- United States

- /

- Insurance

- /

- NYSE:AFL

Aflac (AFL): Assessing Valuation Following Board-Approved Dividend Increase

Reviewed by Simply Wall St

Aflac (AFL) has just announced a 5% increase to its quarterly dividend, boosting payouts for investors and underscoring management’s emphasis on rewarding shareholders. Moves like this typically suggest solid financial footing and a positive company outlook.

See our latest analysis for Aflac.

Aflac’s latest 5% dividend boost comes after some meaningful corporate actions, including the launch of a children’s book aligned with its longstanding cancer care initiatives. While recent trading has seen some volatility, the year-to-date share price return stands at a solid 8%. The company’s three- and five-year total shareholder returns, at 64% and 172% respectively, indicate enduring momentum and long-term value creation for investors.

If news like this has you thinking bigger, now’s the perfect time to widen your perspective and discover fast growing stocks with high insider ownership

With Aflac’s shares trading near analysts’ price targets and recent gains reflecting continued business strength, the question remains: is there still value left for investors, or has the market already factored in the company’s future growth?

Most Popular Narrative: 40% Undervalued

With Aflac shares closing at $110.55 and the most closely watched narrative assigning a fair value of $111, the stock is seen as attractively priced compared to its underlying fundamentals. The stage is set for a closer look at the drivers behind this narrative.

The successful launch of new, customizable cancer insurance (Miraito) in Japan, coupled with strong early sales across all distribution channels including banks and Japan Post, positions Aflac to capture growing demand for supplemental health coverage among aging and younger consumers. This supports topline revenue and premium growth.

How did analysts arrive at this fair value? One key input is future earnings growth powered by margin expansion and market reach. The real surprise is that the projections behind this price rely on profit multiples that break from industry norms. Unpack the numbers to see how Aflac’s fundamentals and forward-looking assumptions shape this bold valuation.

Result: Fair Value of $111 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing declines in Japan’s net earned premiums and persistent currency fluctuations could quickly challenge the current outlook as well as Aflac’s growth trajectory.

Find out about the key risks to this Aflac narrative.

Another View: Multiples Tell a Different Story

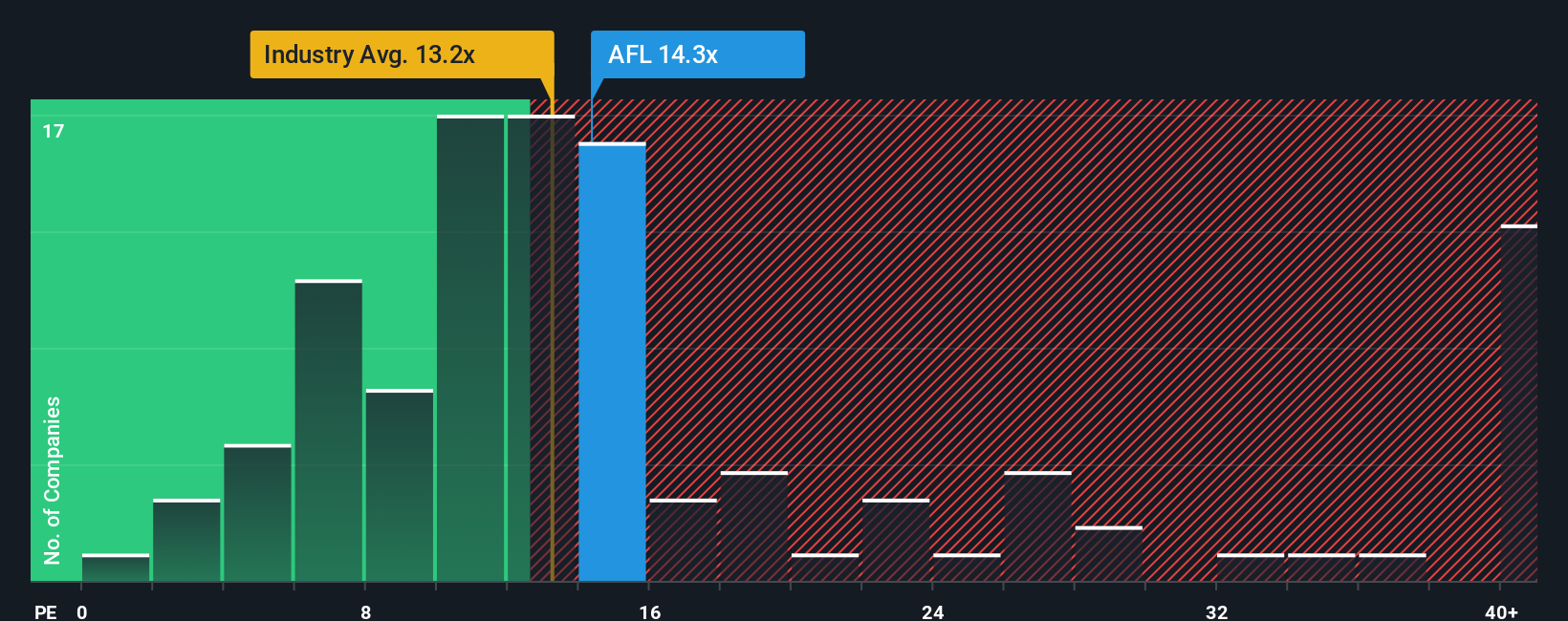

Looking at Aflac’s price-to-earnings ratio of 13.9x, the company appears pricey compared to both its peers (13.2x) and the broader US Insurance industry (12.7x). This ratio is also above the fair ratio of 12.2x set by our market regression, suggesting that investors may be paying a premium. Does this raise potential risks if market sentiment shifts, or does Aflac’s stability warrant the higher valuation?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Aflac Narrative

If you see the numbers differently or want to dig deeper on your own, you can craft your own perspective in just a few minutes, too: Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Aflac.

Looking for More Investment Ideas?

Why limit your strategy to one company when some of today’s biggest opportunities are just a few clicks away? Don’t miss this chance to target up-and-coming sectors and resilient performers with the Simply Wall Street Screener.

- Uncover hidden gems with strong financials by checking out these 3609 penny stocks with strong financials making major waves across the market.

- Supercharge your returns by tapping into the most promising names with these 916 undervalued stocks based on cash flows that stand out for solid cash flow and growth potential.

- Gain early insight into the next wave of innovation through these 25 AI penny stocks set to transform industries with advanced, real-world applications.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AFL

Aflac

Through its subsidiaries, provides supplemental health and life insurance products.

Established dividend payer with acceptable track record.

Similar Companies

Market Insights

Community Narratives