- United States

- /

- Insurance

- /

- NYSE:BNT

The 2.5% return delivered to Brookfield Reinsurance's (NYSE:BNRE) shareholders actually lagged YoY earnings growth

Passive investing in an index fund is a good way to ensure your own returns roughly match the overall market. Active investors aim to buy stocks that vastly outperform the market - but in the process, they risk under-performance. Investors in Brookfield Reinsurance Ltd. (NYSE:BNRE) have tasted that bitter downside in the last year, as the share price dropped 17%. That's well below the market return of 16%. Brookfield Reinsurance may have better days ahead, of course; we've only looked at a one year period. On the other hand the share price has bounced 7.3% over the last week. The buoyant market could have helped drive the share price pop, since stocks are up 4.1% in the same period.

While the last year has been tough for Brookfield Reinsurance shareholders, this past week has shown signs of promise. So let's look at the longer term fundamentals and see if they've been the driver of the negative returns.

See our latest analysis for Brookfield Reinsurance

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the unfortunate twelve months during which the Brookfield Reinsurance share price fell, it actually saw its earnings per share (EPS) improve by 277%. Of course, the situation might betray previous over-optimism about growth.

It's fair to say that the share price does not seem to be reflecting the EPS growth. But we might find some different metrics explain the share price movements better.

With a low yield of 1.7% we doubt that the dividend influences the share price much. In contrast, the 20% drop in revenue is a real concern. Many investors see falling revenue as a likely precursor to lower earnings, so this could well explain the weak share price.

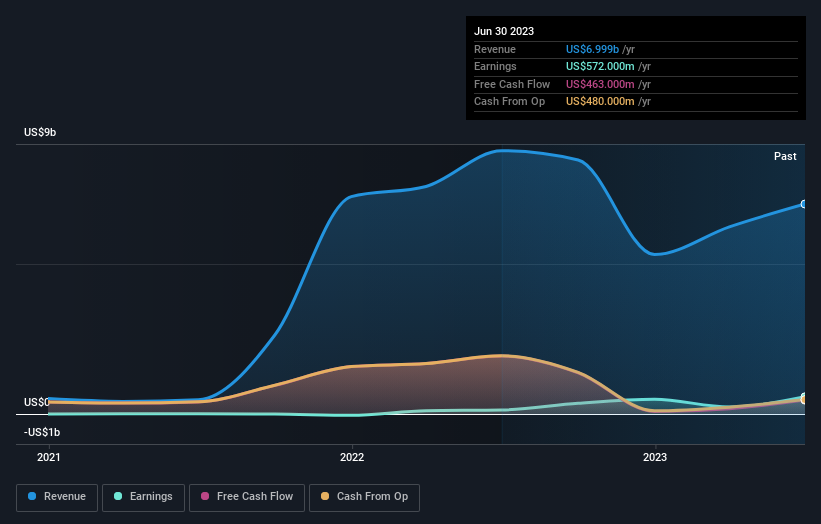

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. We note that for Brookfield Reinsurance the TSR over the last 1 year was 2.5%, which is better than the share price return mentioned above. This is largely a result of its dividend payments!

A Different Perspective

We're happy to report that Brookfield Reinsurance are up 2.5% over the year (even including dividends). Unfortunately this falls short of the market return of around 16%. Unfortunately the share price is down 2.5% over the last quarter. It's possible that this is just a short term share price setback. If the business executes and delivers key metric growth, it could definitely be worth putting on your watchlist. It's always interesting to track share price performance over the longer term. But to understand Brookfield Reinsurance better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with Brookfield Reinsurance , and understanding them should be part of your investment process.

We will like Brookfield Reinsurance better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Brookfield Wealth Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:BNT

Brookfield Wealth Solutions

Brookfield Reinsurance Ltd., through its subsidiaries, provides insurance and reinsurance services to individuals and institutions in the United States, Canada, and internationally.

Solid track record with adequate balance sheet.