- United States

- /

- Insurance

- /

- NYSE:FG

A Look at F&G Annuities & Life's (FG) Valuation After Its Latest Dividend Boost

Reviewed by Simply Wall St

F&G Annuities & Life (FG) has just announced a 14% increase in its quarterly dividend, bumping the payout to $0.25 per share. This move highlights management’s confidence in the company’s financial footing and signals a continued focus on shareholder value.

See our latest analysis for F&G Annuities & Life.

The recent dividend hike comes after a challenging year for F&G Annuities & Life, with the share price down over 25% year-to-date and the one-year total shareholder return at -33.2%. Despite a dip in momentum, the company’s 28.5% total return over three years shows that long-term holders have still come out ahead. The latest news suggests that management has confidence in the business’s long-term growth prospects even as the stock consolidates following recent volatility.

If you’re looking to broaden your search beyond insurance, now could be a great time to uncover opportunities among fast growing stocks with high insider ownership.

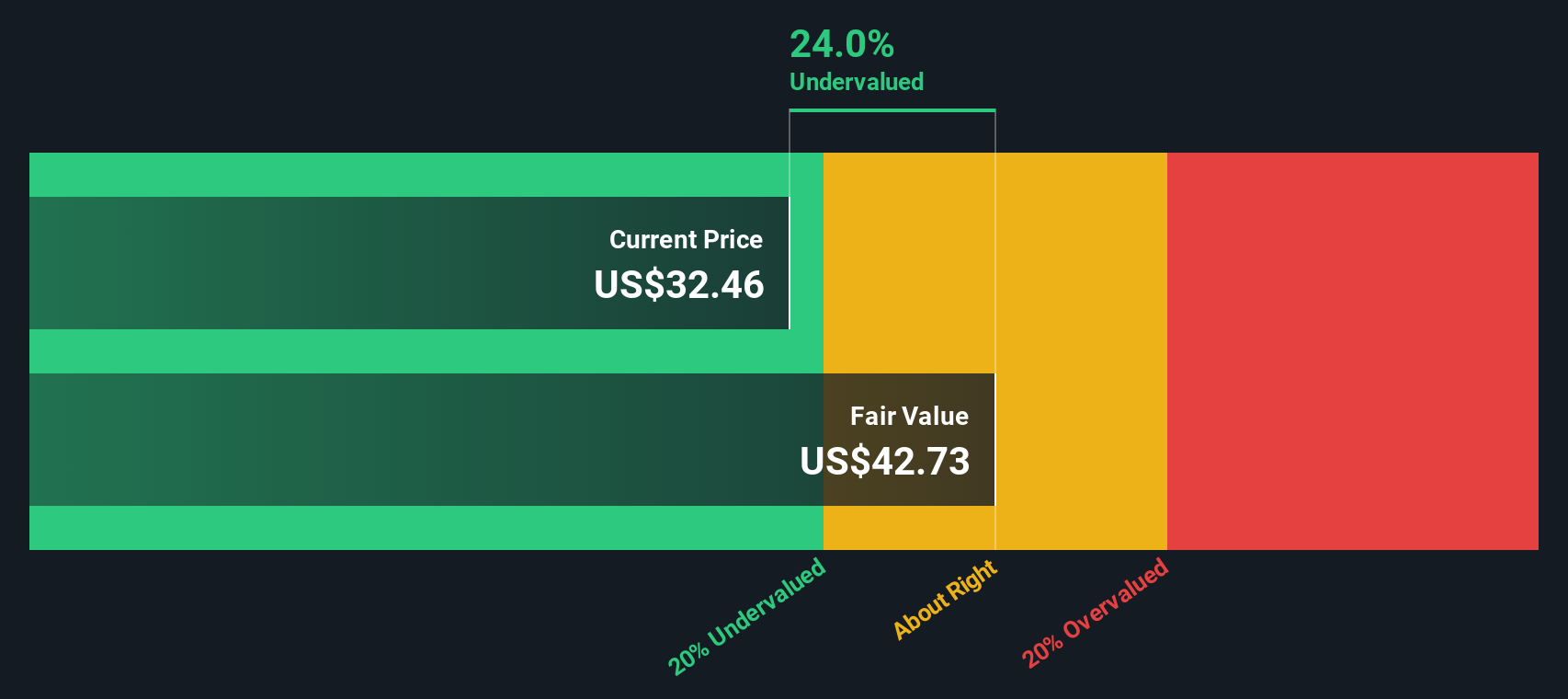

With shares still well below recent highs and the latest dividend boost on the table, the key question remains: Is F&G Annuities & Life undervalued at this level, or is the market simply factoring in its expected growth already?

Price-to-Earnings of 9.3x: Is it justified?

Based on F&G Annuities & Life’s price-to-earnings (P/E) ratio of 9.3x, the stock appears attractively valued compared to its peers and the broader insurance industry. With a last close price of $30.72, investors are currently paying less for each dollar of the company’s earnings than the average peer in the market.

The P/E ratio is a widely used tool to determine how much investors are willing to pay for a company’s future earnings potential. For the insurance sector, it reflects expectations about growth, consistency of profits, and risk exposure. A lower P/E can suggest the market is overlooking future earnings strength or is more cautious about the company’s outlook.

F&G’s P/E is below both the US Insurance industry average of 12.7x and the peer group’s average of 10.6x. This discount stands out and suggests the market may be underpricing the company's current profitability and future prospects. If the fair ratio becomes the reference point, there may be room for this multiple to align more closely with the sector norm.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 9.3x (UNDERVALUED)

However, slower annual revenue growth and persistent share price pressure remain risks that could challenge the company's path back to sector average valuations.

Find out about the key risks to this F&G Annuities & Life narrative.

Another View: Discounted Cash Flow Model

Taking a different angle, our DCF model values F&G Annuities & Life at $42.73 per share, which is about 28% above the current market price. This suggests the shares could be undervalued based on the company’s expected future cash flows. Does this model highlight an opportunity that traditional multiples might miss?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out F&G Annuities & Life for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 918 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own F&G Annuities & Life Narrative

You might have a different perspective or spot trends we missed. Why not dive into the numbers and shape your own view? Do it your way.

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding F&G Annuities & Life.

Looking for more investment ideas?

Don’t limit your gains to a single opportunity. Take the lead with smarter investing by tapping into unique, data-driven stock ideas powered by Simply Wall Street’s tools.

- Boost your portfolio’s income by targeting strong payers and steady growers. these 16 dividend stocks with yields > 3% delivers 3% yields and higher.

- Uncover tomorrow’s technological winners and ride the wave of disruption. Start with these 26 AI penny stocks making headlines in automation and machine intelligence.

- Gain an edge in your search for bargains by zeroing in on undervalued gems. Begin your hunt here with these 918 undervalued stocks based on cash flows based on proven cash flow metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FG

F&G Annuities & Life

Provides annuity and life insurance products in the United States.

Good value with acceptable track record.

Similar Companies

Market Insights

Community Narratives