- United States

- /

- Insurance

- /

- NYSE:AJG

Do Analyst Downgrades Reflect Deeper Questions About Gallagher's Expansion Strategy and Outlook? (AJG)

Reviewed by Sasha Jovanovic

- In recent days, Barclays downgraded Arthur J. Gallagher & Co. from Equal-Weight to Underweight, while several analysts also lowered their price targets for the company amid increased caution about its outlook.

- This wave of analyst downgrades comes as the company continues its acquisition activity and after an executive-level stock sale, reflecting shifting perceptions despite an active expansion strategy.

- We'll explore how the shift in analyst sentiment following Barclays' downgrade could affect Arthur J. Gallagher's investment narrative and outlook.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

Arthur J. Gallagher Investment Narrative Recap

To be a shareholder of Arthur J. Gallagher, you need to believe in the company's ability to drive recurring revenue through insurance brokerage expertise and a robust M&A pipeline, despite market skepticism. Recent analyst downgrades, including Barclays' shift to Underweight and price target cuts, may weigh on sentiment, but they do not materially impact the underlying catalyst: ongoing acquisition-driven expansion. The main near-term risk remains integration challenges and heightened scrutiny around M&A pace and execution. Among recent announcements, Gallagher’s acquisition of Tompkins Insurance Agencies for US$183 million stands out, reaffirming its commitment to growth through acquisitions even as market concerns around deal execution and integration risk persist. This continued expansion signals that the company is pressing forward with its core growth strategy, which could provide a buffer against fee compression but heightens exposure to potential integration setbacks. On the other hand, for investors, the risk of overreliance on acquisitions raising operational complexities and integration hurdles is something to keep in mind...

Read the full narrative on Arthur J. Gallagher (it's free!)

Arthur J. Gallagher's outlook anticipates $19.5 billion in revenue and $3.5 billion in earnings by 2028. This is predicated on a 19.0% annual revenue growth rate and an earnings increase of $1.9 billion from the current $1.6 billion.

Uncover how Arthur J. Gallagher's forecasts yield a $319.80 fair value, a 29% upside to its current price.

Exploring Other Perspectives

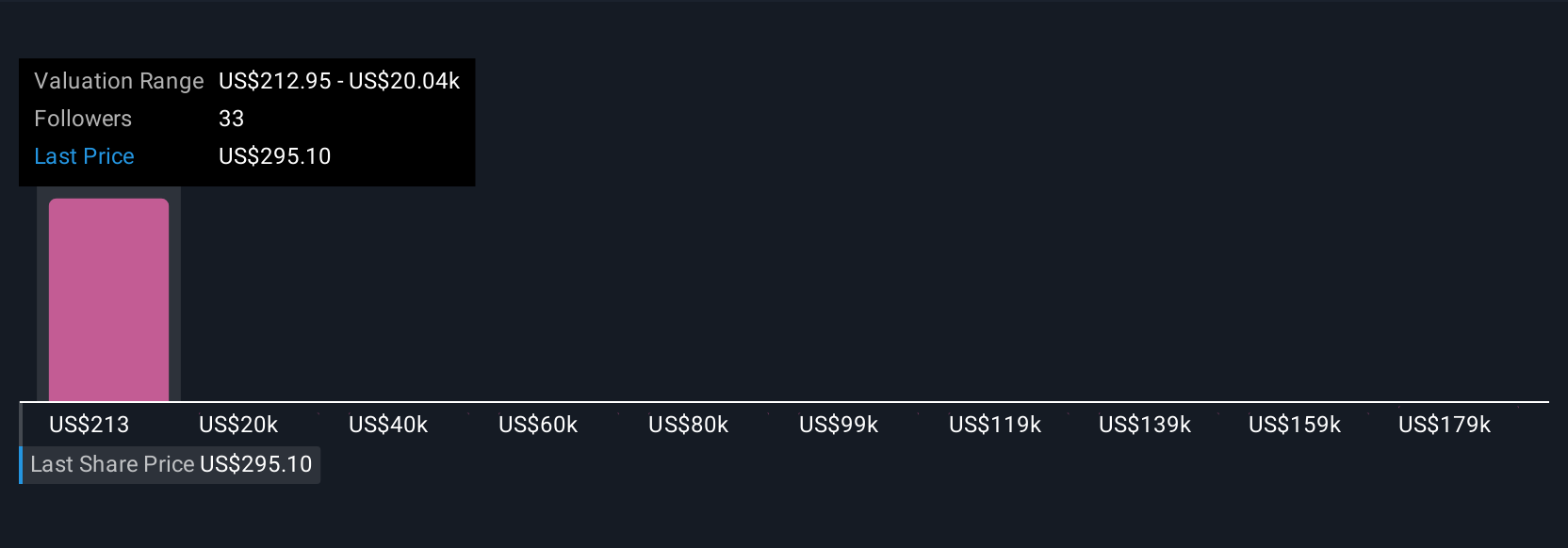

Six private investor fair value estimates from the Simply Wall St Community range widely, from US$239 up to US$198,517. While acquisition activity drives optimism for some, others caution that successful integration is crucial to future earnings. Explore how your own view aligns with these varied perspectives.

Explore 6 other fair value estimates on Arthur J. Gallagher - why the stock might be a potential multi-bagger!

Build Your Own Arthur J. Gallagher Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Arthur J. Gallagher research is our analysis highlighting 4 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Arthur J. Gallagher research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Arthur J. Gallagher's overall financial health at a glance.

Ready For A Different Approach?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AJG

Arthur J. Gallagher

Provides insurance and reinsurance brokerage, consulting, and third-party property/casualty claims settlement and administration services to entities and individuals worldwide.

Proven track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

No miracle in sight

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success