- United States

- /

- Insurance

- /

- NYSE:AFL

Does Diverging Aflac (AFL) Earnings and Revenue Outlook Reveal Shifting Fundamentals?

Reviewed by Sasha Jovanovic

- In its latest quarterly preview, analysts forecast that Aflac's earnings per share will decline by 16.7% year over year to $1.80, while revenues are expected to see a very large annual increase of 52.2%.

- Revisions in these earnings estimates have recently highlighted shifting analyst views, especially regarding performance expectations in Aflac's core Japanese and U.S. segments.

- We will explore how analysts' downward earnings revisions ahead of the report may affect Aflac's investment outlook and risk assessment.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Aflac Investment Narrative Recap

To be an Aflac shareholder today, you have to believe the company can offset stagnant premium growth and earnings pressure in Japan with its digital initiatives, new product launches, and US segment momentum. The latest analyst earnings downgrade reflects ongoing challenges in Aflac’s largest market, but the jump in revenue forecasts suggests fluctuations from investment activity, not core business reversal, so the short-term investment thesis or primary risk hasn’t dramatically shifted yet.

The recent buyback authorization, expanding the program by 100 million shares, is especially relevant, as it signals Aflac’s commitment to capital return even as analysts temper near-term profit growth. While buybacks can support shareholder value, they do little to address the core challenge of reviving sustainable premium and earnings growth in Japan, which remains a pivotal catalyst for investor confidence.

However, when the yen weakens sharply or investment returns lag, investors should know that...

Read the full narrative on Aflac (it's free!)

Aflac's narrative projects $18.5 billion in revenue and $3.8 billion in earnings by 2028. This requires 5.1% yearly revenue growth and a $1.4 billion increase in earnings from the current $2.4 billion.

Uncover how Aflac's forecasts yield a $110.00 fair value, a 3% upside to its current price.

Exploring Other Perspectives

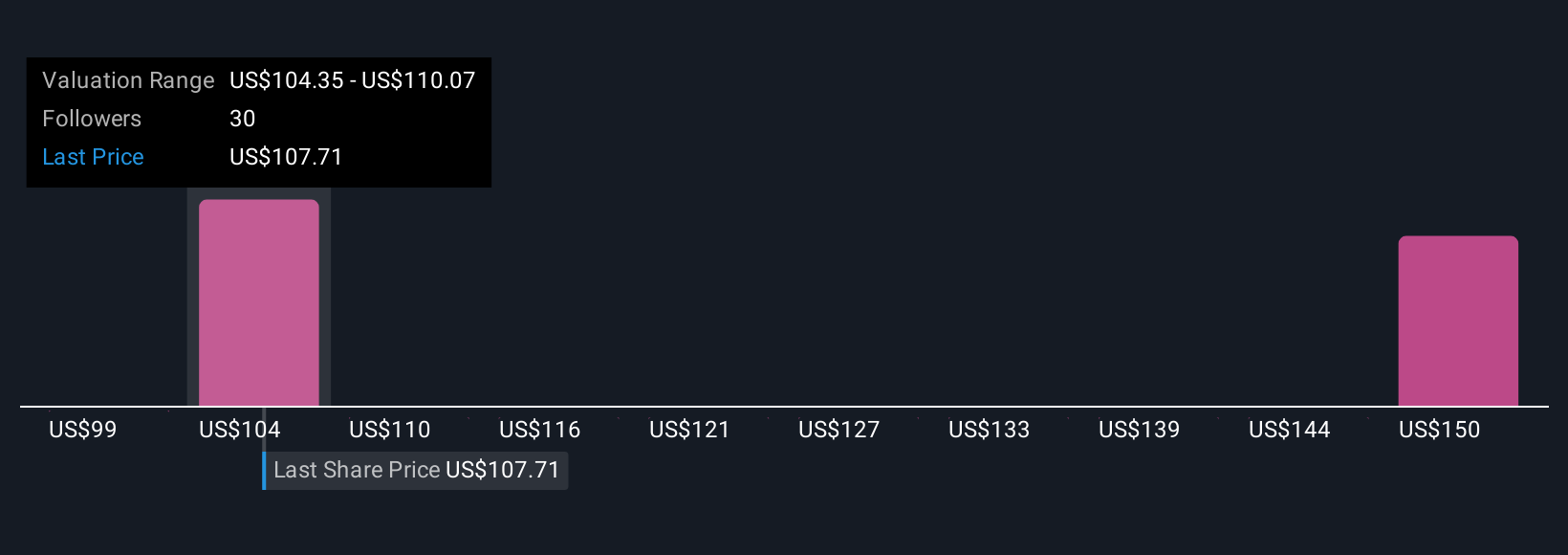

Simply Wall St Community members provided three fair value estimates for Aflac ranging from US$98.64 to US$155.52 per share. While opinions vary widely, ongoing weakness in Japanese premium growth could weigh on sentiment across this broad spectrum of investor outlooks.

Explore 3 other fair value estimates on Aflac - why the stock might be worth as much as 45% more than the current price!

Build Your Own Aflac Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Aflac research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Aflac research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Aflac's overall financial health at a glance.

Interested In Other Possibilities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AFL

Aflac

Through its subsidiaries, provides supplemental health and life insurance products.

Established dividend payer with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives