- United States

- /

- Insurance

- /

- NYSE:MET

How Investors May Respond To MetLife (MET) Asia Sales Strength and Increased Capital Returns Amid Revenue Miss

Reviewed by Sasha Jovanovic

- MetLife, Inc. recently reported third-quarter 2025 results, with adjusted earnings per share rising 22% year-over-year, supported by strong sales growth in Asia and increased variable investment income, even as overall revenue missed analyst forecasts at US$17.36 billion.

- The company returned approximately US$875 million to shareholders through dividends and share buybacks, while also securing US$12 billion in pension risk transfer mandates and expanding access to retirement income products via a partnership with Alight, Inc.

- We'll explore how MetLife's robust Asia sales growth and capital return initiatives may reshape its investment narrative.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

MetLife Investment Narrative Recap

To be a shareholder in MetLife, you need to believe in its ability to leverage global scale and resilient earnings in international markets, particularly as demand for retirement and protection products grows in Asia. While the recent jump in adjusted earnings per share stands out, softer headline revenues and muted net income growth suggest this quarter's results may not materially change the short term narrative, with persistent volatility in investment margins remaining the most important risk to watch.

Of the recent developments, MetLife’s collaboration with Alight, Inc. is especially relevant. By expanding access to institutional annuity products for nearly 12 million defined contribution plan participants, this partnership directly aligns with MetLife's push to capture more retirement-related flows, a key catalyst for top-line growth amid margin pressures and changing industry demand drivers.

Yet, in contrast to the company’s upbeat commentary, investors should stay mindful of how ongoing volatility in variable investment income could still disrupt near-term earnings growth and capital return confidence…

Read the full narrative on MetLife (it's free!)

MetLife's outlook points to $83.8 billion in revenue and $6.3 billion in earnings by 2028. This scenario is based on analysts projecting 4.7% annual revenue growth and a $2.2 billion increase in earnings from the current $4.1 billion.

Uncover how MetLife's forecasts yield a $93.00 fair value, a 20% upside to its current price.

Exploring Other Perspectives

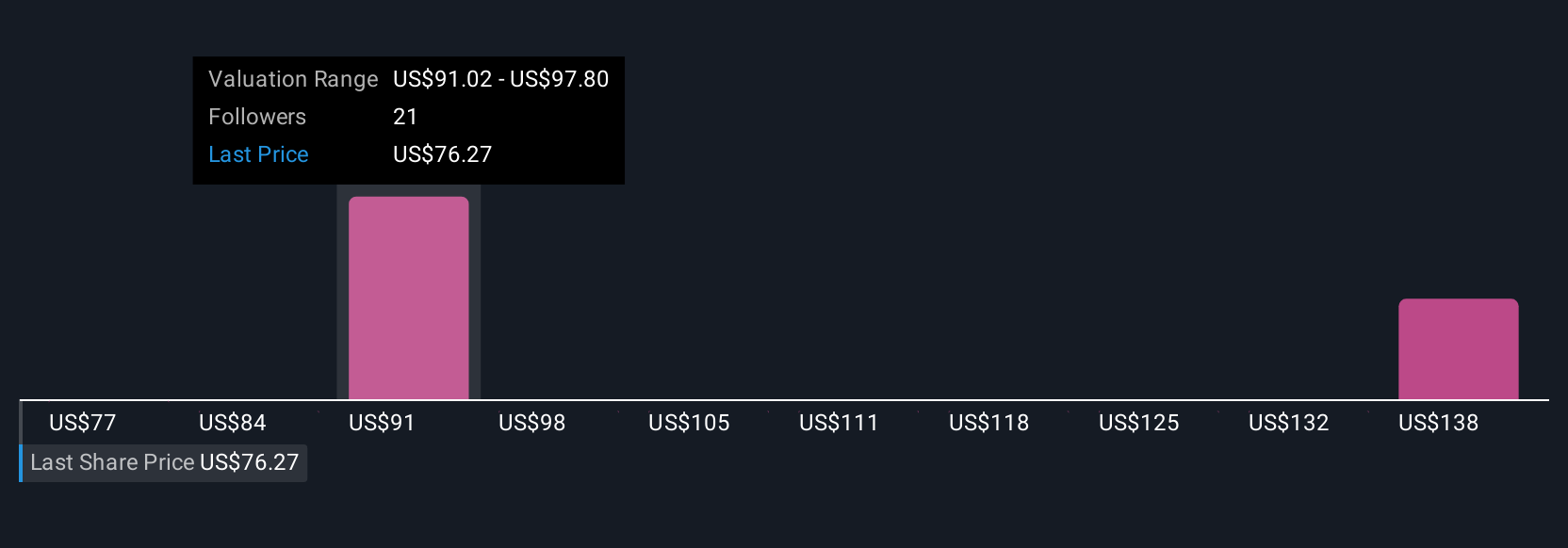

The Simply Wall St Community offers four independent fair value opinions for MetLife, ranging widely from US$77.46 to US$110.98 per share. As views differ sharply, many are closely watching the impact of persistent investment margin risks on MetLife’s future growth and market confidence.

Explore 4 other fair value estimates on MetLife - why the stock might be worth just $77.46!

Build Your Own MetLife Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your MetLife research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free MetLife research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate MetLife's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MET

MetLife

A financial services company, provides insurance, annuities, employee benefits, and asset management services worldwide.

Established dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives