- United States

- /

- Insurance

- /

- NYSE:BRO

Brown & Brown (BRO): Assessing Valuation as Investors Weigh Upcoming Earnings Drop and Margin Pressures

Reviewed by Kshitija Bhandaru

Brown & Brown (BRO) is preparing to release its third-quarter results later this month. The company has caught the attention of investors after prior declines in income before taxes and persistent margin compression, even as revenue has grown.

See our latest analysis for Brown & Brown.

Shares of Brown & Brown have faced pressure this year, especially after investors reacted to recent margin concerns and leadership changes, most notably, the 10.4% drop following last quarter’s results. Even so, momentum appears somewhat mixed: the 1-year total shareholder return is down 7.4%, but long-term holders have still enjoyed a strong 109% total return over five years. This reminds us that the bigger picture is not defined by short-term swings alone.

If leadership shifts and evolving insurance trends have sparked your curiosity, this is the perfect moment to broaden your perspective and discover fast growing stocks with high insider ownership

The key question now is whether Brown & Brown’s subdued recent performance and modest earnings outlook are already reflected in its share price, or if today's levels represent a genuine buying opportunity for long-term investors.

Most Popular Narrative: 11.8% Undervalued

Brown & Brown’s most widely followed narrative values the company above its recent closing price, indicating a bullish stance on its long-term potential. The analysis weighs anticipated growth against modest margin pressures and suggests there is more behind today’s price than meets the eye.

Brown & Brown's strategic focus on acquisitions, having completed 13 acquisitions with projected annual revenues of $36 million, could significantly enhance future revenue streams and market presence. This aligns with their goal of sustained revenue growth through expansion.

What is really sparking this premium valuation? There is a projected leap in key earnings metrics, paired with a profit multiple typically reserved for industry disruptors. Dive into the full narrative for the specific growth figures and bold assumptions driving this fair value. It may not be what you would expect from a traditional insurer.

Result: Fair Value of $108.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing economic uncertainty and falling CAT property rates could easily disrupt Brown & Brown’s anticipated growth and put pressure on its future earnings stability.

Find out about the key risks to this Brown & Brown narrative.

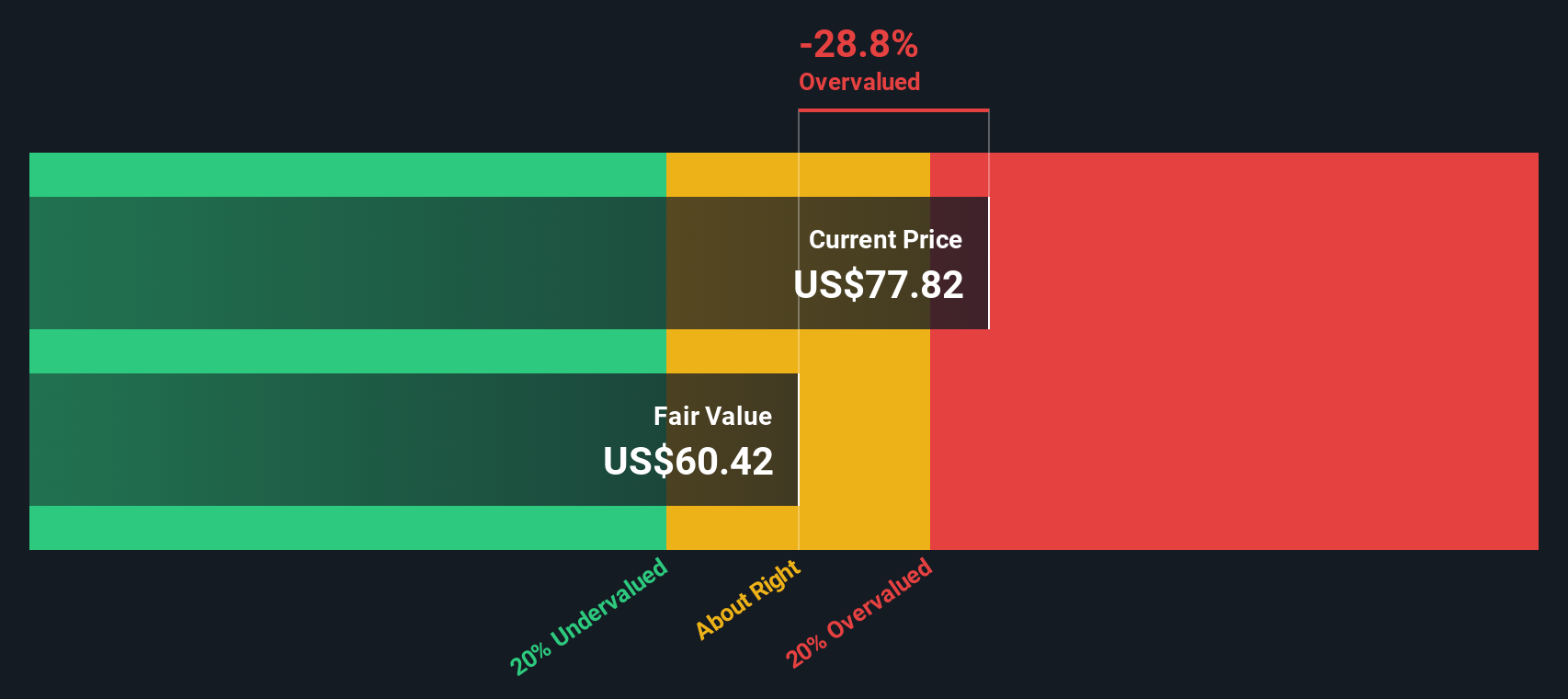

Another View: A Closer Look at SWS DCF Valuation

While the consensus price target points to Brown & Brown being undervalued, the SWS DCF model offers a different perspective. By focusing on the company’s projected cash flows, this approach estimates a fair value of $58.63 per share, which is well below the current price. Which view makes the most sense for long-term investors?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Brown & Brown for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Brown & Brown Narrative

Keep in mind, if you want a different perspective or prefer hands-on analysis, crafting a personal, data-driven narrative takes just a few minutes. Do it your way

A great starting point for your Brown & Brown research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If you're serious about expanding your portfolio, now is the time to seize fresh opportunities that other investors might overlook. Avoid regret by taking action today.

- Amplify your income strategy by evaluating these 18 dividend stocks with yields > 3% which offers robust yields above 3% and stable payout histories.

- Capitalize on innovation by exploring these 25 AI penny stocks that are transforming industries with advanced artificial intelligence solutions.

- Take advantage of rare market opportunities with these 888 undervalued stocks based on cash flows based on solid cash flow fundamentals before the broader market catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Brown & Brown might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BRO

Brown & Brown

Brown & Brown, Inc. markets and sells insurance products and services in the United States, Canada, Ireland, the United Kingdom, and internationally.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives