- United States

- /

- Insurance

- /

- NYSE:FIHL

Does Fidelis Insurance Holdings’ (FIHL) Dividend Signal Enduring Strength or a Shift in Capital Strategy?

Reviewed by Sasha Jovanovic

- On November 3, 2025, Fidelis Insurance Holdings Limited announced that its Board of Directors declared a quarterly dividend of US$0.15 per share, payable on December 23, 2025, to shareholders of record as of December 10, 2025.

- The dividend declaration reflects Fidelis Insurance's confidence in its capital strength and a continued commitment to delivering shareholder returns through disciplined capital management.

- We'll explore how this newly announced dividend payout highlights Fidelis Insurance's financial stability and may shape its investment narrative going forward.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Fidelis Insurance Holdings Investment Narrative Recap

To be a shareholder in Fidelis Insurance Holdings, you need to believe that specialty insurers with strong capital positions will benefit from long-term demand for bespoke (re)insurance offerings, ongoing pricing discipline, and capital-light revenue streams. The recent US$0.15 per share dividend signals board confidence and a focus on capital management, but it doesn't materially change the most important short-term catalyst, consistent underwriting profitability, or the biggest risk, which remains vulnerability to large natural catastrophe losses and costly adverse reserve development.

The most relevant recent announcement is the August 2025 dividend increase from US$0.10 to US$0.15 per share, establishing a pattern of rising shareholder payouts. This ties directly to the company's ongoing capital return strategy and highlights management’s reliance on capital strength to support investor confidence, even as underlying results show significant earnings volatility and thin coverage of dividends by current profits.

However, it’s important for investors to be mindful of the increased risk from outsized catastrophe events, particularly as loss frequency and severity...

Read the full narrative on Fidelis Insurance Holdings (it's free!)

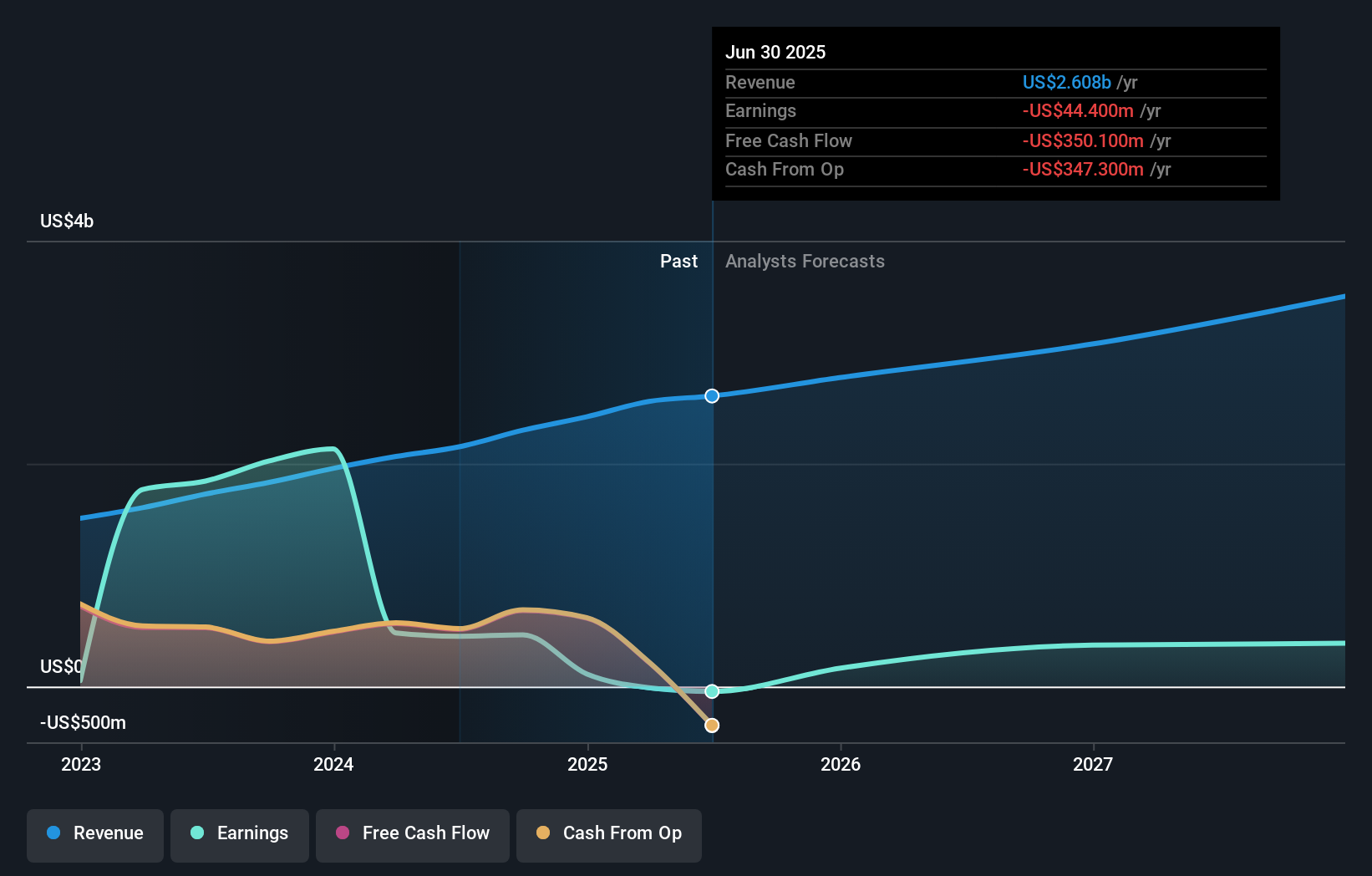

Fidelis Insurance Holdings' outlook anticipates $3.6 billion in revenue and $660.8 million in earnings by 2028. This projection relies on an annual revenue growth rate of 11.1% and a $705.2 million increase in earnings from the current level of -$44.4 million.

Uncover how Fidelis Insurance Holdings' forecasts yield a $19.78 fair value, a 7% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community member estimates for Fidelis Insurance Holdings’ fair value range widely from US$19.78 to US$122.70 across four perspectives. Persistent pricing competition in specialty lines could challenge the capital return story, so weigh these varied opinions before deciding your next steps.

Explore 4 other fair value estimates on Fidelis Insurance Holdings - why the stock might be worth over 6x more than the current price!

Build Your Own Fidelis Insurance Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Fidelis Insurance Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Fidelis Insurance Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Fidelis Insurance Holdings' overall financial health at a glance.

Contemplating Other Strategies?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FIHL

Fidelis Insurance Holdings

Provides insurance and reinsurance solutions in Bermuda, the Republic of Ireland, and the United Kingdom.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives