- United States

- /

- Insurance

- /

- NYSE:AIZ

Assessing Assurant (AIZ) Valuation Following OptoFidelity Tech Acquisition and Surge in Analyst Optimism

Reviewed by Kshitija Bhandaru

Assurant (AIZ) recently acquired OptoFidelity’s mobile device test automation technology, a move intended to expand efficiency and scale in its Global Connected Living business. This strategic step has brought fresh attention from investors.

See our latest analysis for Assurant.

Momentum has picked up for Assurant lately, with investors responding to its OptoFidelity acquisition, a major share buyback, and continued upbeat analyst sentiment. The stock’s strong 90-day share price return of 17.3% and robust one-year total shareholder return of 14.4% highlight building confidence in both near-term and long-term prospects.

If this renewed momentum has you thinking broader, it could be the right moment to see what’s unfolding among other fast-rising names. Discover fast growing stocks with high insider ownership

With shares already climbing on analyst optimism and strategic moves, investors are now weighing whether Assurant’s current valuation leaves room for more upside or if the market has already factored in its future growth potential.

Most Popular Narrative: 10.7% Undervalued

Assurant’s widely followed narrative pitches its fair value at $243.50, which stands well above the recent closing price of $217.37. Rapid innovation and diversified revenue streams are fueling this bullish outlook from market participants.

The company’s investments in AI, automation, and digital platforms are driving operational efficiencies in claims processing, trade-in, and document management. These initiatives are generating significant expense leverage and supporting ongoing margin expansion across both Housing and Lifestyle businesses.

What is the secret sauce behind this bullish target? Hint: The narrative is betting on stronger profitability, recurring revenue, and a reimagined earnings mix powered by tech investments. Curious about which bold financial projections make this fair value possible? Dive in to see the numbers for yourself.

Result: Fair Value of $243.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks such as intensifying digital competition and regulatory headwinds could challenge Assurant’s growth trajectory and create uncertainty regarding future earnings projections.

Find out about the key risks to this Assurant narrative.

Another View: What Do Multiples Say?

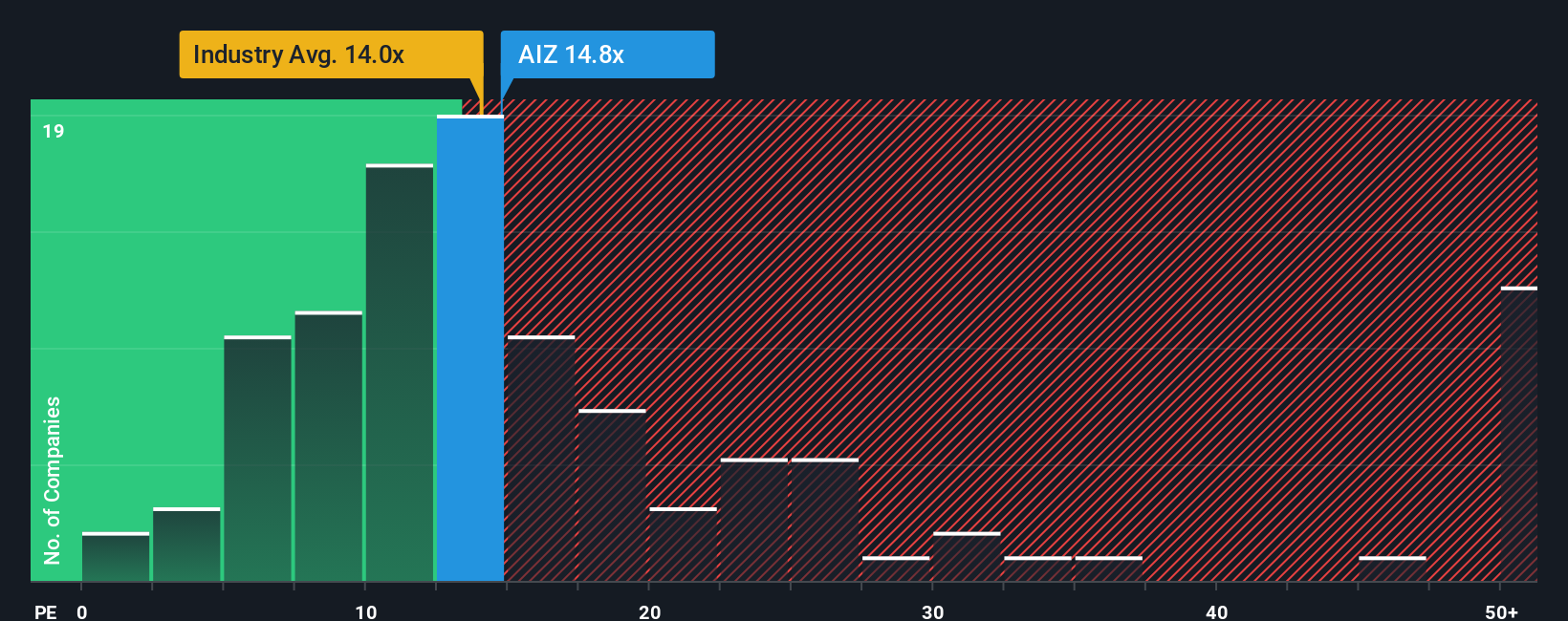

Looking at valuation from a different angle, Assurant trades at a price-to-earnings ratio of 15.3, which is more expensive than both the US insurance industry average (13.8) and its closest peers (12.5). However, its ratio still sits below the estimated fair ratio of 16.7. This suggests room for debate on whether the market is ahead of itself or if there is untapped value left. Is the current premium justified, or could expectations prove too optimistic?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Assurant Narrative

If you are inclined to challenge this perspective or want to see the numbers from your own angle, you can build your own narrative in just a few minutes. Do it your way

A great starting point for your Assurant research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Unlock even more opportunities for your portfolio by tapping into fresh trends, resilient value picks, and tomorrow’s leaders in emerging sectors. Don't let potential breakouts pass you by. Expand your research with these handpicked themes:

- Spot up-and-coming opportunities by checking out these 3585 penny stocks with strong financials making waves with robust financials and growth potential you won’t want to overlook.

- Seize the chance to ride the artificial intelligence surge by browsing these 25 AI penny stocks propelling innovation and transforming how key industries operate.

- Capture reliable cash flow and steady returns when you review these 19 dividend stocks with yields > 3% featuring strong yields and consistency even in changing markets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AIZ

Assurant

Provides protection services to connected devices, homes, and automobiles in North America, Latin America, Europe, and the Asia Pacific.

Solid track record established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion