- United States

- /

- Insurance

- /

- NYSE:MET

MetLife (MET): Exploring Current Valuation and Shareholder Returns After Recent Price Movement

Reviewed by Simply Wall St

See our latest analysis for MetLife.

MetLife’s share price has cooled off recently, down 7.17% over the past month, as investors weigh the company’s future growth and risk profile against broader market dynamics. Despite that, the long-term picture remains resilient. The total shareholder return of 98.55% over the last five years reflects substantial value creation for committed investors.

If you’re interested in broadening your perspective beyond insurance, it’s a great moment to explore fast growing stocks with high insider ownership.

With shares trading nearly 22% below analyst targets and boasting strong long-term returns, the key question now is whether MetLife’s current valuation leaves room for upside or if the market already reflects its future prospects.

Most Popular Narrative: 18.1% Undervalued

With MetLife shares closing at $76.15 and the most prominent narrative setting fair value at $93, there is a notable gap between current price and future potential. The narrative consensus points to underlying strengths that may not yet be fully reflected in today’s market pricing.

Ongoing investment in digital transformation (AI-driven underwriting, process automation, embedded insurance partnerships, and tech-enabled distribution) enables MetLife to reduce acquisition and operating costs, improve customer engagement and retention, and, over time, boost net margins.

Curious about what’s fueling this bullish price target? The secret sauce lies in bold growth projections and ambitious profit margins, calculated on a rapidly evolving digital platform and international expansion. You’ll want to see how these numbers stack up against the company’s recent performance and the wider insurance landscape.

Result: Fair Value of $93 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent low investment yields or slower than expected digital adoption could challenge MetLife’s margin expansion and might alter the bullish thesis ahead.

Find out about the key risks to this MetLife narrative.

Another View: Looking Through the Earnings Lens

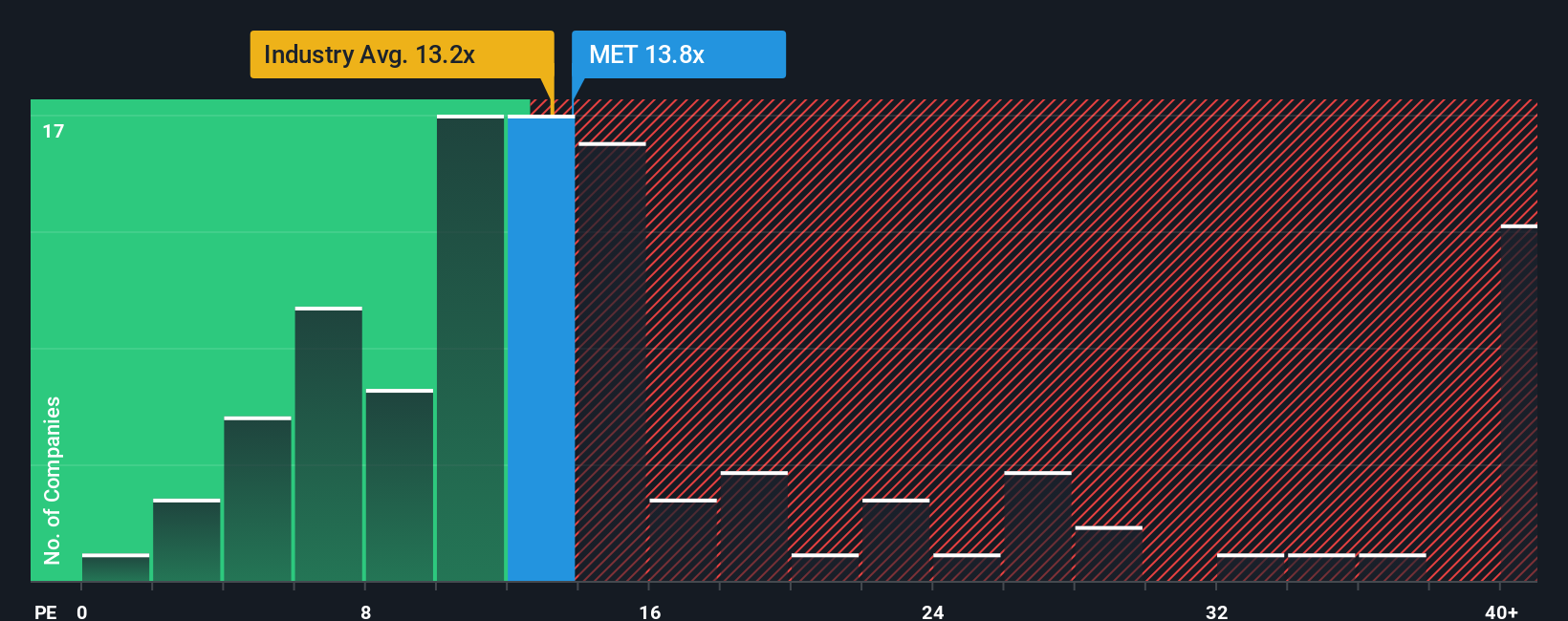

While long-term fair value models suggest MetLife is distinctly undervalued, a closer look at its price-to-earnings ratio tells a subtler story. Shares are trading at 13.8 times earnings, which is slightly above both the industry average of 13.1 and the peer average of 13.7. However, the current valuation is well below the fair ratio of 17.3. This means that if the market sentiment improves, there could be additional upside; alternatively, if it reverts, there is downside risk. Does the market see something others do not, or is there opportunity hiding in plain sight?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own MetLife Narrative

If you see the story differently or want to dig into the numbers yourself, you can build your own MetLife narrative in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding MetLife.

Looking for More Investment Ideas?

Smart investors are always on the lookout for the next great opportunity. Don’t miss your chance to find tomorrow’s top performers before everyone else does.

- Capitalize on steady income streams by reviewing these 16 dividend stocks with yields > 3%, which offers robust yields and a track record of rewarding shareholders.

- Jump into the future with these 24 AI penny stocks, where cutting-edge artificial intelligence is redefining entire industries and unlocking significant growth potential.

- Seize undervalued gems hiding in plain sight by checking out these 870 undervalued stocks based on cash flows, based on powerful cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MET

MetLife

A financial services company, provides insurance, annuities, employee benefits, and asset management services worldwide.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives