- United States

- /

- Insurance

- /

- NasdaqGM:TRUP

A Piece Of The Puzzle Missing From Trupanion, Inc.'s (NASDAQ:TRUP) 27% Share Price Climb

Despite an already strong run, Trupanion, Inc. (NASDAQ:TRUP) shares have been powering on, with a gain of 27% in the last thirty days. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 41% in the last twelve months.

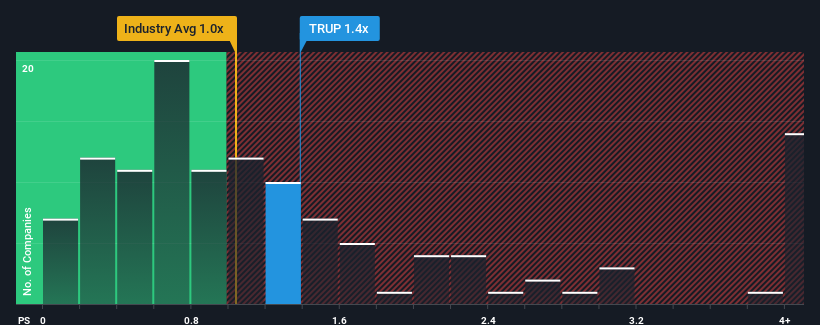

In spite of the firm bounce in price, there still wouldn't be many who think Trupanion's price-to-sales (or "P/S") ratio of 1.4x is worth a mention when the median P/S in the United States' Insurance industry is similar at about 1x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Trupanion

How Trupanion Has Been Performing

Trupanion certainly has been doing a good job lately as it's been growing revenue more than most other companies. One possibility is that the P/S ratio is moderate because investors think this strong revenue performance might be about to tail off. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Want the full picture on analyst estimates for the company? Then our free report on Trupanion will help you uncover what's on the horizon.How Is Trupanion's Revenue Growth Trending?

In order to justify its P/S ratio, Trupanion would need to produce growth that's similar to the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 24%. The latest three year period has also seen an excellent 128% overall rise in revenue, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing revenue over that time.

Shifting to the future, estimates from the seven analysts covering the company suggest revenue should grow by 11% per year over the next three years. With the industry only predicted to deliver 6.6% per annum, the company is positioned for a stronger revenue result.

In light of this, it's curious that Trupanion's P/S sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Key Takeaway

Its shares have lifted substantially and now Trupanion's P/S is back within range of the industry median. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Despite enticing revenue growth figures that outpace the industry, Trupanion's P/S isn't quite what we'd expect. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

Having said that, be aware Trupanion is showing 1 warning sign in our investment analysis, you should know about.

If these risks are making you reconsider your opinion on Trupanion, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Trupanion might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:TRUP

Trupanion

Provides medical insurance for cats and dogs on subscription basis in the United States, Canada, Continental Europe, and Australia.

Adequate balance sheet with questionable track record.

Similar Companies

Market Insights

Community Narratives