- United States

- /

- Insurance

- /

- NYSE:MMC

Will Marsh McLennan's (MMC) New Bloomberg Media Partnership Reshape Its Global Risk Advisory Narrative?

Reviewed by Sasha Jovanovic

- On October 22, 2025, Marsh McLennan and Bloomberg Media announced a knowledge partnership to offer thought leadership and analysis at prominent Bloomberg global events, including the Bloomberg New Economy Forum and Qatar Economic Forum.

- This collaboration is the first media partnership to launch under the new Marsh brand and emphasizes the company’s expertise in addressing economic uncertainties and systemic risks relevant to leading business policymakers worldwide.

- We’ll explore how contributing Marsh McLennan’s expertise on risk and resilience at Bloomberg’s high-profile forums may influence the company’s investment outlook.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Marsh & McLennan Companies Investment Narrative Recap

Shareholders in Marsh & McLennan Companies need to believe in the company’s ability to remain an essential advisor in risk and resilience as global uncertainties rise. The new partnership with Bloomberg Media may enhance the company's profile and reinforce its role as a trusted thought leader, but it is unlikely to meaningfully alter the most pressing catalyst, demand for specialized advisory services, or mitigate the key risk of persistent softness in property and reinsurance pricing in the short term. The recent Q3 earnings report stands out as highly relevant: while sales climbed to US$6,351 million year-over-year, profit and EPS were flat, underscoring steady demand but also highlighting margin pressures that remain a central issue for investors focused on earnings growth catalysts. Yet, investors should be aware that against the backdrop of evolving industry risks, persistent decline in reinsurance pricing may still represent an underappreciated challenge...

Read the full narrative on Marsh & McLennan Companies (it's free!)

Marsh & McLennan Companies is projected to reach $30.7 billion in revenue and $5.3 billion in earnings by 2028. This outlook implies a 5.9% annual revenue growth and a $1.2 billion increase in earnings from the current $4.1 billion.

Uncover how Marsh & McLennan Companies' forecasts yield a $218.21 fair value, a 16% upside to its current price.

Exploring Other Perspectives

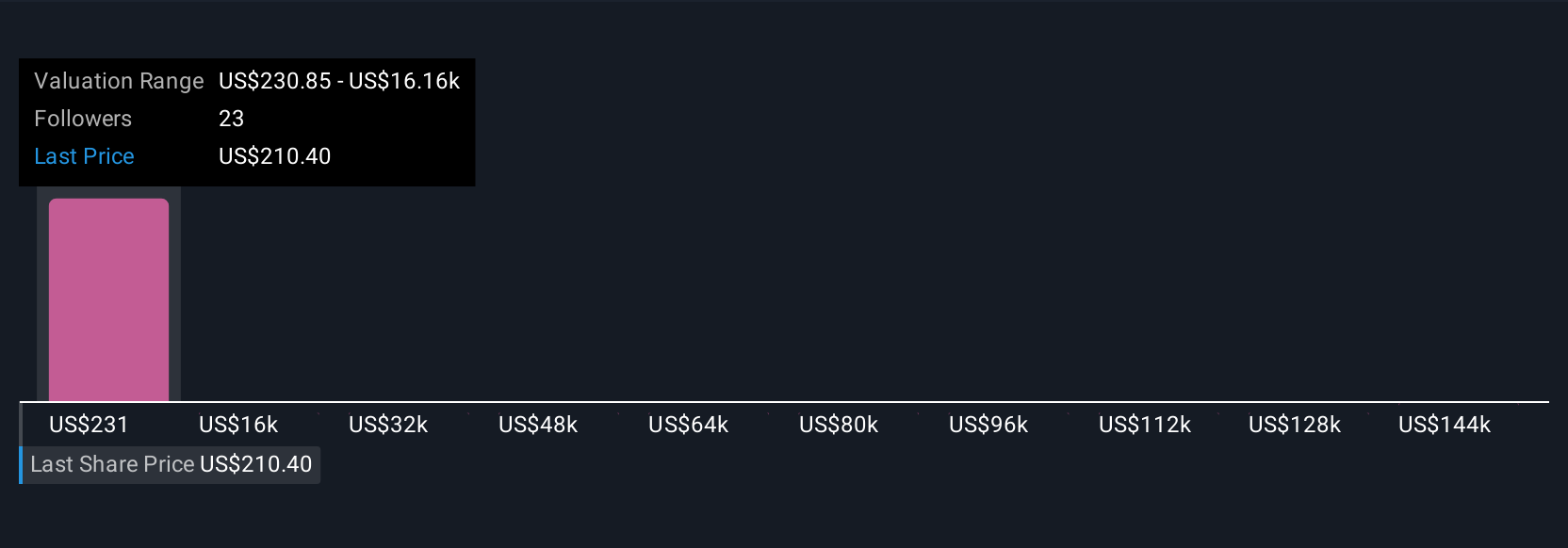

Three individual fair value estimates from the Simply Wall St Community span US$218 to US$159,561 per share. While many expect demand for risk and resilience advisory to support growth, such a wide range of opinions shows why it's worth exploring diverse viewpoints on Marsh & McLennan’s prospects.

Explore 3 other fair value estimates on Marsh & McLennan Companies - why the stock might be a potential multi-bagger!

Build Your Own Marsh & McLennan Companies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Marsh & McLennan Companies research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Marsh & McLennan Companies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Marsh & McLennan Companies' overall financial health at a glance.

Contemplating Other Strategies?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MMC

Marsh & McLennan Companies

A professional services company, provides advisory services and insurance solutions to clients in the areas of risk, strategy, and people worldwide.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives