- United States

- /

- Insurance

- /

- NYSE:KNSL

Kinsale Capital Group (KNSL): Evaluating Valuation as Competition Intensifies and Premium Growth Cools

Reviewed by Simply Wall St

Recent investor commentary and industry updates have put a spotlight on Kinsale Capital Group (KNSL), as the insurer faces mounting competition and softer premium rates in the Excess and Surplus market. Despite these challenges, the company continues to deliver solid results and outperform in select segments.

See our latest analysis for Kinsale Capital Group.

Kinsale Capital Group’s share price has taken a hit lately, dropping nearly 16% over the past month as competition in the Excess and Surplus insurance market has ramped up and premium growth expectations have cooled. Although momentum has faded in the short term, the company’s longer-range track record, with a three-year total shareholder return of 34% and a five-year total return of 72%, shows that disciplined execution and selective growth have rewarded shareholders willing to look beyond near-term volatility.

If you’re curious about what other high-potential companies are catching attention right now, it’s a great moment to broaden your search and discover fast growing stocks with high insider ownership

With the stock now trading nearly 28% below its estimated intrinsic value, but with growth expected to moderate, investors have to ask whether Kinsale is a bargain at these levels or if future gains are already accounted for.

Most Popular Narrative: 15.9% Undervalued

Compared to Kinsale Capital Group’s last close at $396.94, the most widely followed narrative sees the stock as trading at a notable discount to fair value. This view is supported by higher earnings growth and margin assumptions that underlie the valuation.

Kinsale’s advanced technology platform and strict expense discipline yield an industry-low expense ratio (approximately 20.7%). This positions the company to preserve and expand net margins as automation and data analytics further scale underwriting, quoting, and policy servicing over time. Continued investment in proprietary underwriting and conservative reserving practices build a resilient balance sheet and maintain loss ratio outperformance. These factors support long-term earnings growth and help limit downside risk from adverse claim development, even during periods of headline inflation or market volatility.

Why do analysts think Kinsale deserves a price target well above today’s level? Want to unlock the financial assumptions and strategic bets fueling this narrative’s bullish outlook? Only by reading the narrative in full will you grasp just how aggressive the projections behind this premium valuation really are. The story is in the numbers.

Result: Fair Value of $472 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heightened competition in commercial property lines, or persistent inflation impacting claim costs, could challenge Kinsale’s growth assumptions and put pressure on future profit margins.

Find out about the key risks to this Kinsale Capital Group narrative.

Another View: Market Ratios Highlight a Premium Price

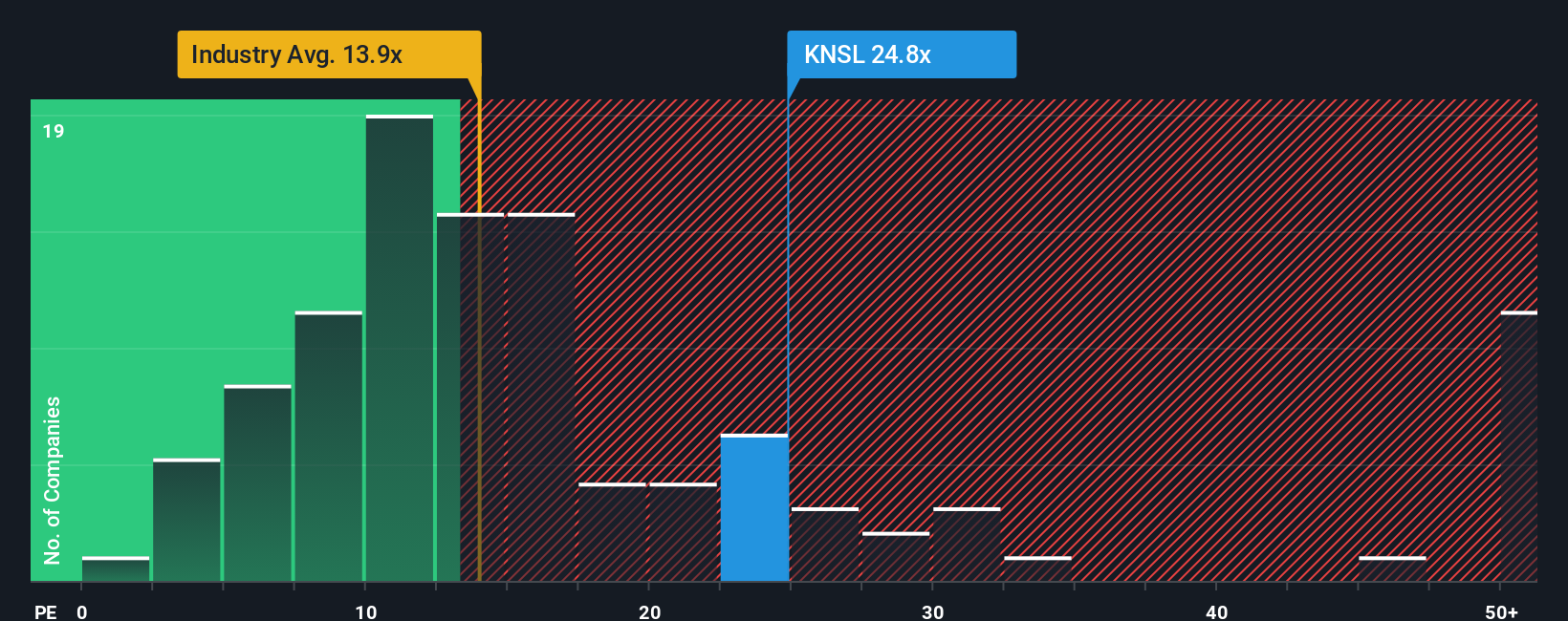

Looking through the lens of market valuation ratios, Kinsale trades at 19.5 times earnings. This is not only above the industry average of 13.2x but also higher than the average for its peers, which sits at 17.2x. Compared to the fair ratio of 11.1x, the gap suggests that investors are paying a notable premium for future growth and quality. But is that premium justified, or does it introduce more risk if growth slows?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Kinsale Capital Group Narrative

If you’re unconvinced by this outlook or would rather draw your own conclusions from the fundamentals, you can build a personalized view in just a few minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Kinsale Capital Group.

Looking for More Investment Ideas?

Why settle for just one opportunity when smart investors look for multiple ways to win? Uncover fresh strategies by tapping into unique market niches you might have missed.

- Benefit from resilient income streams as you scan for reliable payouts using these 14 dividend stocks with yields > 3% with yields above 3%.

- Boost your long-term potential by sizing up cutting-edge contenders in AI and automation through these 25 AI penny stocks.

- Capitalize on overlooked gems trading below their cash flow value by starting with these 864 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kinsale Capital Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KNSL

Kinsale Capital Group

Engages in the provision of property and casualty insurance products in the United States.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives