- United States

- /

- Insurance

- /

- NYSE:KNSL

Kinsale Capital Group's (NYSE:KNSL) five-year total shareholder returns outpace the underlying earnings growth

Kinsale Capital Group, Inc. (NYSE:KNSL) shareholders have seen the share price descend 13% over the month. But over five years returns have been remarkably great. In fact, during that period, the share price climbed 482%. Impressive! So we don't think the recent decline in the share price means its story is a sad one. Of course what matters most is whether the business can improve itself sustainably, thus justifying a higher price.

In light of the stock dropping 4.5% in the past week, we want to investigate the longer term story, and see if fundamentals have been the driver of the company's positive five-year return.

View our latest analysis for Kinsale Capital Group

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

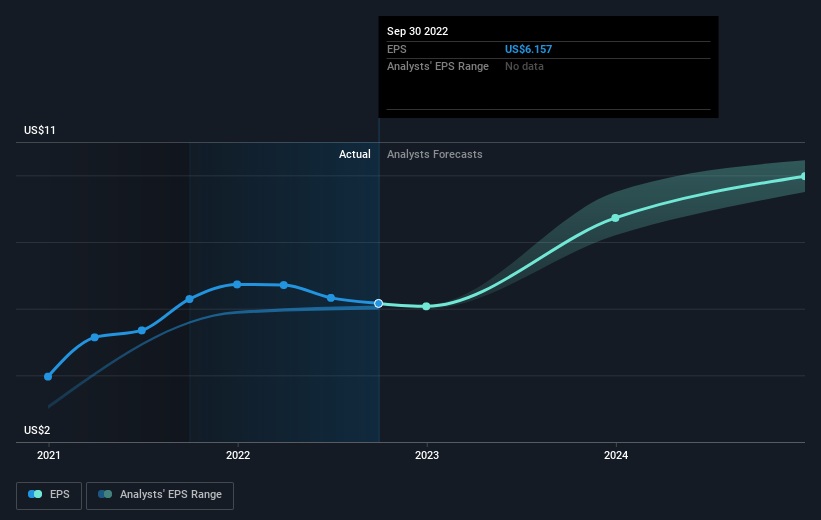

During five years of share price growth, Kinsale Capital Group achieved compound earnings per share (EPS) growth of 41% per year. That makes the EPS growth particularly close to the yearly share price growth of 42%. That suggests that the market sentiment around the company hasn't changed much over that time. Rather, the share price has approximately tracked EPS growth.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. It might be well worthwhile taking a look at our free report on Kinsale Capital Group's earnings, revenue and cash flow.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. In the case of Kinsale Capital Group, it has a TSR of 491% for the last 5 years. That exceeds its share price return that we previously mentioned. This is largely a result of its dividend payments!

A Different Perspective

We're pleased to report that Kinsale Capital Group shareholders have received a total shareholder return of 10% over one year. And that does include the dividend. Having said that, the five-year TSR of 43% a year, is even better. The pessimistic view would be that be that the stock has its best days behind it, but on the other hand the price might simply be moderating while the business itself continues to execute. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider risks, for instance. Every company has them, and we've spotted 1 warning sign for Kinsale Capital Group you should know about.

But note: Kinsale Capital Group may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Kinsale Capital Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:KNSL

Kinsale Capital Group

Engages in the provision of property and casualty insurance products in the United States.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives