- United States

- /

- Insurance

- /

- NasdaqGS:GBLI

Global Indemnity Group (GBLI): Net Profit Margin Drops to 6.3%, Challenging Margin Recovery Narrative

Reviewed by Simply Wall St

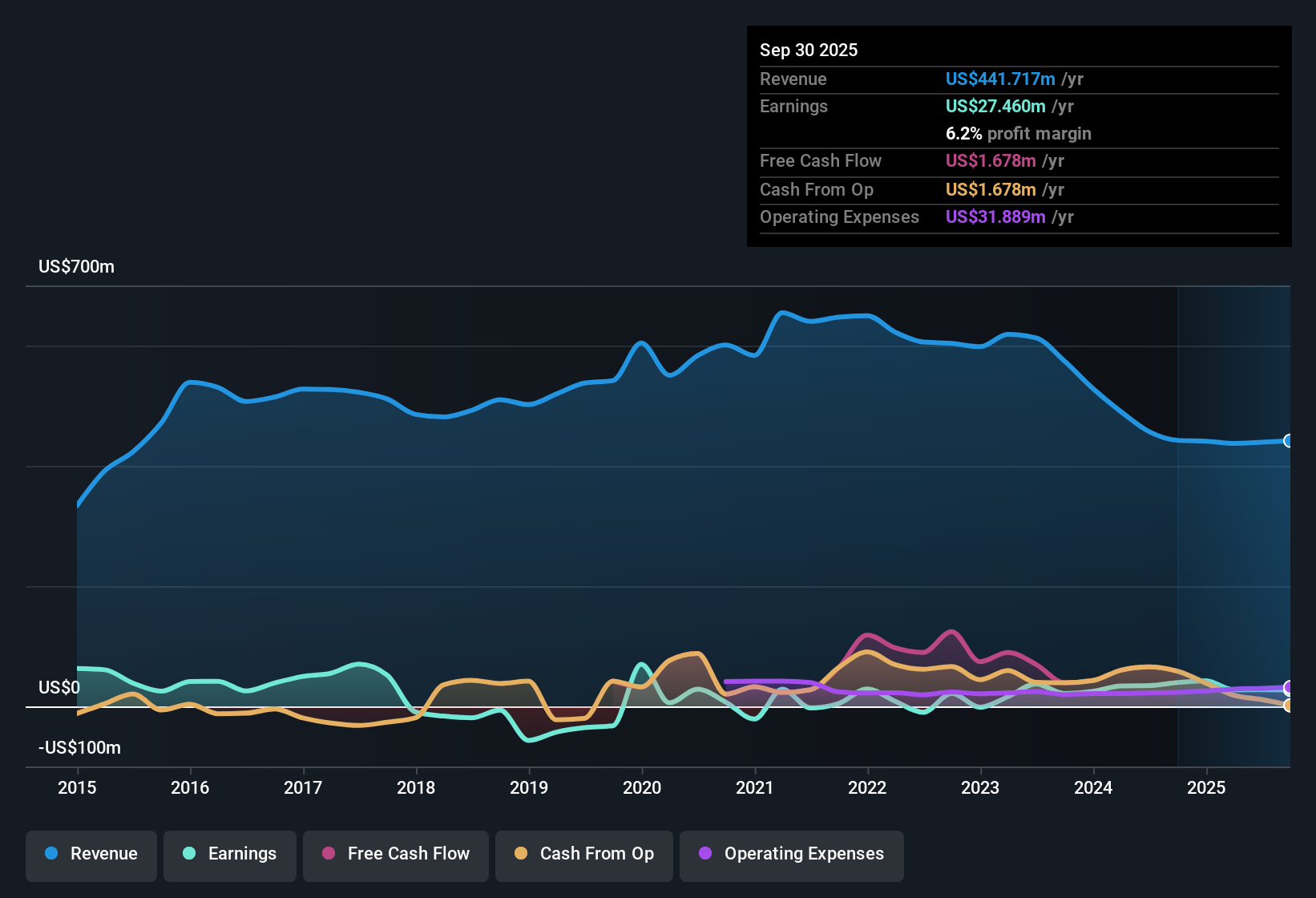

Global Indemnity Group (GBLI) posted a net profit margin of 6.3%, down from 7.6% last year, as the company’s earnings declined over the most recent year. Despite this dip, GBLI has delivered a robust 36.7% annualized earnings growth rate over the past five years. Its earnings remain high quality by company standards. With a share price at $29.25 and a price-to-earnings ratio of 15.1x, investors are balancing GBLI’s multi-year profit growth track record and perceived good value against the challenge of falling margins and questions about dividend sustainability.

See our full analysis for Global Indemnity Group.The next section will put these fresh numbers side by side with the most common narratives investors follow, highlighting where storylines align and where they get upended.

See what the community is saying about Global Indemnity Group

Tech-Led Cost Efficiency: Expense Ratio Targeted at 37%

- Management aims to cut the long-term expense ratio from 39% to 37% through investments in technology and revamped agency services, signaling a direct focus on operational efficiency.

- The analysts' consensus view highlights that advanced data analytics and AI adoption, including the recent migration to cloud-based data storage and upgrades in underwriting platforms, are expected to streamline policy processes and risk pricing.

- Modern systems are seen as key drivers behind projected margin improvement from 6.3% to 11.2% over three years.

- The consensus narrative supports the notion that ongoing tech spending may weigh on current profitability, but is likely to enhance both earnings growth and return on equity in the long term.

- The latest results show tangible savings potential, but consensus warns that expense reductions must be balanced with specialized investments to maintain underwriting quality.

To see whether ongoing expense control will be enough to drive higher returns, catch the full balanced narrative breakdown in the detailed analyst view. 📊 Read the full Global Indemnity Group Consensus Narrative.

Premium Pricing Power Versus Catastrophe Exposure

- Analysts estimate that revenue will grow at 7.7% per year for the next three years, driven by demand for specialized property and casualty insurance such as Vacant Express and collectibles.

- The analysts' consensus view underscores the company’s strong position in niche markets, where disciplined underwriting and ongoing rate increases underpin premium growth.

- However, reliance on specialty lines and geographic focus increases vulnerability to loss spikes from catastrophic events like California wildfires.

- Consensus notes that while combined and loss ratios are improving, persistent climate risk could pressure revenues and income unpredictably.

Valuation: Gap to Fair Value and Analyst Target

- GBLI currently trades at $29.25, which is not only above the DCF fair value of $15.51, but also at a price-to-earnings ratio of 15.1x, below its peer average (51x) but above the US insurance industry (13.2x).

- The analysts' consensus view maintains that to justify the consensus analyst target price of $55.00, a 47% premium to the current share price, investors would need to believe earnings reach $61.8 million and PE rises to 17.3x by 2028.

- Consensus narrative notes robust multi-year profit growth and technology-driven efficiency justify optimism, but sustainability of margins and continued dividend risks keep the valuation debate active.

- The sizable discount to peer multiples suggests obvious upside, yet the stock’s premium to both DCF value and industry average signals a classic “show me” story for long-term investors.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Global Indemnity Group on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Spot something others might have missed? Share your take and shape your unique perspective in just a few minutes. Do it your way

A great starting point for your Global Indemnity Group research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Despite several years of profit growth, Global Indemnity Group faces lingering questions about margin sustainability, premium justification, and whether its valuation is stretched above fair value.

If premium pricing and upside potential look uncertain, uncover better bargains among these 833 undervalued stocks based on cash flows that align more closely with proven value and growth expectations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GBLI

Global Indemnity Group

Through its subsidiaries, provides specialty property and casualty insurance, and reinsurance products in the United States.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion