- United States

- /

- Insurance

- /

- NYSE:L

How Investors May Respond To Loews (L) Earnings, Buybacks and New Board Appointment

Reviewed by Sasha Jovanovic

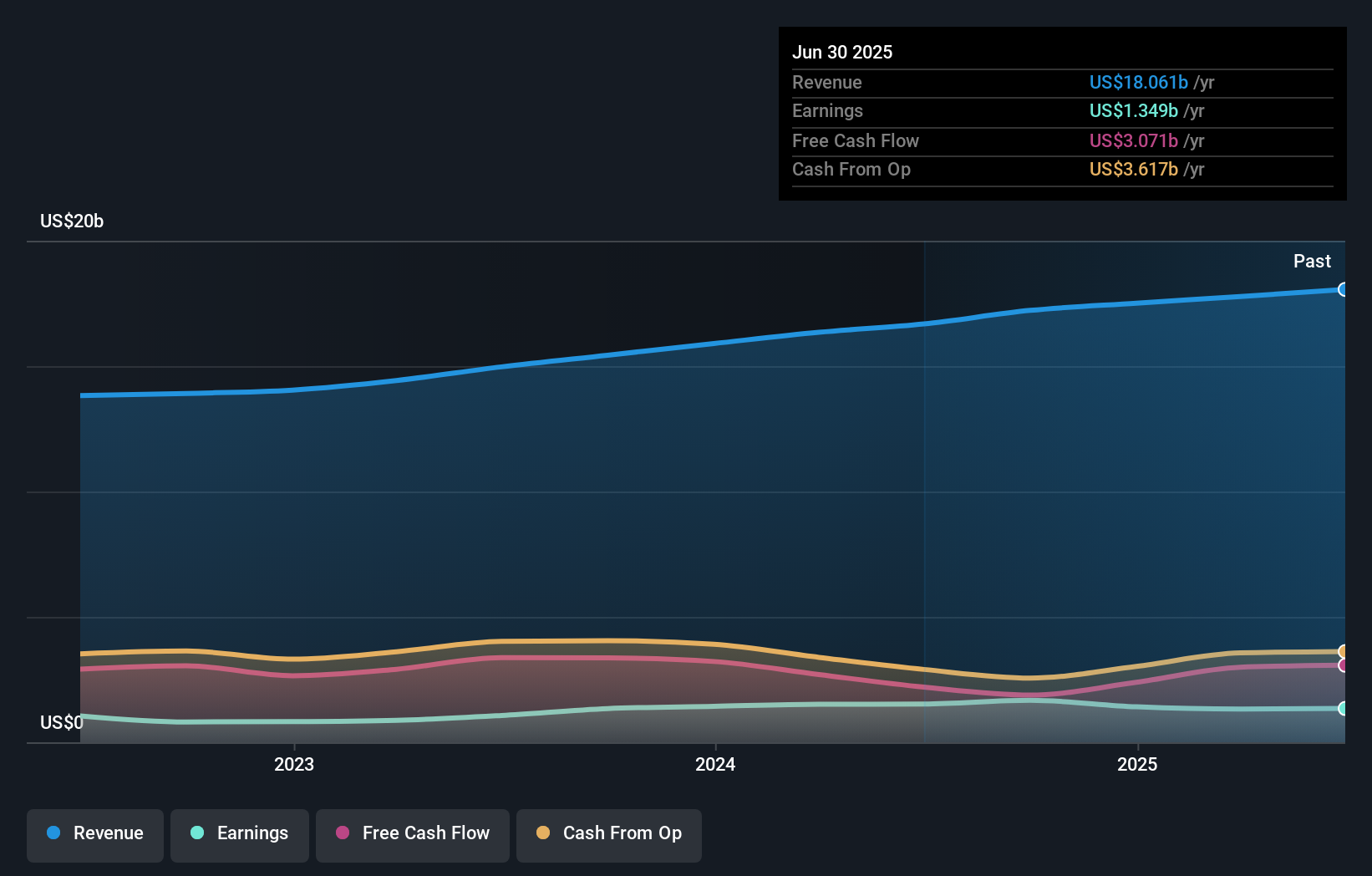

- Loews Corporation recently reported third quarter 2025 results, highlighting higher revenue of US$4.67 billion and net income of US$504 million compared to the prior year, alongside continued buybacks with 587,959 shares repurchased for US$56.2 million.

- An additional announcement revealed Dino Robusto, currently Executive Chairman of CNA Financial Corporation, will join the Loews board as a director effective January 1, 2026, reflecting Loews’s approach to leadership continuity from within its subsidiaries.

- We’ll explore how Loews’s sustained earnings growth and ongoing share repurchases influence its overall investment narrative and shareholder appeal.

We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Loews' Investment Narrative?

Owning shares in Loews is about confidence in its diversified business model, steady buyback track record, and disciplined management, traits that have historically set the company apart, even as earnings growth sometimes slowed. The most recent quarterly results showed a solid revenue lift and improvement in net income year-on-year, reinforcing Loews’s core financial stability. The upcoming board addition of Dino Robusto, recently Executive Chairman at its CNA subsidiary, signals a strong commitment to internal leadership continuity, but this move alone doesn’t materially change current risks or short-term growth drivers. Principal near-term catalysts remain anchored in Loews’s ability to generate sustainable earnings and continue capital returns through buybacks and dividends. The primary risks, including below-peer return on equity and the challenge of accelerating profit growth from a maturing business profile, persist much as before. Overall, recent news affirms Loews’s steady direction, but doesn’t reset the major questions facing shareholders.

But not all investors will be comfortable with Loews’s relatively low return on equity today. Loews' shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore 2 other fair value estimates on Loews - why the stock might be worth 33% less than the current price!

Build Your Own Loews Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Loews research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free Loews research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Loews' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:L

Loews

Through its subsidiaries, provides commercial property and casualty insurance in the United States and internationally.

Adequate balance sheet with questionable track record.

Similar Companies

Market Insights

Community Narratives