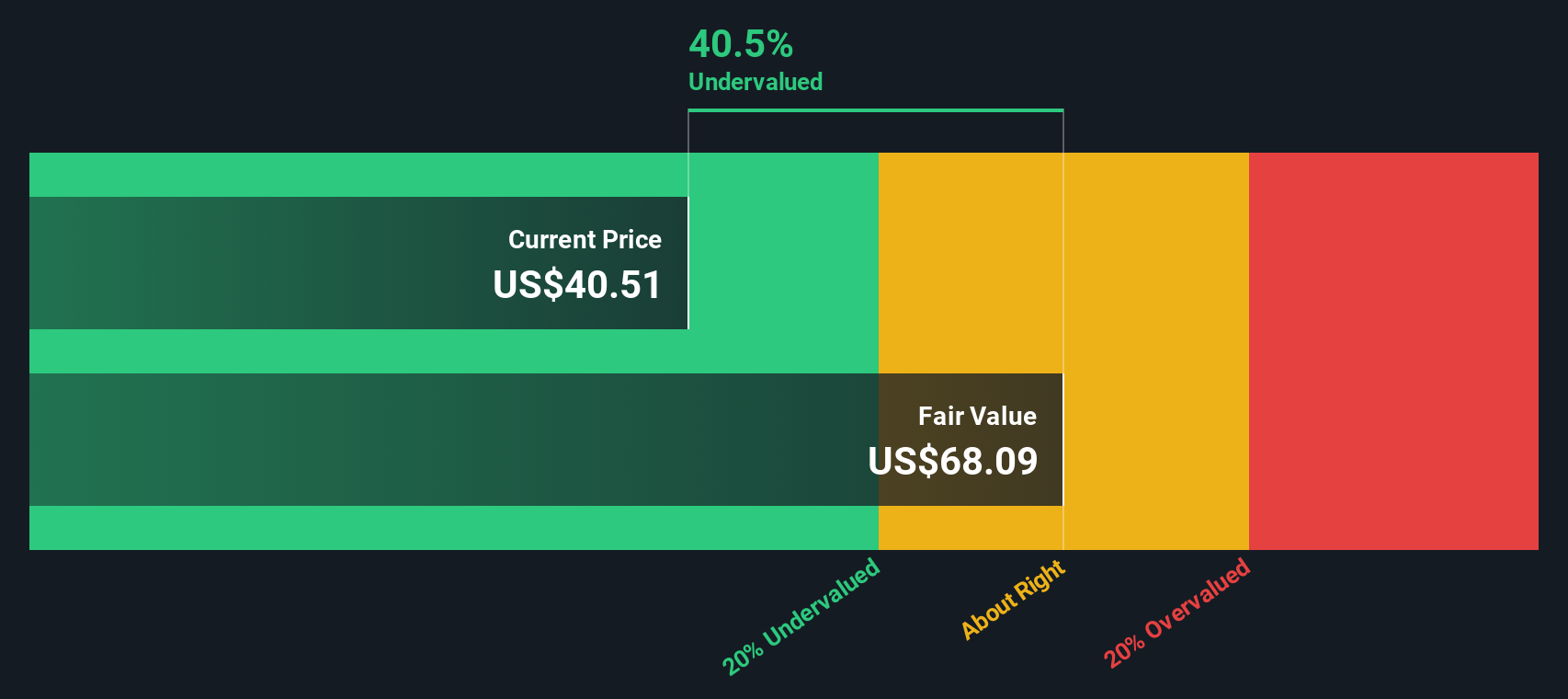

For Old Republic International, the numbers are encouraging. The company’s book value sits at $26.18 per share, and recent performance suggests a stable EPS of $3.45 per share, based on the median return on equity from the past five years. With a cost of equity at $1.89 per share and an excess return of $1.56 per share, Old Republic’s average return on equity is a solid 12.67%. Looking ahead, analysts project a stable future book value of $27.22 per share.

Given these inputs, the Excess Returns model estimates that Old Republic International is trading at a 40.3% discount to its intrinsic value. This points to a stock that appears decisively undervalued, offering current investors a meaningful cushion and upside potential, as measured by its ability to generate profits above its true cost of equity.

Result: UNDERVALUED

Our Excess Returns analysis suggests Old Republic International is undervalued by 40.3%. Track this in your watchlist or portfolio, or discover 870 more undervalued stocks based on cash flows.

Approach 2: Old Republic International Price vs Earnings

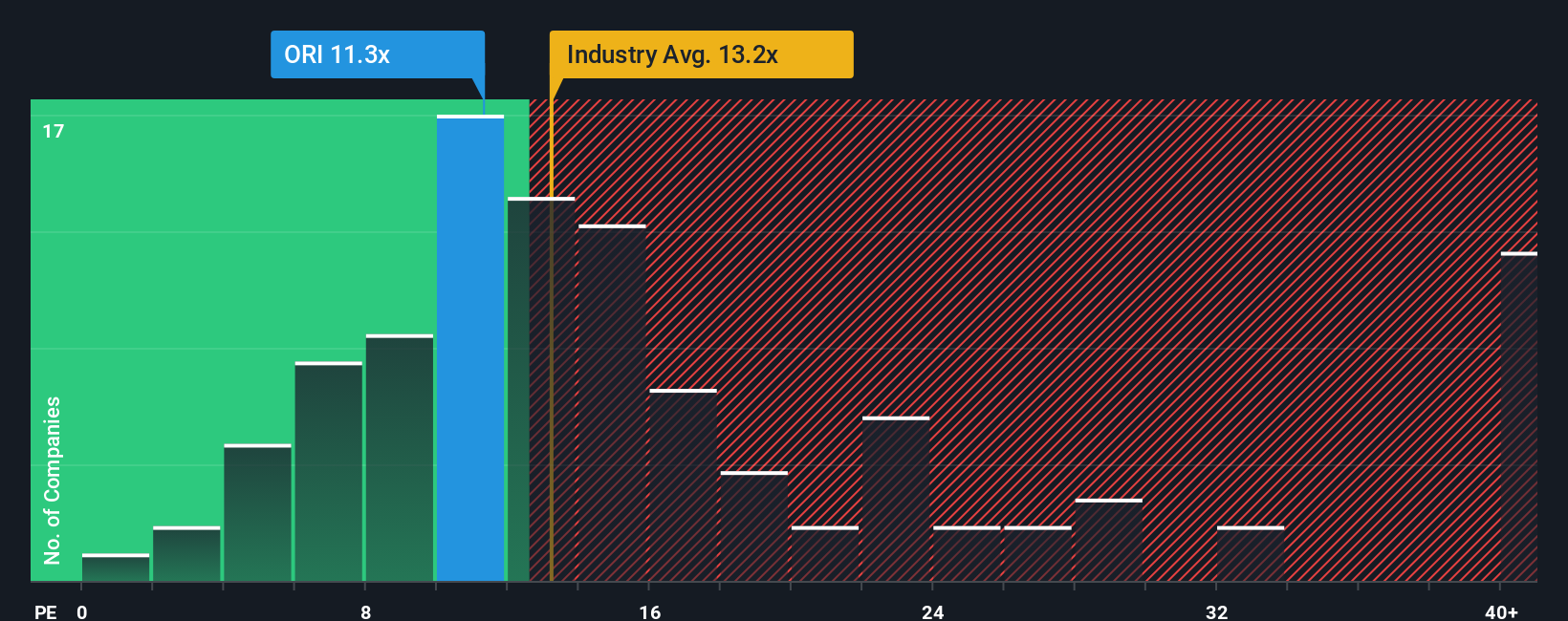

The Price-to-Earnings (PE) ratio is a widely used valuation multiple for profitable companies like Old Republic International because it directly ties the company’s share price to its actual bottom-line earnings. For investors, the PE ratio helps indicate how much they are paying for each dollar of the company’s earnings, offering a clear gauge of value relative to profitability.

What counts as a "fair" PE ratio can depend on factors like earnings growth expectations, overall profitability, and perceived risks. Faster-growing or less risky businesses generally command higher PE ratios, while slower-growing or riskier companies tend to have lower ones as the market adjusts for uncertainty or weaker prospects.

Currently, Old Republic International trades at a PE ratio of 12.08x. This figure closely aligns with both its peer average of 12.08x and is slightly below the insurance industry average of 13.20x. A noteworthy comparison is the company’s Fair Ratio of 10.71x, a proprietary metric calculated by Simply Wall St. This Fair Ratio goes further than the usual peer or industry averages by factoring in Old Republic’s unique growth outlook, profit margins, size, and specific risks to establish what the "right" multiple should be for this business.

When we compare Old Republic’s current PE ratio of 12.08x to its Fair Ratio of 10.71x, the difference is only 1.37x. This suggests the share price is a little higher than what fundamentals would indicate as fair, implying a slightly elevated valuation.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1401 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Old Republic International Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your story or perspective on a company, connecting your expectations for Old Republic International's future revenue, earnings, and margins to what you believe is a "fair value" by anchoring financial forecasts with real-world context.

Narratives are designed to be intuitive and accessible, available on Simply Wall St's Community page where millions of investors share and track their own perspectives. With Narratives, you link your view of the business’s key drivers like revenue growth or profit margins to the numbers, and the platform instantly shows how your assumptions stack up against the current market price. This makes it easy to spot whether the stock looks undervalued or overvalued based on your outlook.

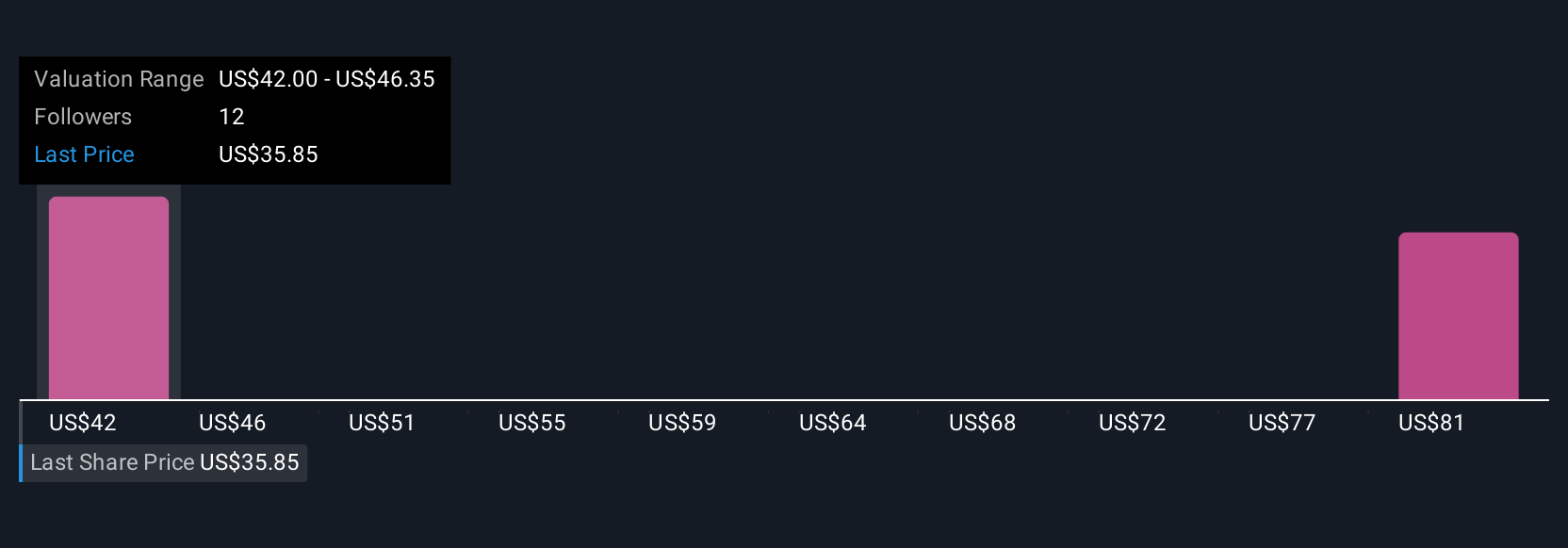

One of the best parts about Narratives is their dynamic nature, meaning your fair value calculation and investment story update automatically when fresh earnings, news, or changes in sector conditions arise. For example, some investors might be bullish and see Old Republic International’s fair value as high as $46.50, expecting growth from digital investments and specialty insurance. Others may be more cautious, pegging fair value closer to the lower consensus of around $42.00 due to industry headwinds, highlighting how Narratives turn data and opinions into actionable insights.

Do you think there's more to the story for Old Republic International? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ORI

Old Republic International

Through its subsidiaries, provides insurance underwriting and related services primarily in the United States and Canada.

Good value with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives