- United States

- /

- Insurance

- /

- NYSE:AJG

Arthur J. Gallagher (AJG): Valuation Insights After Q3 Revenue Gains and Earnings Dip

Reviewed by Simply Wall St

Arthur J. Gallagher (AJG) recently posted its third quarter results. The company reported revenue gains driven by recent acquisitions, even as quarterly net income and earnings per share slipped compared to last year.

See our latest analysis for Arthur J. Gallagher.

Arthur J. Gallagher’s share price has faced some pressure lately, with a 1-month return of -15.48% and a 1-year total shareholder return of -12.19%. Even so, the company’s ongoing string of acquisitions and steady revenue growth hint at positive long-term momentum, as reflected in a healthy 5-year total shareholder return of 133.59%.

If you’re curious about what other fast-moving companies are building momentum, now is a compelling moment to broaden your search and discover fast growing stocks with high insider ownership

With recent results showing strong revenue growth yet declining earnings, and the stock trading at a discount to analyst targets, is Arthur J. Gallagher an undervalued opportunity, or is the market already factoring in its expansion plans?

Most Popular Narrative: 21.5% Undervalued

Arthur J. Gallagher’s widely followed narrative estimates the fair value at $327.07, which is notably higher than its recent closing price of $256.71. This sets the stage for a closer look at the financial logic supporting this valuation.

Successful, disciplined execution of the ongoing M&A strategy, including the Assured Partners acquisition and a deep pipeline of additional bolt-on deals, broadens AJG's geographic reach, service offerings, and client base, serving as a catalyst for both revenue and earnings accretion.

Curious which future growth assumptions power this bold estimate? Rumor has it, the upcoming numbers hinge on ambitious profit targets and robust margin expansion tied to major deals. Don’t miss the narrative formula behind this potential upside. See the key drivers inside.

Result: Fair Value of $327.07 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sharply declining property insurance rates or challenges in integrating ongoing acquisitions could quickly undermine the optimistic outlook that supports AJG’s current valuation.

Find out about the key risks to this Arthur J. Gallagher narrative.

Another View: Market Multiples Signal Caution

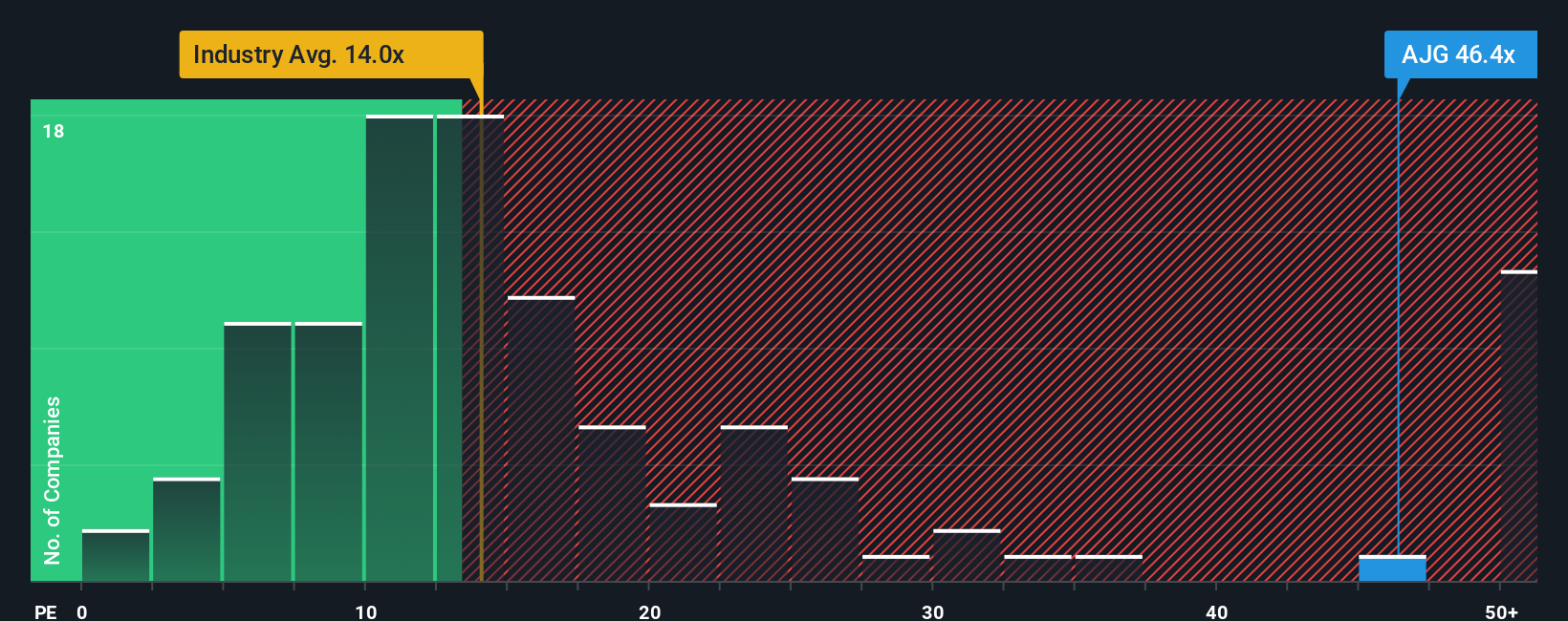

While long-term growth stories and analyst models look promising, Arthur J. Gallagher’s actual price-to-earnings ratio stands at 41.2x. That is far above the US Insurance sector average of 13.3x, as well as its peer average of 22.9x, and even overshoots the fair ratio of 20.2x our analysis projects the market could revert towards. Trading at such a steep premium highlights valuation risk. So does the market know something others do not, or is optimism running hot?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Arthur J. Gallagher Narrative

If you want to follow a different path or dig deeper into the numbers yourself, you can assemble your own view in just a few minutes, your way. Do it your way.

A great starting point for your Arthur J. Gallagher research is our analysis highlighting 4 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors never limit their search. Let Simply Wall Street spotlight unique opportunities you might miss. Unlock market potential with these hand-picked strategies and get ahead of the curve now.

- Boost your passive income by targeting reliable yield opportunities and see which companies made the cut via these 14 dividend stocks with yields > 3%.

- Seize emerging trends in healthcare by accessing these 32 healthcare AI stocks focused on revolutionizing medical technology with artificial intelligence.

- Tap into the next wave of financial evolution by finding high-conviction picks among these 82 cryptocurrency and blockchain stocks harnessing cryptocurrency and blockchain breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AJG

Arthur J. Gallagher

Provides insurance and reinsurance brokerage, consulting, and third-party property/casualty claims settlement and administration services to entities and individuals worldwide.

Proven track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives