- United States

- /

- Insurance

- /

- NYSE:MKL

How Investors Are Reacting To Markel Group (MKL) Beating Earnings Estimates Despite Revenue Decline

Reviewed by Sasha Jovanovic

- Markel Group recently reported quarterly revenues of US$4.37 billion, a 5.3% year-over-year decline, yet surpassed analysts’ expectations by 11.5% and achieved beats in both EPS and net premiums earned.

- CEO Tom Gayner expressed satisfaction with the company’s performance and progress, highlighting Markel Group’s ability to outperform consensus despite revenue pressure.

- We’ll see how Markel’s earnings outperformance and management optimism may influence the company’s investment outlook and narrative.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

Markel Group Investment Narrative Recap

Owning Markel Group stock requires confidence in its continued ability to balance disciplined underwriting, specialty insurance focus, and earnings diversification through Ventures, even as legacy lines and reinsurance runoff put pressure on growth metrics. The latest revenue decline did not materially alter the biggest near-term catalyst, operational gains from reorganization, nor did it significantly impact the risk of possible reserve deficiencies in discontinued lines, as quarterly outperformance mainly reflects improved core business execution.

Recent executive and board appointments, announced alongside Q3 results, are most relevant in this context. Leadership changes are targeted at strengthening operational focus and efficiency, both essential for Markel to deliver on its restructuring catalyst and manage ongoing integration risks during what remains a critical transitional period.

By contrast, investors should also keep in mind the persistent risk tied to legacy reserve deficiencies in the company’s runoff operations…

Read the full narrative on Markel Group (it's free!)

Markel Group is projected to reach $17.7 billion in revenue and $2.0 billion in earnings by 2028. This outlook is based on an annual revenue growth rate of 2.5% and a decline in earnings by $0.2 billion from the current $2.2 billion.

Uncover how Markel Group's forecasts yield a $2013 fair value, in line with its current price.

Exploring Other Perspectives

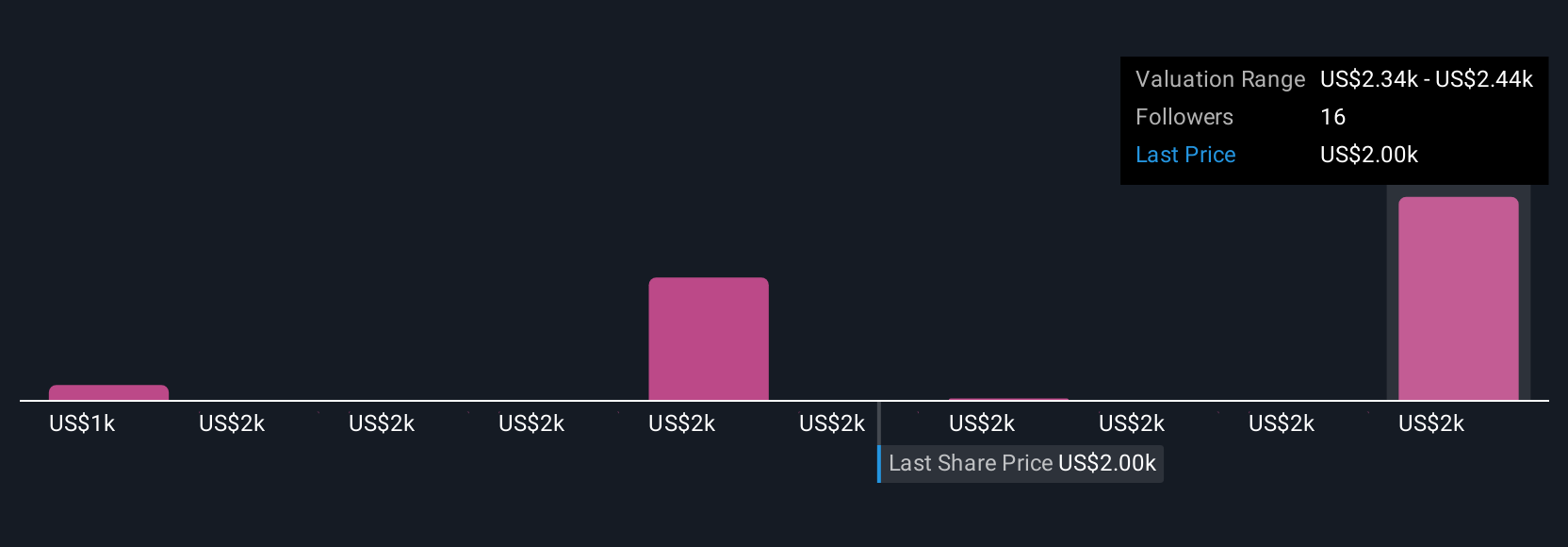

Five fair value estimates from the Simply Wall St Community range from US$1,476.64 to US$2,403.04, showing broad differences in expectations. As many weigh operational restructuring as a key catalyst, you can explore how other investors factor this into their outlook for the stock.

Explore 5 other fair value estimates on Markel Group - why the stock might be worth as much as 17% more than the current price!

Build Your Own Markel Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Markel Group research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Markel Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Markel Group's overall financial health at a glance.

Seeking Other Investments?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MKL

Markel Group

Through its subsidiaries, engages in the insurance business in the United States and internationally.

Excellent balance sheet with questionable track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

The AI Infrastructure Giant Grows Into Its Valuation

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success