- United States

- /

- Insurance

- /

- NYSE:MCY

Does Mercury General's (MCY) Dividend Affirmation Reflect Renewed Confidence in Its Core Profitability?

Reviewed by Sasha Jovanovic

- Mercury General Corporation recently reported its third-quarter and nine-month earnings for 2025, showing third-quarter revenue of US$1.58 billion and net income of US$280.4 million, both up from the prior year, while also affirming a quarterly dividend of US$0.3175 per share to be paid in December.

- An interesting detail is that while year-to-date net income declined compared to the prior year, third-quarter profitability and earnings per share saw improvement, suggesting stronger core performance in the most recent quarter.

- We’ll now examine how Mercury General’s improved quarterly earnings and dividend affirmation influence its broader investment narrative and future outlook.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Mercury General Investment Narrative Recap

To be a Mercury General shareholder, you need to believe in the company's underlying insurance operations, resilience against catastrophe losses, and its ability to stabilize earnings and rebuild surplus. The recent quarterly earnings beat and dividend affirmation provide some evidence of improving core performance, but do not fundamentally change the biggest short term risk, the financial impact of recent catastrophic wildfires, including their effect on reinsurance and statutory surplus.

Of the recent announcements, the dividend affirmation stands out, as it signals a commitment to capital returns even in a year with subdued nine-month profits. However, dividend sustainability could be tested if wildfire-related risks escalate or if reinsurance costs increase further, placing more pressure on the company’s margins and available capital.

But while the improved third-quarter numbers might seem reassuring, investors should be aware that the lingering uncertainty tied to future wildfire losses could still...

Read the full narrative on Mercury General (it's free!)

Mercury General's narrative projects $6.7 billion revenue and $452.5 million earnings by 2028. This requires 5.1% yearly revenue growth and a $62.4 million earnings increase from $390.1 million today.

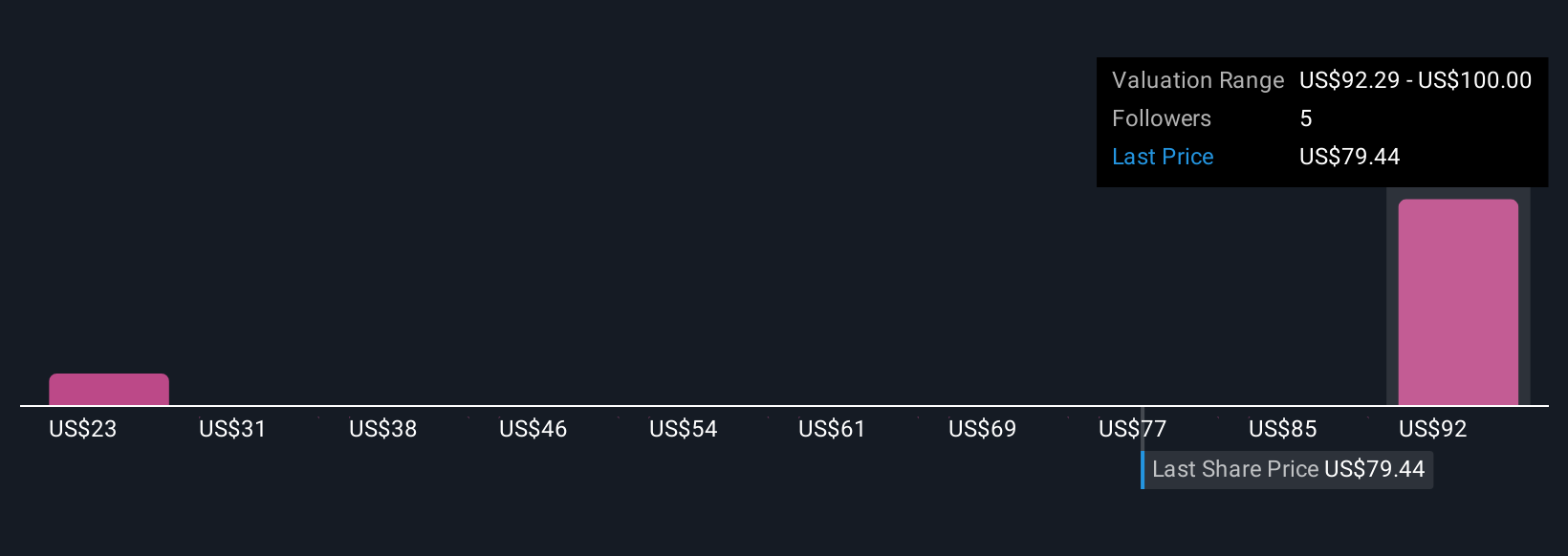

Uncover how Mercury General's forecasts yield a $100.00 fair value, a 22% upside to its current price.

Exploring Other Perspectives

Two users in the Simply Wall St Community estimate Mercury General's fair value between US$79.55 and US$100. These varied perspectives contrast with the ongoing risk of elevated reinsurance costs, reminding you to consider multiple viewpoints.

Explore 2 other fair value estimates on Mercury General - why the stock might be worth as much as 22% more than the current price!

Build Your Own Mercury General Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Mercury General research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Mercury General research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Mercury General's overall financial health at a glance.

Looking For Alternative Opportunities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MCY

Mercury General

Engages in writing personal automobile insurance in the United States.

Adequate balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives