- United States

- /

- Insurance

- /

- NasdaqGM:TRUP

Trupanion (TRUP): Examining the Valuation After Latest Earnings Report and Recent Share Price Moves

Reviewed by Simply Wall St

Trupanion (TRUP) has recently seen some movement in its stock price following its latest earnings report. Investors are assessing how the company’s revenue and net income growth might influence its performance in the coming months.

See our latest analysis for Trupanion.

Trupanion's share price has struggled to hold momentum this year, with a 1-day gain of 1.29% barely making a dent in what’s been a tough stretch. Its year-to-date share price return is down 23.6%, and the 1-year total shareholder return sits at -30.5%. These numbers hint that despite some solid earnings growth, the market still sees meaningful risks or needs more proof before bidding the shares higher for the long term.

If you want to keep an eye on companies that may be building momentum, now is a great time to broaden your search and discover fast growing stocks with high insider ownership

With Trupanion’s stock still trading nearly 49% below the average analyst price target despite healthy revenue and profit growth, the key question is whether investors are overlooking a bargain or if the market is already factoring in all the upside potential.

Most Popular Narrative: 34.8% Undervalued

Trupanion’s latest widely-followed narrative pins its fair value well above the recent closing price. This gap is driven by ambitious future projections and confidence in the company’s ability to optimize growth levers. The valuation relies heavily on the company converting operational improvements and efficiency gains into stronger financial performance, creating a critical growth story.

Improved underwriting discipline, focus on higher lifetime value pets, and optimization of acquisition channels are driving higher-quality book growth and supporting strong free cash flow. This is setting up the company for scalable and more profitable expansion in the coming years.

What’s fueling all this optimism? The key factors behind this valuation include operational upgrades, margin expansion, and a playbook for repeatable growth. Want to see how all the bold analyst assumptions come together for this price tag? Unlock the full breakdown in the full narrative.

Result: Fair Value of $56.5 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, stalled subscriber growth or rising customer price sensitivity could quickly challenge the optimistic case and reduce Trupanion’s long-term upside potential.

Find out about the key risks to this Trupanion narrative.

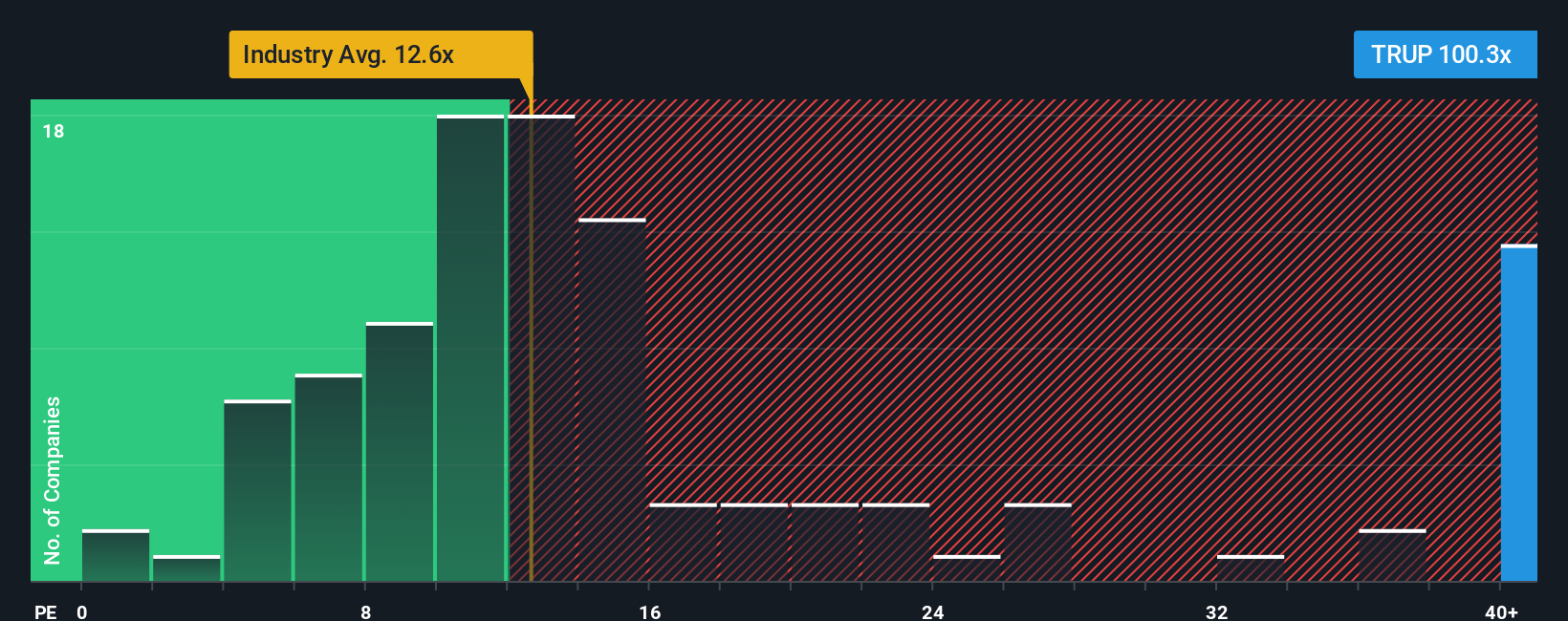

Another View: Market Ratios Offer a Stark Reality Check

While analysts see upside in Trupanion’s shares, the company’s current price-to-earnings ratio tells a more cautious story. Trading at 102.9x, it is far higher than both the insurance industry average of 12.9x and peers at 11.6x. It also stands well above the fair ratio of 21.2x. This wide gap raises questions about whether the market is pricing in too much optimism or if future growth can justify such lofty multiples. Are investors ready to pay up for future potential, or does this signal valuation risk that is easy to overlook?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Trupanion Narrative

If you have a different perspective or want to investigate the numbers for yourself, you can shape your own view in just a few minutes. Do it your way

A great starting point for your Trupanion research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Moves?

Don’t let opportunity pass by. Expand your strategy and uncover standout stocks that fit your unique goals with our tailored screeners below:

- Accelerate your hunt for hidden gems that have robust cash flows by checking out these 904 undervalued stocks based on cash flows that could be trading at a discount right now.

- Unlock growth potential by targeting these 27 AI penny stocks benefiting from advances in artificial intelligence and automation across industries.

- Boost your portfolio’s income with these 18 dividend stocks with yields > 3% designed to spotlight strong yields above 3% for reliable returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Trupanion might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:TRUP

Trupanion

Provides medical insurance for cats and dogs on subscription basis in the United States, Canada, Continental Europe, and Australia.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives