- United States

- /

- Insurance

- /

- NYSE:LMND

Why Lemonade (LMND) Is Up 27.3% After Raising 2025 Outlook and Narrowing Net Loss

Reviewed by Sasha Jovanovic

- Lemonade reported third-quarter 2025 results, showing revenue of US$194.5 million, a net loss of US$37.5 million, and raised its full-year guidance for both revenue and premiums, reflecting stronger-than-expected operating performance.

- The company’s updated outlook underscores continued year-over-year growth in both gross earned premium and revenue, alongside a narrowing net loss and improved operating metrics.

- We'll examine how Lemonade's higher full-year revenue guidance and reduced net loss may influence its investment outlook and risk profile.

We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Lemonade Investment Narrative Recap

To be a shareholder in Lemonade, you need to believe in the company's ability to scale its AI-powered insurance platform and drive sustained revenue growth while narrowing losses in a competitive sector. The raised full-year revenue guidance is a positive near-term development, but the company's ongoing lack of profitability remains the main risk, this news does not fundamentally change that equation or the path to break-even as the most important short-term catalyst. Among recent announcements, Lemonade's improved Q3 earnings and narrower net loss stand out most. This signals incremental progress toward cost discipline, supporting optimism around operating leverage, but the continued net losses reinforce that Lemonade’s journey to profitability is not assured, especially given aggressive competitor activity and cost pressures. However, in contrast, investors should be aware that Lemonade’s reliance on lower reinsurance rates also exposes it to higher risk from large claims and...

Read the full narrative on Lemonade (it's free!)

Lemonade's narrative projects $1.8 billion revenue and $201.4 million earnings by 2028. This requires 44.9% yearly revenue growth and a $405.4 million earnings increase from -$204.0 million today.

Uncover how Lemonade's forecasts yield a $49.62 fair value, a 34% downside to its current price.

Exploring Other Perspectives

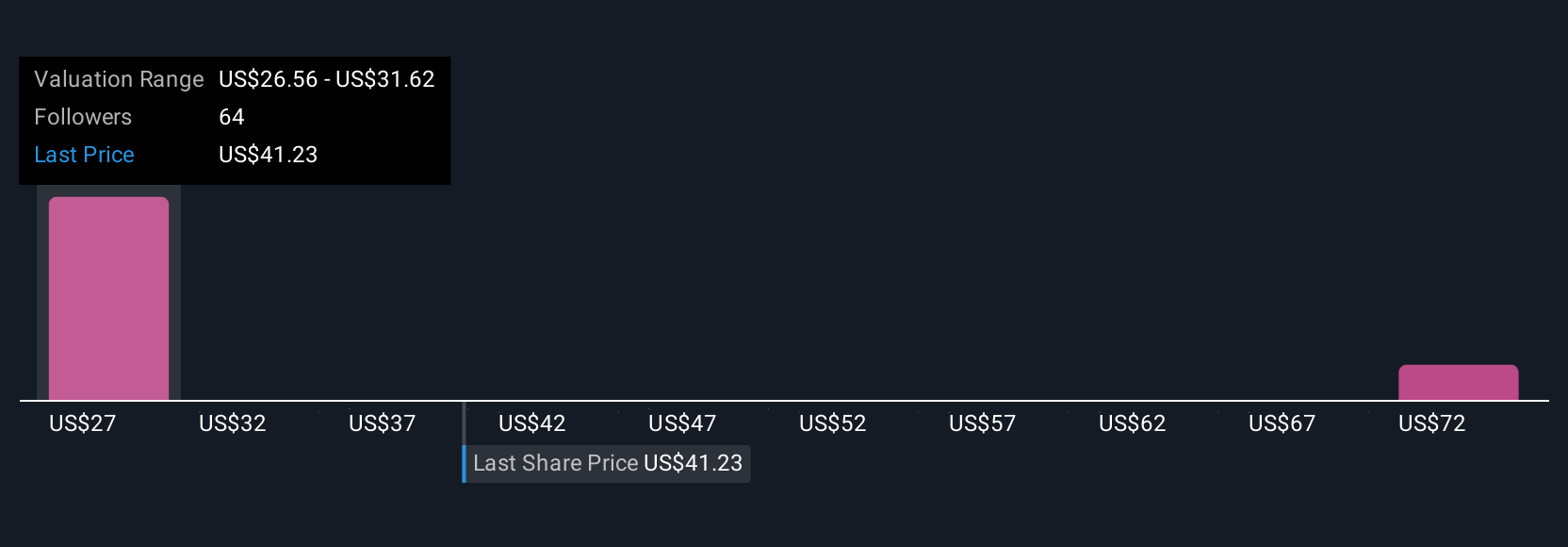

Thirteen fair value estimates from the Simply Wall St Community span from US$23.34 to US$77.14 per share. While investor outlooks vary widely, the focus on revenue growth meeting or outpacing guidance continues to shape the broader debate about Lemonade’s potential and the risks that could affect its profit trajectory.

Explore 13 other fair value estimates on Lemonade - why the stock might be worth less than half the current price!

Build Your Own Lemonade Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Lemonade research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Lemonade research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Lemonade's overall financial health at a glance.

Searching For A Fresh Perspective?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Find companies with promising cash flow potential yet trading below their fair value.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 34 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LMND

Lemonade

Provides various insurance products in the United States, Europe, and the United Kingdom.

Adequate balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives