- United States

- /

- Insurance

- /

- NYSE:EG

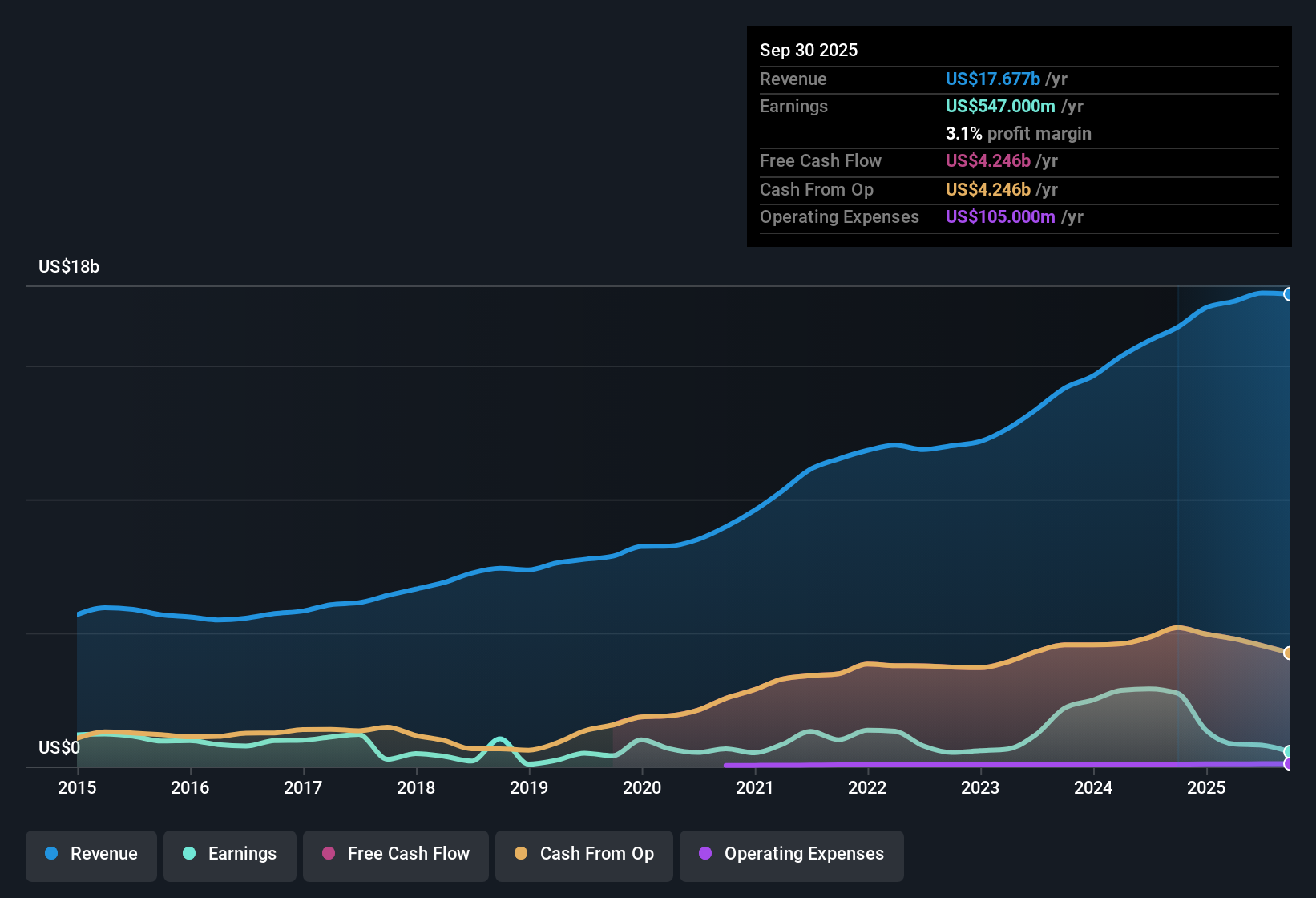

Everest Group (EG): Net Margin Drops to 3.1%, Challenging Bullish Profit Narratives

Reviewed by Simply Wall St

Everest Group (EG) saw its net profit margin fall to 3.1%, a steep drop from last year’s 16.7%. Shares now trade at $304.91, well below the estimated fair value of $1,405.68. Looking ahead, revenue is forecast to decline slightly at a -0.1% annual rate over the next three years. However, analysts expect a sharp recovery in earnings, projecting annual EPS growth of 52% and robust profit increases through to 2027. Investors face the challenge of weighing short-term margin pressures against strong growth expectations and a share price that appears undervalued by the market’s key yardsticks.

See our full analysis for Everest Group.Next up, we’ll see how Everest Group’s results line up with the widely discussed narratives, highlighting where consensus holds and where surprises emerge.

See what the community is saying about Everest Group

Margin Expansion Forecast: 4.5% to 21.7%

- Analysts expect Everest Group's profit margins to increase from 4.5% currently to 21.7% over the next three years, while revenue is projected to dip slightly at a -0.1% annual rate.

- According to the analysts' consensus view, this margin improvement is based on two major factors:

- Strategic focus on catastrophe reinsurance and specialty lines, which benefit from robust pricing and stronger-than-average returns well above the cost of capital.

- Expansion into international and specialty lines is delivering double-digit premium growth, strengthening long-term earnings and supporting analysts' view that profitability will outpace the minor topline headwind.

- Consensus narrative suggests margin gains from global insurance trends and operational efficiencies, even with short-term volatility in catastrophe losses.

- Consensus narrative notes that the rising expense ratio, driven by investments in new platforms and capabilities, could dampen margins if not offset by scale.

- New global exposures and increased catastrophe risk could undermine the path to those higher profit margins if major loss events occur.

DCF Fair Value Gap Remains Wide

- Everest Group stock trades at $304.91, significantly below its estimated DCF fair value of $1,405.68 and still at a discount to the analyst price target of $386.93.

- Analysts' consensus view highlights a critical valuation tension:

- Despite an ambitious EPS growth target of 52% annually, the high price-to-earnings ratio (23.8x) signals investors are already paying a premium, which is well above the industry average of 13.5x, yet the share price remains far below long-term fair value estimates.

- Consensus sees this undervaluation as possible support for the stock but indicates that actual PE multiple compression would be needed to reach the forecasted price target, raising questions about future rerating potential.

Expense Pressures from International Buildout

- The Insurance segment's expense ratio remains elevated due to substantial investment in international expansion and technology, with premium growth not yet sufficient to absorb these higher costs.

- Analysts' consensus view considers this a key risk factor:

- Consensus narrative notes that while these investments aim to support scalable future growth and better risk selection, persistently high costs could impact net margins and delay the expected margin recovery if international premiums increase slower than anticipated.

- Risk is heightened by Everest’s aggressive repositioning of its U.S. casualty book, which has reduced diversification and increased the company’s reliance on performance in fewer international and specialty lines, amplifying expense sensitivity.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Everest Group on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different take on the data? Share your perspective and shape a fresh narrative. Create your own story in just a few minutes. Do it your way

A great starting point for your Everest Group research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Everest Group faces ongoing pressure from rising operating expenses and uncertain margins. Investments have not yet translated into consistent revenue or earnings growth.

If you want steadier opportunities, use our stable growth stocks screener (2116 results) to discover companies consistently expanding revenue and profits, offering more reliable performance even when others stumble.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Everest Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EG

Everest Group

Through its subsidiaries, provides reinsurance and insurance products in the United States, Europe, and internationally.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives