- United States

- /

- Insurance

- /

- NasdaqGS:WTW

Did WTW’s AI-Powered Radar 5 and Snowflake Integration Just Shift Willis Towers Watson’s Investment Narrative?

Reviewed by Sasha Jovanovic

- Earlier this month, Willis Towers Watson announced the launch of Radar 5, an enhanced insurance analytics platform featuring generative AI and cloud-based SaaS capabilities, alongside the introduction of the Radar Connector for Snowflake to streamline secure, direct data access and analysis for insurance clients.

- These advancements represent a material push toward accelerated, data-driven decision-making in insurance analytics, specifically addressing the sector’s need for efficiency, scalability, and improved risk assessment in an increasingly complex data landscape.

- With the launch of direct Snowflake integration, let’s explore how WTW’s investment narrative could shift to reflect this innovation in insurance analytics.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Willis Towers Watson Investment Narrative Recap

To be a shareholder in Willis Towers Watson, you need to believe that technology-led innovation and scalable analytics solutions will keep the company differentiated and enable it to defend its margins, even as competition and digital disruption in insurance consulting intensify. The recent roll-out of Radar 5 and the Radar Connector for Snowflake stands out as an incremental improvement, potentially supporting key short-term catalysts around margin expansion and new business wins, though the core risks of fee compression from commoditization remain material.

Among recent announcements, the launch of Radar 5 is highly relevant: by adding generative AI and real-time analytics capabilities, WTW deepens its value proposition in a competitive market hungry for efficiency and differentiated insight. This aligns closely with the idea that unlocking productivity through advanced analytics is a meaningful business driver, especially as clients seek greater speed and accuracy in risk modeling and decision-making.

But in contrast, investors should also be aware that faster digital adoption in insurance may bring WTW’s premium services under greater pricing pressure as...

Read the full narrative on Willis Towers Watson (it's free!)

Willis Towers Watson's narrative projects $10.9 billion in revenue and $2.5 billion in earnings by 2028. This requires 3.7% yearly revenue growth and a $2.36 billion increase in earnings from the current $137 million.

Uncover how Willis Towers Watson's forecasts yield a $374.44 fair value, a 13% upside to its current price.

Exploring Other Perspectives

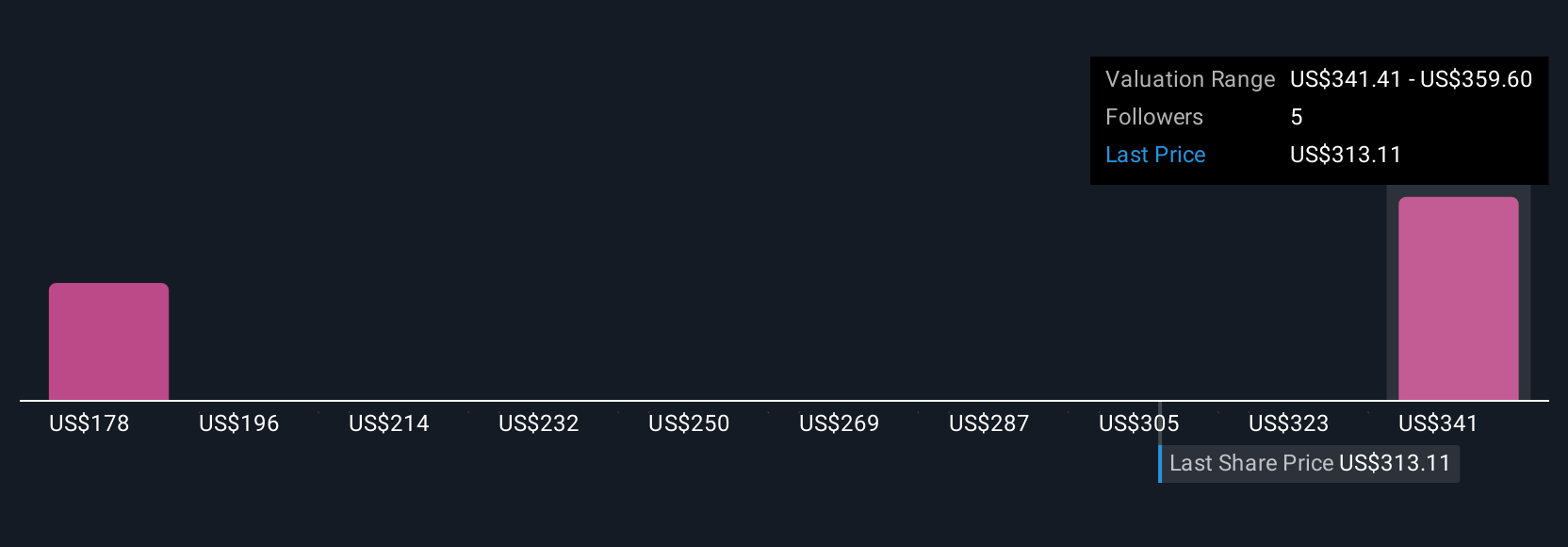

Simply Wall St Community members contributed 2 fair value estimates for WTW ranging from US$374.44 to US$383.32 per share. While these opinions point to a narrow spread, remember that concerns about fee compression from digital automation could reshape outcomes for all market participants.

Explore 2 other fair value estimates on Willis Towers Watson - why the stock might be worth as much as 16% more than the current price!

Build Your Own Willis Towers Watson Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Willis Towers Watson research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Willis Towers Watson research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Willis Towers Watson's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Willis Towers Watson might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WTW

Willis Towers Watson

Operates as an advisory, broking, and solutions company worldwide.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives