- United States

- /

- Insurance

- /

- NYSE:AIZ

Did Assurant's (AIZ) $700 Million Buyback Mark a Shift in Its Shareholder Value Strategy?

Reviewed by Sasha Jovanovic

- Assurant, Inc. recently authorized a substantial new US$700 million share repurchase program while also announcing a quarterly dividend of US$0.88 per share, following its third-quarter results showing higher revenue and net income compared to the previous year.

- This combination of enhanced capital returns and improved financial performance highlights Assurant's focus on shareholder value and operational progress.

- We'll examine how the approval of a major share repurchase program may influence Assurant's investment narrative and future outlook.

Find companies with promising cash flow potential yet trading below their fair value.

Assurant Investment Narrative Recap

To be a shareholder in Assurant, you need to believe in the company's ability to evolve with growing global demand for device, home, and auto protection, while managing competitive and regulatory pressures. The recent US$700 million share repurchase program and dividend hike underscore management's confidence but are unlikely to impact the most immediate catalyst: maintaining growth momentum in the international device protection business. The primary near-term risk, regulatory scrutiny over lender-placed insurance, remains unchanged by these moves.

The third-quarter results, which showed significant increases in both revenue and net income year over year, are particularly relevant. These figures reflect the company’s recent operational progress and provide vital support for its capital return programs, reinforcing the ongoing earnings growth catalyst, especially in Assurant's core Lifestyle segment.

By contrast, investors should be aware that revenue tied to lender-placed insurance still exposes Assurant to...

Read the full narrative on Assurant (it's free!)

Assurant's narrative projects $14.2 billion revenue and $1.2 billion earnings by 2028. This requires 4.9% yearly revenue growth and a $483 million earnings increase from $717 million today.

Uncover how Assurant's forecasts yield a $246.00 fair value, a 8% upside to its current price.

Exploring Other Perspectives

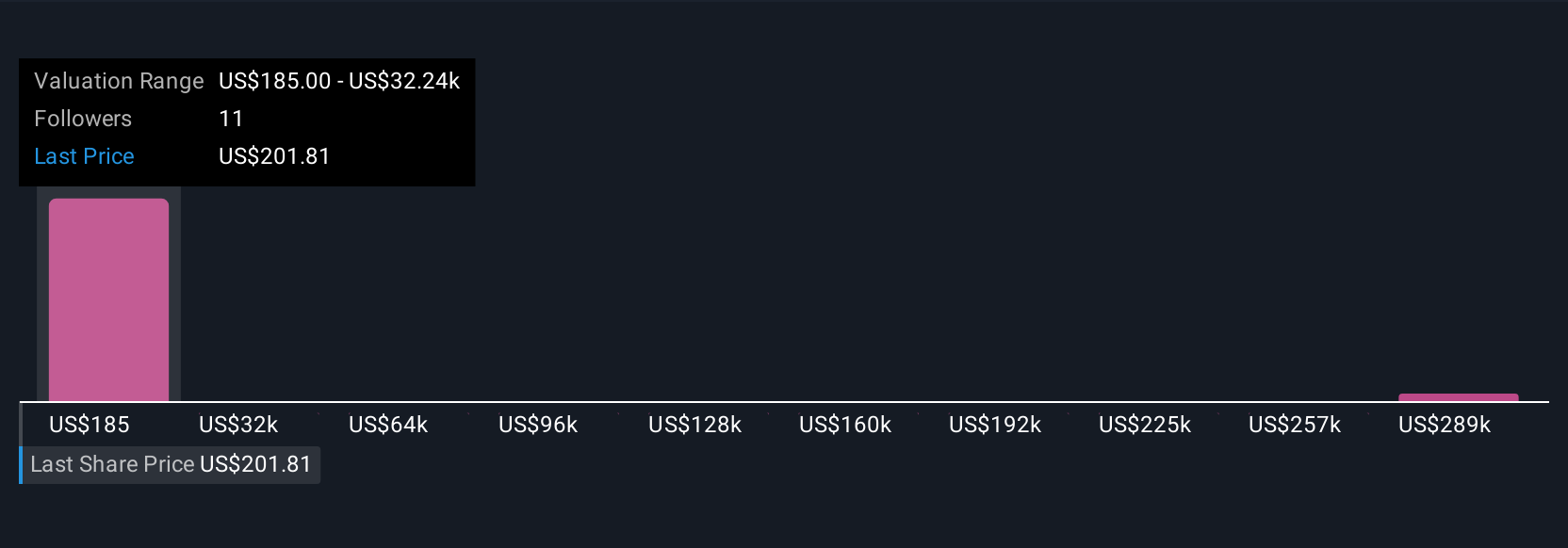

Across four independently calculated fair value estimates from the Simply Wall St Community, expectations for Assurant’s shares stretch from US$185 to over US$320,700.23. With this diversity of outlooks, keep in mind that regulatory risks in core segments could carry broader consequences for the company’s future performance, see how other investors view the tradeoffs.

Explore 4 other fair value estimates on Assurant - why the stock might be worth 19% less than the current price!

Build Your Own Assurant Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Assurant research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Assurant research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Assurant's overall financial health at a glance.

Ready For A Different Approach?

Our top stock finds are flying under the radar-for now. Get in early:

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AIZ

Assurant

Provides protection services to connected devices, homes, and automobiles in North America, Latin America, Europe, and the Asia Pacific.

Solid track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives