- United States

- /

- Insurance

- /

- NYSE:AFG

Does American Financial Group’s Specialty Market Expansion Signal Opportunity After Recent Price Swings?

Reviewed by Bailey Pemberton

- Wondering if American Financial Group still offers value at its current price? You are not alone. It is a good time to take a closer look at what the numbers say.

- The stock has seen some swings lately, climbing 4.1% over the last week but sliding 8.5% in the past month. This might spark questions about growth potential or changes in risk perception.

- Recent headlines about the insurance industry’s broader outlook and American Financial Group’s expansion into new specialty markets have added fuel to the discussion around the stock’s direction. These updates are keeping both bulls and bears engaged as investors weigh what these industry shifts could mean in the months ahead.

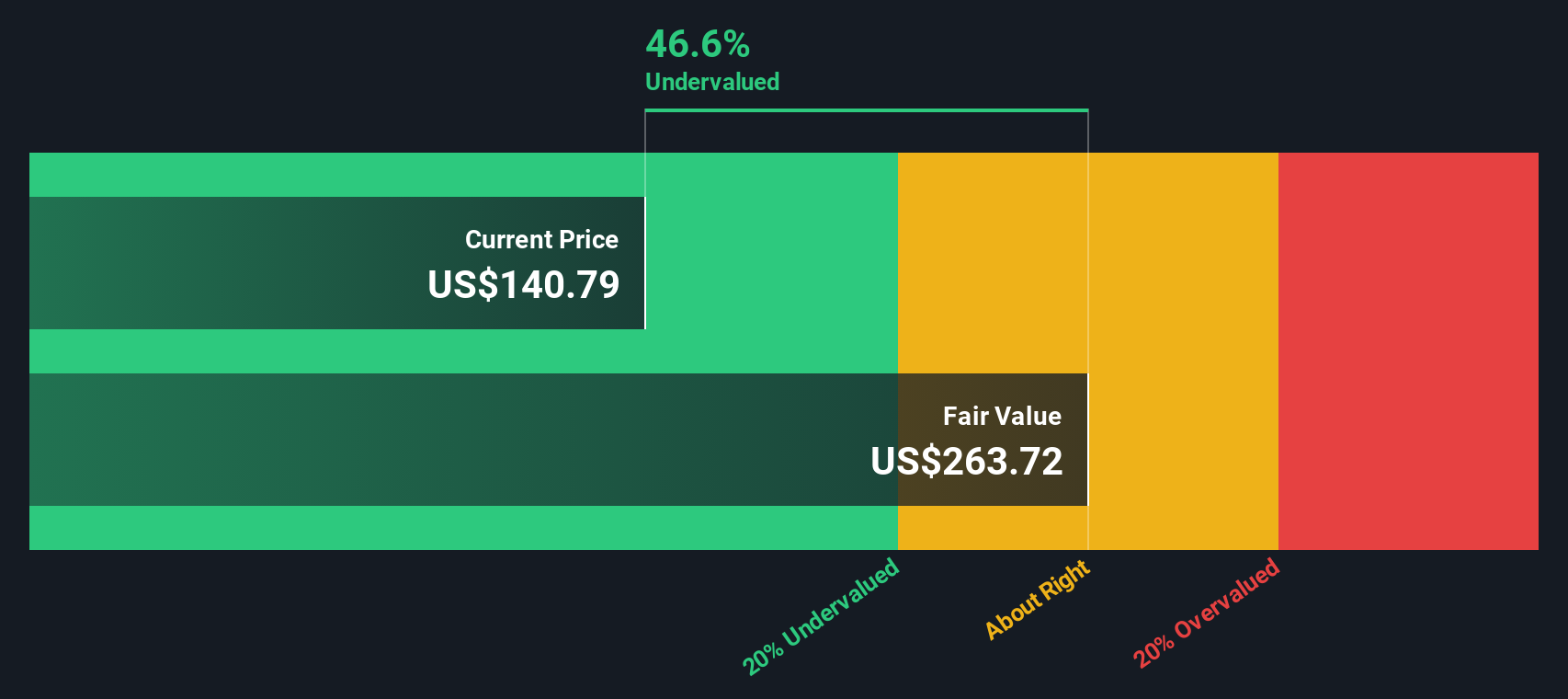

- On our valuation checklist, American Financial Group scores 2 out of 6 for being undervalued. There is definitely more to unpack about how the market rates this business. Next up, we will explore the standard valuation methods, so be sure to stick around for an even deeper insight into what those numbers really mean.

American Financial Group scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: American Financial Group Excess Returns Analysis

The Excess Returns valuation model estimates a company's intrinsic value by analyzing the profit a business generates above its cost of equity capital. This approach focuses on how efficiently American Financial Group puts shareholders’ money to work and whether its returns exceed what investors could earn taking similar risk elsewhere.

For American Financial Group, the numbers tell a compelling story. The company boasts a book value of $54.16 per share and a stable earnings per share of $12.69, as projected by four analysts using future return on equity estimates. The cost of equity is $4.38 per share, so the excess return, the profit over and above this hurdle, is a solid $8.31 per share. Notably, the average return on equity stands at an impressive 19.65%, a sign of strong capital efficiency. The stable book value is forecasted to rise to $64.57 per share, again drawing on consensus from four analysts.

Based on these fundamentals, the Excess Returns model calculates the stock's intrinsic value at $289.49 per share. With the current market price trading roughly 53.3% below this figure, American Financial Group appears significantly undervalued by this measure.

Result: UNDERVALUED

Our Excess Returns analysis suggests American Financial Group is undervalued by 53.3%. Track this in your watchlist or portfolio, or discover 849 more undervalued stocks based on cash flows.

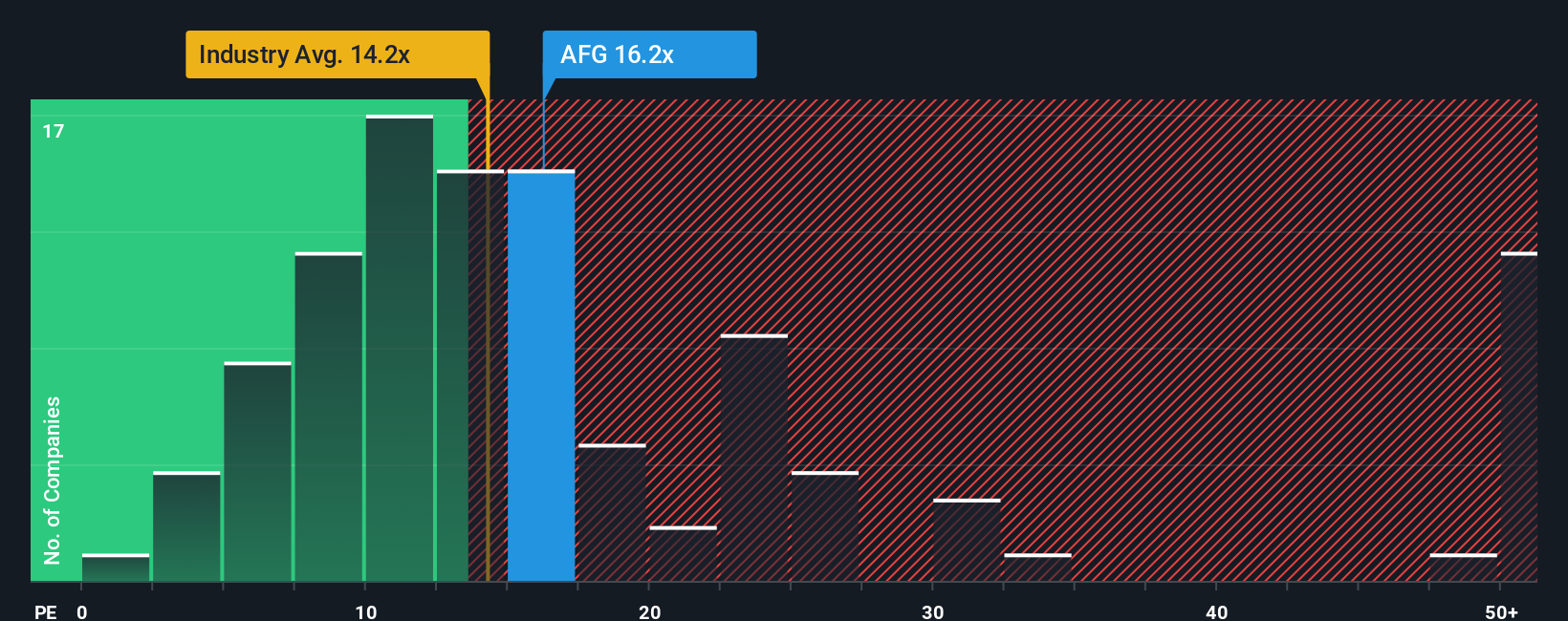

Approach 2: American Financial Group Price vs Earnings

The price-to-earnings (PE) ratio is widely regarded as the go-to valuation measure for profitable companies like American Financial Group. It helps investors gauge how much the market is willing to pay for each dollar of earnings, offering a clear window into market expectations and sentiment around future profits.

Generally, a “fair” PE ratio is influenced by both the company’s expected growth and the risks it faces. Firms with higher forecasted growth or more stable earnings often command loftier PE ratios. Riskier or slower-growing businesses typically trade at lower multiples.

American Financial Group is currently trading at a PE ratio of 14.76x. For context, the average PE among industry peers is 11.74x, and the broader insurance sector clocks in at 13.58x. These numbers indicate that American Financial Group commands a premium to both peers and the industry, likely reflecting its robust profit growth and strong track record.

However, to arrive at a more tailored benchmark, Simply Wall St’s proprietary “Fair Ratio” considers not just peer and industry averages but also multiple factors unique to American Financial Group, such as its future earnings growth, risk profile, profit margins, market capitalization, and industry dynamics. In this case, the Fair Ratio for American Financial Group is 14.67x, providing a nuanced and up-to-date yardstick for comparison.

Comparing the company’s actual PE (14.76x) to the Fair Ratio (14.67x) shows they are nearly identical. This suggests the stock is priced roughly in line with what all the key metrics would justify today.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1407 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your American Financial Group Narrative

Earlier, we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is a simple story that you, as an investor, create based on your own perspective about American Financial Group’s future. This could include the numbers you expect it to reach (like revenues, profit margins, or fair value) and the reasons why. Each Narrative not only connects what’s happening in the business or industry to a financial forecast, it also leads to a fair value estimate, giving you a clear, logical link between your beliefs and a price target.

On Simply Wall St’s Community page, Narratives are an easy and powerful tool, used by millions of investors, to clarify their thinking and share their view of where a stock might be headed. Narratives help you decide when to buy or sell by comparing your Fair Value to the current Price, and they update automatically whenever new news, results, or insights emerge so you always stay current.

For instance, with American Financial Group, one investor might be bullish, seeing catalysts like steady dividends, new business lines, and digital transformation, leading them to a Narrative fair value as high as $155 per share. Meanwhile, another more cautious investor could highlight risks from catastrophe losses or business concentration, arriving at a fair value closer to $124. Narratives embrace both outlooks, helping you act with conviction when your own fair value and the market price diverge.

Do you think there's more to the story for American Financial Group? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AFG

American Financial Group

An insurance holding company, provides specialty property and casualty insurance products in the United States.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives