- United States

- /

- Insurance

- /

- NYSE:AIZ

Did Earnings Outperformance Expectations Just Shift Assurant’s (AIZ) Investment Narrative?

Reviewed by Simply Wall St

- Assurant is set to report its second quarter results tomorrow, with analysts predicting 6.5% year-on-year revenue growth and adjusted earnings of US$4.45 per share.

- The company has regularly exceeded Wall Street revenue forecasts over the last two years, highlighting its pattern of outperformance against consensus expectations.

- We'll assess how the expectation of continued earnings outperformance may influence Assurant's evolving investment narrative and market positioning.

AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Assurant Investment Narrative Recap

Belief in Assurant comes down to confidence in its global, diversified operations and the sustained growth potential in Connected Living and Global Housing. The market’s focus is on whether yet another quarter of earnings outperformance will reinforce that narrative and offset concerns over margin pressure from inflation and claims costs, at present, the new results seem likely to keep the current trajectory intact, so neither the key catalyst nor the principal risk has materially shifted in the short term.

One announcement that draws attention in light of the upcoming earnings is the recent partnership with Plug®, which aims to strengthen Assurant’s presence in certified pre-owned devices. This move is closely linked to growth potential in the Connected Living segment and may act as a modest lever for revenue, aligning with the broader catalyst of leveraging new client relationships for top-line expansion.

However, investors should not overlook that, in contrast, exposure to catastrophic events and reinsurance costs can quickly alter the earnings outlook...

Read the full narrative on Assurant (it's free!)

Assurant's outlook projects $13.8 billion in revenue and $1.2 billion in earnings by 2028. This scenario is based on an annual revenue growth rate of 4.6% and represents a $529.6 million increase in earnings from the current level of $670.4 million.

Uncover how Assurant's forecasts yield a $233.20 fair value, a 23% upside to its current price.

Exploring Other Perspectives

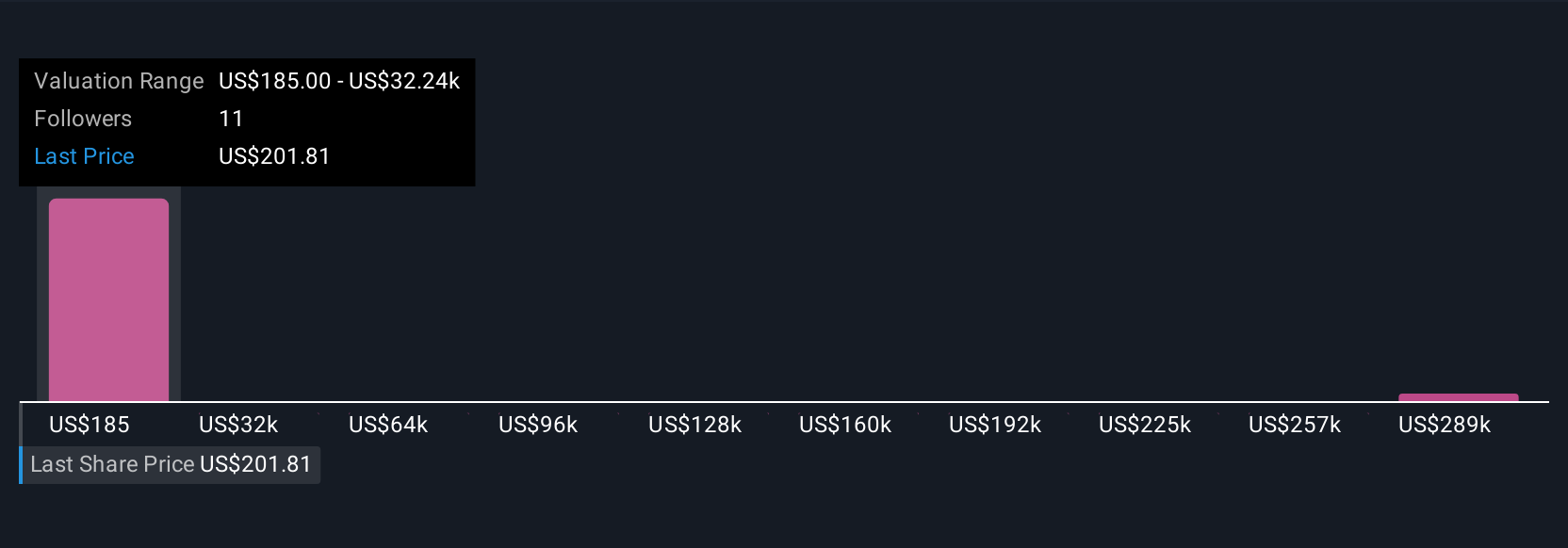

Simply Wall St Community members produced four fair value estimates for Assurant ranging from US$185 to over US$320,700 per share. Despite this spread, recent Connected Living partnerships touch on key catalysts for future growth, highlighting why so many interpretations exist about where value really lies in this business.

Explore 4 other fair value estimates on Assurant - why the stock might be worth just $185.00!

Build Your Own Assurant Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Assurant research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Assurant research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Assurant's overall financial health at a glance.

Want Some Alternatives?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The latest GPUs need a type of rare earth metal called Terbium and there are only 25 companies in the world exploring or producing it. Find the list for free.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AIZ

Assurant

Provides protection services to connected devices, homes, and automobiles in North America, Latin America, Europe, and the Asia Pacific.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives