- United States

- /

- Insurance

- /

- NYSE:BNT

The Bull Case for Brookfield Wealth Solutions (BNT) Could Change Following Just Group Acquisition and Q3 Earnings

Reviewed by Sasha Jovanovic

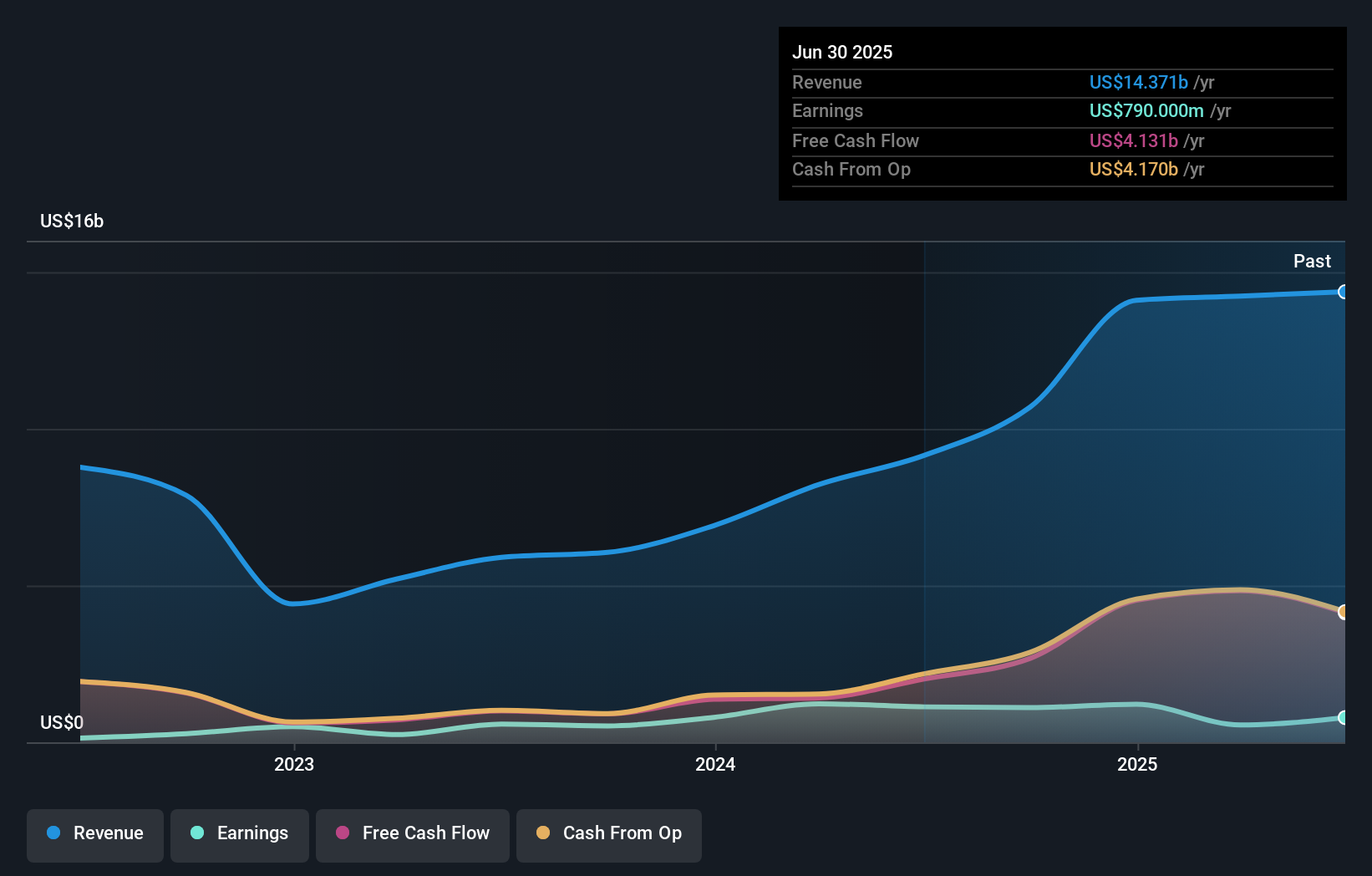

- Brookfield Wealth Solutions reported third quarter 2025 earnings, with revenue of US$2.93 billion and net income rising to US$583 million, alongside maintaining a consistent quarterly return of capital to shareholders.

- International expansion efforts, including the announced acquisition of U.K.-based retirement specialist Just Group plc, are supporting growth in total assets and strengthening the company’s presence in key foreign markets.

- We’ll now explore how Brookfield’s strong net income growth underscores its evolving investment narrative in international retirement solutions.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

What Is Brookfield Wealth Solutions' Investment Narrative?

For investors considering Brookfield Wealth Solutions, the essential belief is in its ability to accelerate international growth and drive reliable earnings from global retirement and reinsurance markets. The latest announcement confirms substantial net income growth and a significant increase in total assets, bolstered by the planned acquisition of Just Group plc in the U.K. This news refreshes the short-term catalyst conversation, as international expansion and inorganic growth now have clearer momentum, potentially smoothing some of the execution risks tied to entering new markets. However, revenue was slightly softer year over year, and profit margins have compressed compared to prior periods, echoing persistent headwinds from price competition and integration costs. While recent results may support sentiment in the near term, risks around valuation, margin recovery, and successful integration of new acquisitions remain critical factors for shareholders to track.

Yet, even with new opportunities, integrating acquisitions could present unforeseen challenges for Brookfield Wealth Solutions investors.

Exploring Other Perspectives

Explore 4 other fair value estimates on Brookfield Wealth Solutions - why the stock might be worth just $46.30!

Build Your Own Brookfield Wealth Solutions Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Brookfield Wealth Solutions research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Brookfield Wealth Solutions research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Brookfield Wealth Solutions' overall financial health at a glance.

Seeking Other Investments?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 36 companies in the world exploring or producing it. Find the list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Brookfield Wealth Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BNT

Brookfield Wealth Solutions

Through its subsidiaries, provides retirement services, wealth protection products, and capital solutions to individuals and institutions.

Excellent balance sheet with questionable track record.

Market Insights

Community Narratives