- United States

- /

- Insurance

- /

- NYSE:AJG

Arthur J. Gallagher (AJG): Evaluating Valuation After Strong Q3 Growth and Tompkins Insurance Acquisition

Reviewed by Simply Wall St

Arthur J. Gallagher (AJG) delivered its nineteenth consecutive quarter of double-digit revenue growth in the third quarter of 2025, continuing a long streak of expansion. The recent acquisition of Tompkins Insurance Agencies further expands its reach across New York and Pennsylvania and highlights the company’s active growth strategy.

See our latest analysis for Arthur J. Gallagher.

Despite consistently strong revenue and steady expansion, Arthur J. Gallagher’s 1-year total shareholder return of -18.9% reflects recent investor caution, even as its five-year total return remains an impressive 124.5%. Momentum has faded in the short term, but the company’s acquisition strategy keeps its long-term growth story in consideration.

If AJG’s growth ambitions have you thinking bigger, this may be a good time to broaden your search and discover fast growing stocks with high insider ownership

With AJG still trading nearly 23% below analysts’ price targets despite healthy revenue growth and active expansion, the main question remains: Is there a real buying opportunity here, or has the market already factored in its future potential?

Most Popular Narrative: 20.6% Undervalued

Arthur J. Gallagher’s most tracked narrative points to a significant gap between its fair value estimate and the current share price. With the narrative implying a valuation notably above the last close, the debate turns to whether the underlying financial assumptions truly warrant such optimism.

Rising global business complexity, regulatory scrutiny, and evolving risks (e.g., cyber, litigation, climate-related events) are increasing client reliance on specialized risk advisory, data-driven assessment, and tailored insurance solutions. This also supports recurring revenue growth and higher advisory fees.

What is the secret sauce behind this valuation? One bold projection in the narrative leans on a future profit outlook and an earnings multiple that is usually reserved for the market’s fastest growers. Want to see what assumptions propel that high fair value? Click to uncover the core financial drivers reshaping the case for AJG’s rebound.

Result: Fair Value of $311.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution risks from recent earnings shortfalls and ongoing pricing pressures in the P&C sector could quickly shift analyst sentiment regarding AJG’s rebound narrative.

Find out about the key risks to this Arthur J. Gallagher narrative.

Another View: Market Multiples Raise a Concern

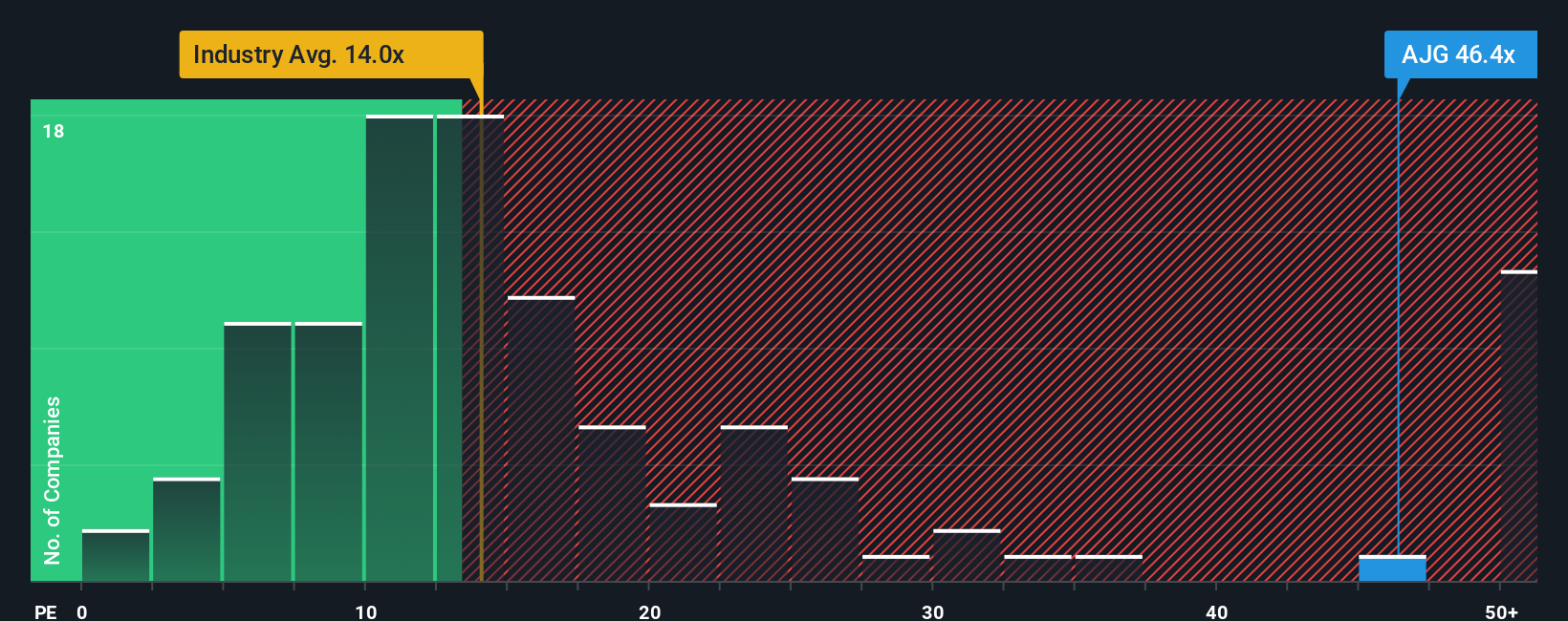

While the fair value calculation suggests AJG could be undervalued, market multiples approach the story quite differently. AJG is trading at nearly 39.7 times earnings, much higher than both its peers’ average of 23x and the US insurance industry average of just 13.2x. The so-called fair ratio stands at 18.2x, less than half AJG’s current level, which signals a potential risk that its valuation could come under pressure if sentiment shifts.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Arthur J. Gallagher Narrative

If the current outlook does not match your perspective or you prefer hands-on research, you are free to create your own narrative in just a few minutes with Do it your way.

A great starting point for your Arthur J. Gallagher research is our analysis highlighting 4 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

There’s a world of opportunity beyond Arthur J. Gallagher. Take the next step and sharpen your strategy with top-rated stock ideas handpicked for every type of investor.

- Boost your potential returns by targeting undervalued companies primed for growth. Get started with these 913 undervalued stocks based on cash flows and see the possibilities others overlook.

- Capitalize on the coming wave in healthcare by tapping into future-focused companies. Pursue innovation with these 30 healthcare AI stocks today.

- Build income and resilience into your portfolio by seeking out consistent payers. Access some of the market's best with these 15 dividend stocks with yields > 3% now and give your investments a natural edge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AJG

Arthur J. Gallagher

Provides insurance and reinsurance brokerage, consulting, and third-party property/casualty claims settlement and administration services to entities and individuals worldwide.

Proven track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026