- United States

- /

- Insurance

- /

- NasdaqCM:TIPT

Don't Buy Tiptree Inc. (NASDAQ:TIPT) For Its Next Dividend Without Doing These Checks

Some investors rely on dividends for growing their wealth, and if you're one of those dividend sleuths, you might be intrigued to know that Tiptree Inc. (NASDAQ:TIPT) is about to go ex-dividend in just 3 days. If you purchase the stock on or after the 19th of March, you won't be eligible to receive this dividend, when it is paid on the 29th of March.

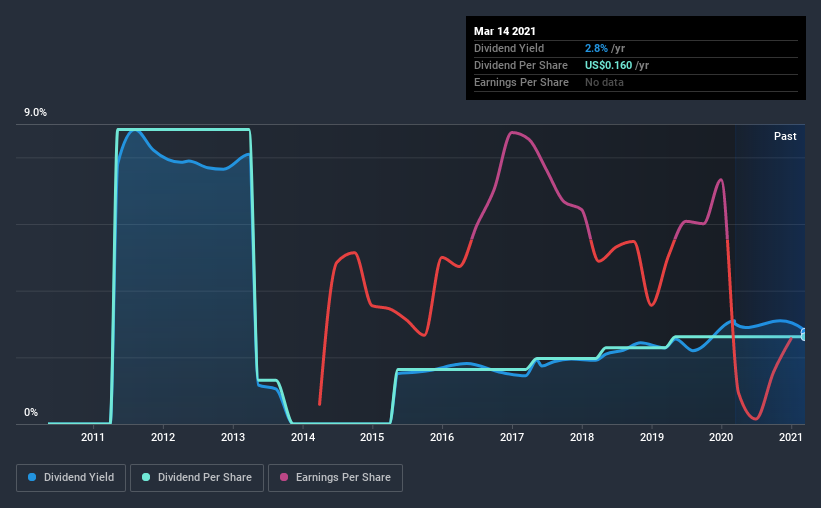

Tiptree's upcoming dividend is US$0.04 a share, following on from the last 12 months, when the company distributed a total of US$0.16 per share to shareholders. Looking at the last 12 months of distributions, Tiptree has a trailing yield of approximately 2.8% on its current stock price of $5.81. Dividends are an important source of income to many shareholders, but the health of the business is crucial to maintaining those dividends. So we need to check whether the dividend payments are covered, and if earnings are growing.

View our latest analysis for Tiptree

If a company pays out more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. Tiptree's dividend is not well covered by earnings, as the company lost money last year. This is not a sustainable state of affairs, so it would be worth investigating if earnings are expected to recover.

Click here to see how much of its profit Tiptree paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

When earnings decline, dividend companies become much harder to analyse and own safely. If earnings fall far enough, the company could be forced to cut its dividend. Tiptree reported a loss last year, and the general trend suggests its earnings have also been declining in recent years, making us wonder if the dividend is at risk.

Another key way to measure a company's dividend prospects is by measuring its historical rate of dividend growth. Tiptree's dividend payments per share have declined at 11% per year on average over the past 10 years, which is uninspiring. While it's not great that earnings and dividends per share have fallen in recent years, we're encouraged by the fact that management has trimmed the dividend rather than risk over-committing the company in a risky attempt to maintain yields to shareholders.

We update our analysis on Tiptree every 24 hours, so you can always get the latest insights on its financial health, here.

Final Takeaway

Is Tiptree worth buying for its dividend? First, it's not great to see the company paying a dividend despite being loss-making over the last year. Worse, the general trend in its earnings looks negative in recent years. These characteristics don't generally lead to outstanding dividend performance, and investors may not be happy with the results of owning this stock for its dividend.

Having said that, if you're looking at this stock without much concern for the dividend, you should still be familiar of the risks involved with Tiptree. For example, Tiptree has 2 warning signs (and 1 which doesn't sit too well with us) we think you should know about.

A common investment mistake is buying the first interesting stock you see. Here you can find a list of promising dividend stocks with a greater than 2% yield and an upcoming dividend.

If you decide to trade Tiptree, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Tiptree might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqCM:TIPT

Tiptree

Through its subsidiaries, provides specialty insurance products and related services in the United States and Europe.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives