- United States

- /

- Insurance

- /

- NYSE:CB

Does Chubb’s Leadership Transition Signal Continuity or Change for Its North American Strategy? (CB)

Reviewed by Sasha Jovanovic

- Chubb Limited announced that John Lupica, Vice Chairman and Executive Chairman of North America Insurance, will retire on December 31, 2025, after 25 years of service, with President and COO John Keogh set to assume his responsibilities.

- This transition marks a significant leadership shift at Chubb, signaling management succession planning at a time when continuity and experience remain important for the company's North American operations.

- We'll explore what the appointment of John Keogh as Chairman, North America Insurance, could mean for Chubb's investment narrative and outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Chubb Investment Narrative Recap

To be a shareholder in Chubb, you have to believe in its disciplined underwriting, global diversification, and the ability of management to balance risk and growth through changing cycles. The recent leadership transition, with John Keogh set to lead North America Insurance, is unlikely to materially impact Chubb’s immediate catalysts or heighten its biggest short-term risks, such as continued pricing pressure and margin challenges in large account property insurance.

Among recent announcements, Chubb’s completion of a US$1.51 billion share repurchase stands out. While not directly connected to the executive change, this move supports ongoing capital management efforts, providing a buffer for earnings per share and reinforcing the company's approach to delivering shareholder value as it navigates shifting insurance markets.

Yet, despite experienced management and proactive planning, the persistent risk of margin pressure from competitive pricing and property market softness is something investors should not overlook, especially as ...

Read the full narrative on Chubb (it's free!)

Chubb's outlook anticipates $49.6 billion in revenue and $9.8 billion in earnings by 2028. This projection assumes a yearly revenue decline of 4.8% and an earnings increase of $0.6 billion from current earnings of $9.2 billion.

Uncover how Chubb's forecasts yield a $307.50 fair value, a 9% upside to its current price.

Exploring Other Perspectives

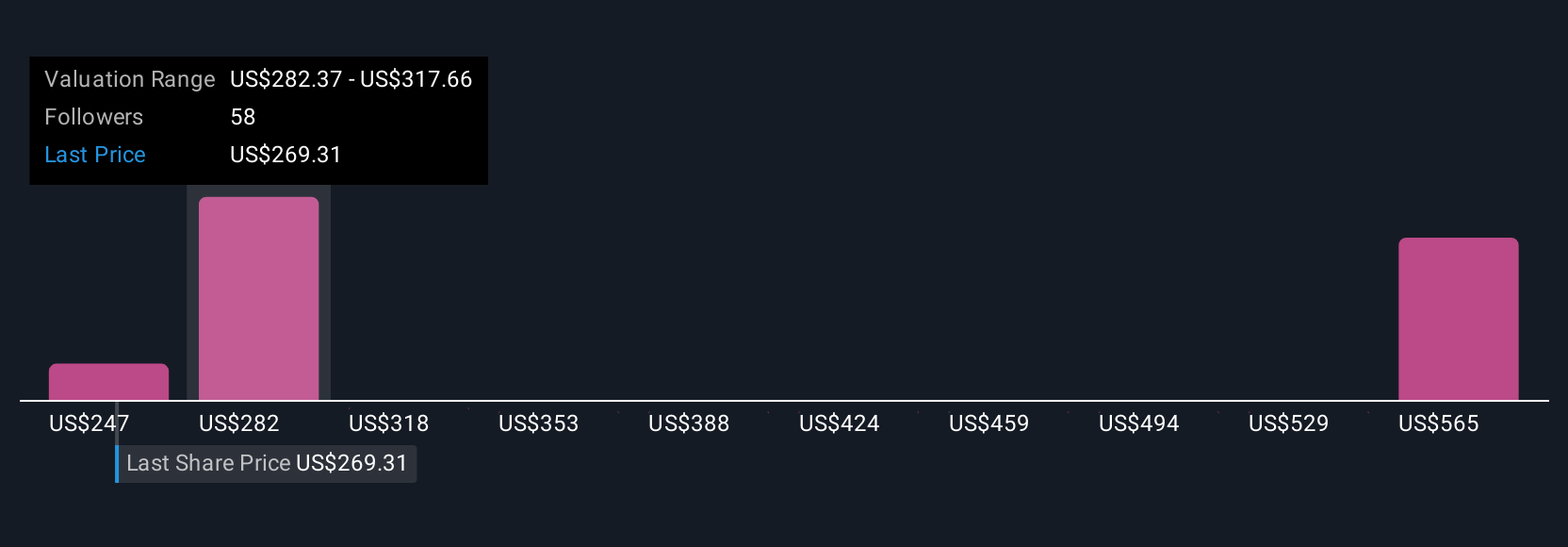

Eight members of the Simply Wall St Community estimate Chubb’s fair value from as low as US$247 to as high as US$646 per share. While viewpoints diverge, many continue to focus on mounting competition and price softness in large account property insurance as a central risk for ongoing performance.

Explore 8 other fair value estimates on Chubb - why the stock might be worth over 2x more than the current price!

Build Your Own Chubb Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Chubb research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Chubb research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Chubb's overall financial health at a glance.

No Opportunity In Chubb?

Our top stock finds are flying under the radar-for now. Get in early:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CB

Good value with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives