- United States

- /

- Insurance

- /

- NYSE:ASIC

Ategrity Specialty Insurance (ASIC) Margin Beat Reinforces Bullish Growth and Valuation Narratives

Reviewed by Simply Wall St

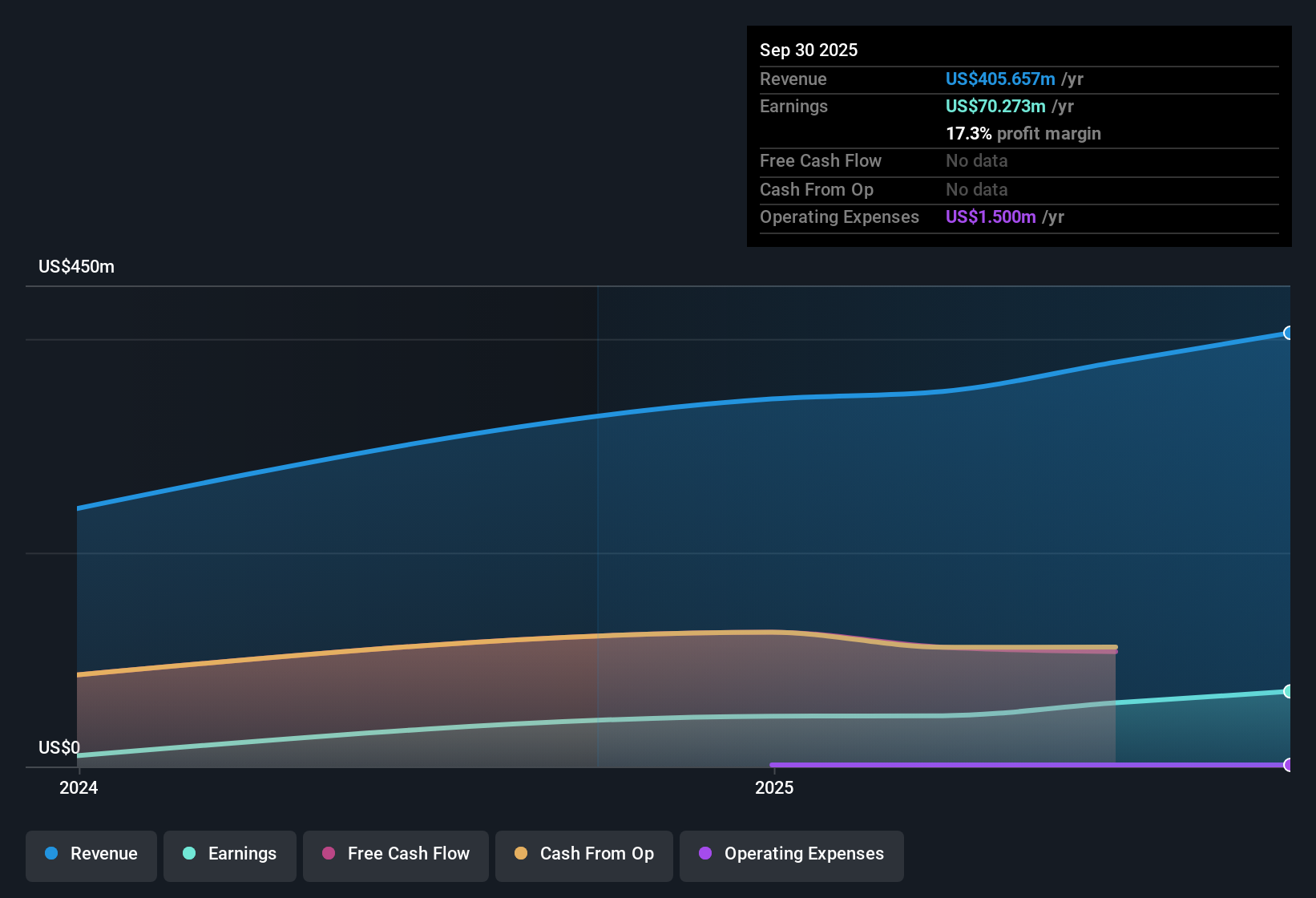

Ategrity Specialty Insurance Company Holdings (ASIC) posted a net profit margin of 17.3%, well above last year’s 11.9%, with high-quality earnings underpinning the results. With revenue forecast to grow at an impressive 32.4% per year and earnings projected to rise 27.9% annually, ASIC is outpacing the US market, while the shares, trading at $18.77, remain below the analyst’s $38 fair value estimate. Investor sentiment is likely to be focused on the company's strong growth prospects and the notable discount to both peer and industry valuation averages.

See our full analysis for Ategrity Specialty Insurance Company Holdings.Next up, we will see how these headline numbers compare to the narratives circulating among investors and analysts. This will shine a light on where expectations match reality and where surprises emerge.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margins Outpace Sector Peers

- Net profit margin sits at 17.3%, pushing above last year’s 11.9% and outstripping the broader US insurance industry’s typical margin range.

- Forecasted revenue growth of 32.4% and projected annual earnings growth of 27.9% heavily supports the optimistic view that Ategrity Specialty Insurance Company Holdings is set to outperform sector averages.

- A margin improvement of over 5 percentage points highlights the operational gains that support arguments for the company’s resilience and discipline in specialty underwriting.

- Revenue and earnings growth, both well ahead of the US market averages, add weight to the claim that ASIC is leveraging sector trends to sustain above-average profitability.

Valuation Discount Versus Peers

- Price-to-Earnings ratio stands at 12.8x, below both the 13.3x peer average and 13.9x US insurance sector average, signaling a potential value gap in the current share price.

- The prevailing analysis argues that this valuation discount is not due to operational weakness, as net margins and growth projections both exceed sector norms. Instead, it suggests investors have not fully priced in ASIC’s performance.

- The share price of $18.77 trades at a steep discount to a DCF fair value of $38.00, reinforcing the idea that market participants may be catching up late to the company’s earnings and growth potential.

- Trading below analyst price targets and peer multiples lends support to the claim that buyers are being offered a margin of safety while still gaining exposure to high-quality growth.

Growth Rates Consistently Beat Market

- Revenue is expected to rise at 32.4% per year and earnings at 27.9% annually over the next three years, both figures significantly stronger than US market averages of 10% and 15.5% respectively.

- Rather than just keeping pace, the latest projections reinforce the view that ASIC’s specialty focus is translating into outperformance, supported by quantified growth trends.

- With high-quality earnings and improved profitability margins supporting the forecasts, investors benefit from both current results and future outlook.

- No specific risks flagged in the statements or summaries suggests that expectations for sector-defensive growth remain intact in the near term.

See our latest analysis for Ategrity Specialty Insurance Company Holdings.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Ategrity Specialty Insurance Company Holdings's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite robust growth, ASIC’s valuation discount suggests the market is hesitant to fully price in its future earnings strength and profitability.

If you want to spot companies the market recognizes as undervalued right now, track down more opportunities through these 876 undervalued stocks based on cash flows before others catch up.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ASIC

Ategrity Specialty Insurance Company Holdings

Through its subsidiaries, provides excess and surplus lines insurance and reinsurance products to small and medium-sized businesses in the United States.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives