- United States

- /

- Insurance

- /

- NYSE:AIG

A Look at AIG’s Valuation After Strong Q3 Earnings and Ongoing Shareholder Returns

Reviewed by Simply Wall St

American International Group, Inc. just reported its third-quarter results, delivering an increase in net income and earnings per share over last year. In addition, the company affirmed its quarterly dividend and continued robust share repurchases.

See our latest analysis for American International Group.

AIG’s latest earnings beat and commitment to dividends have come in the wake of a year defined by steady, if unspectacular, momentum. The 1-year total shareholder return sits at 3.99%, while its share price has climbed 5.41% year-to-date. This suggests the market is rewarding consistent profitability but waiting for a more decisive growth signal.

If you’re wondering where the next momentum story might be taking shape, now is a perfect time to broaden your search and discover fast growing stocks with high insider ownership

With shares currently trading at a notable discount to analysts’ targets and solid but steady financial growth, the big question is whether investors are looking at an undervalued opportunity or if future gains are already reflected in the price.

Most Popular Narrative: 12.9% Undervalued

The most widely tracked narrative implies American International Group's fair value is $88.28, which is higher than its most recent close just under $77. This valuation points to upside potential based on expectations of future earnings growth and operational improvements.

The acceleration of digitalization and artificial intelligence initiatives, such as the Gen AI deployment across underwriting and claims, positions AIG to enhance operational efficiency, improve underwriting precision, reduce fraud, and offer more tailored insurance products. These factors may support improved net margins and sustained earnings growth.

Curious how new tech and operational bets could drive up margins and change the growth outlook? The basis for this valuation is built on bold financial forecasts and a different approach to profit assumptions. Want to discover the surprising levers that analysts believe justify that higher target price? Take a look at the full narrative for the details the market is watching.

Result: Fair Value of $88.28 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy reliance on core segments and rising climate-driven catastrophe losses could threaten AIG’s growth outlook if these risks materialize in the years ahead.

Find out about the key risks to this American International Group narrative.

Another View: Are Shares Really That Cheap?

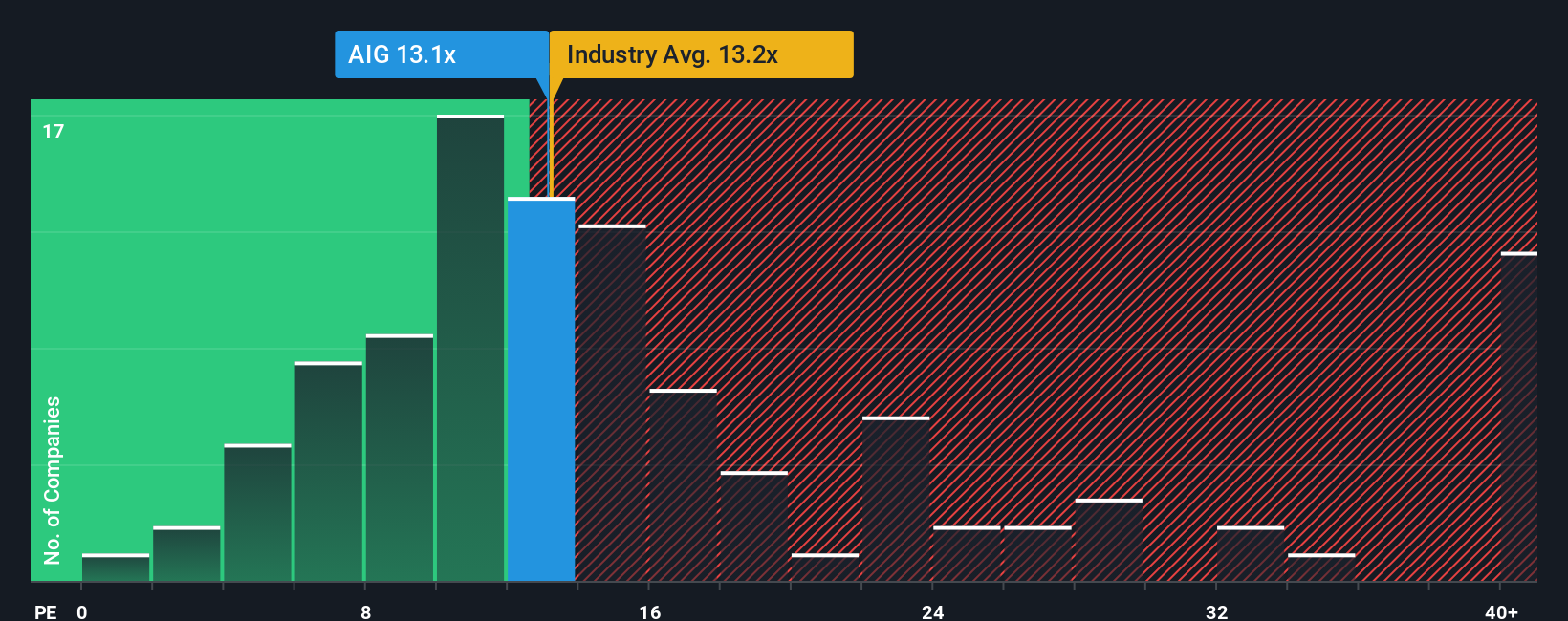

Looking at the company's price-to-earnings ratio offers another angle. American International Group trades at 12.6x earnings, which is more expensive than peers (10.6x) but cheaper than the broader US Insurance industry (13.1x). However, compared to the fair ratio of 13.3x, there is room for the market to re-rate the shares. Could future momentum justify a higher multiple, or is there more risk than meets the eye?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own American International Group Narrative

If you'd rather chart your own course or follow a different perspective, you can investigate the numbers yourself and assemble your own narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding American International Group.

Looking for more investment ideas?

Don't let opportunity pass you by. Some of the market's most exciting trends are hiding in plain sight, just waiting for savvy investors like you to act.

- Unlock steady income streams by checking out these 16 dividend stocks with yields > 3% with attractive yields supported by reliable financials.

- Seize the chance to get ahead in tech by finding these 24 AI penny stocks leading in artificial intelligence and automation breakthroughs.

- Capitalize on value before the crowd with these 870 undervalued stocks based on cash flows that remain underpriced based on strong fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AIG

American International Group

Offers insurance products for commercial, institutional, and individual customers in North America and internationally.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives