- United States

- /

- Insurance

- /

- NYSE:MKL

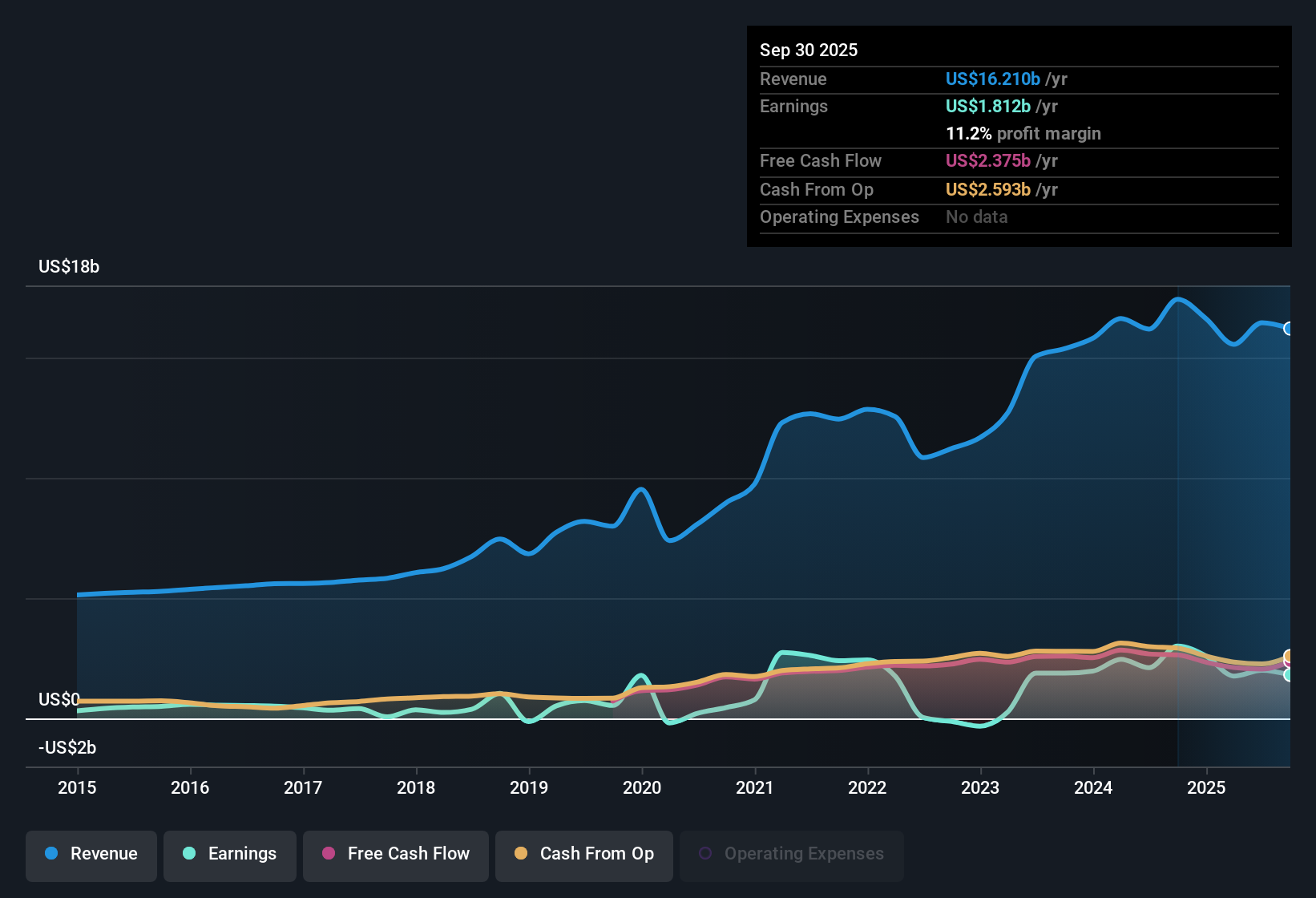

Markel Group (MKL) Profit Margins Decline, Reinforcing Value-Focused Investment Narratives

Reviewed by Simply Wall St

Markel Group (MKL) reported a net profit margin of 11.9% for the most recent period, down from 16.4% a year ago. Over the past twelve months, the company’s earnings have declined, even though profits have expanded at an average pace of 10.7% annually for the past five years. Both earnings and revenue growth projections lag the broader US market. With high-quality earnings and attractive valuation multiples, but moderate forward growth, the latest results leave investors weighing Markel’s relative value against a less robust near-term outlook.

See our full analysis for Markel Group.Next, we’ll see how these results compare to the most widely followed narratives, and where the numbers might challenge the consensus.

See what the community is saying about Markel Group

Profit Margins Under Pressure from Industry Headwinds

- The company’s profit margin shrank from 16.4% to 11.9% in the latest period, a clear indication that Markel is facing cost or pricing pressures as market competition intensifies.

- Analysts' consensus view notes that Markel’s recent restructuring and cost-cutting are meant to improve long-term margins, but persistent industry-wide headwinds, such as increased litigation costs and regulatory burdens, may keep profitability below previous levels.

- Consensus narrative highlights that expense efficiency initiatives and a focus on specialty underwriting could lift margins in the future, but ongoing sector risks have driven the recent margin contraction to below historical averages.

- This tension sets the stage for further volatility in net income as legacy business challenges intersect with efforts to stabilize results in the face of rising external pressures.

- Analysts see hurdles for near-term profit recovery, but management’s operational changes aim to counterbalance these industry risks. 📊 Read the full Markel Group Consensus Narrative.

Capital Freed Up for Higher-Return Initiatives

- The runoff of Markel’s subscale, loss-making reinsurance business is expected to free up sizeable capital, enabling renewed focus on profitable specialty insurance lines and expansion of non-insurance ventures.

- According to the analysts' consensus view, redeploying released capital into stable-growth businesses and higher-yield investments should reduce earnings volatility over time.

- Consensus view emphasizes that Markel Ventures and new business units provide steadier cash flows that can offset cyclical swings in insurance, supporting ongoing compounded earnings growth.

- The risk is that earnings accretion from these changes will take several years to fully materialize, during which near-term revenue growth may lag as the runoff plays out.

Valuation at a Discount Despite Growth Concerns

- Markel trades at $1,938 per share, significantly below its DCF fair value of $4,207, and its 12.7x Price-To-Earnings ratio is notably lower than peer and US insurance sector averages.

- Analysts' consensus view acknowledges that while slow projected earnings growth (0.6% annually) keeps upward share price movement in check, high-quality earnings and the large valuation discount underpin the investment case.

- The tight spread between Markel’s current share price and the $2,009 analyst price target signals that the market already prices in both the risks and moderate growth outlook, offering limited near-term upside but appealing to value-focused investors.

- If operational execution and profit diversification succeed, longer-term re-rating toward fair value remains a possibility even amid subdued revenue momentum.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Markel Group on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Notice something different in the results? Share your insight and shape your own take on Markel in just a few minutes, Do it your way.

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Markel Group.

See What Else Is Out There

Markel’s declining profit margins and subdued near-term growth show its vulnerability to persistent industry pressures and limited paths to rapid earnings recovery.

If you want steadier performance, check out stable growth stocks screener (2112 results) to see companies consistently growing revenue and earnings, even when market cycles turn challenging.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MKL

Markel Group

Through its subsidiaries, engages in the insurance business in the United States and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives