- United States

- /

- Insurance

- /

- NasdaqCM:TIPT

Dividend Investors: Don't Be Too Quick To Buy Tiptree Inc. (NASDAQ:TIPT) For Its Upcoming Dividend

Some investors rely on dividends for growing their wealth, and if you're one of those dividend sleuths, you might be intrigued to know that Tiptree Inc. (NASDAQ:TIPT) is about to go ex-dividend in just three days. The ex-dividend date is usually set to be one business day before the record date which is the cut-off date on which you must be present on the company's books as a shareholder in order to receive the dividend. It is important to be aware of the ex-dividend date because any trade on the stock needs to have been settled on or before the record date. Meaning, you will need to purchase Tiptree's shares before the 20th of May to receive the dividend, which will be paid on the 31st of May.

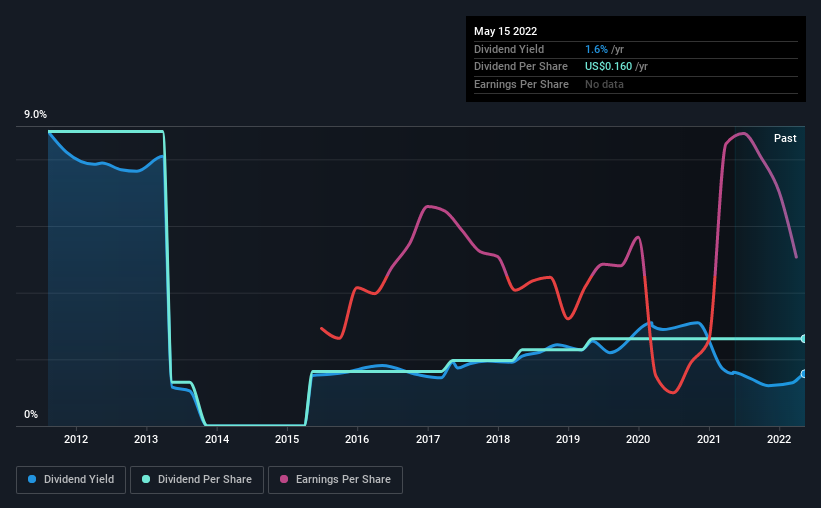

The company's upcoming dividend is US$0.04 a share, following on from the last 12 months, when the company distributed a total of US$0.16 per share to shareholders. Based on the last year's worth of payments, Tiptree stock has a trailing yield of around 1.6% on the current share price of $10.21. Dividends are an important source of income to many shareholders, but the health of the business is crucial to maintaining those dividends. So we need to investigate whether Tiptree can afford its dividend, and if the dividend could grow.

View our latest analysis for Tiptree

If a company pays out more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. Tiptree paid out 63% of its earnings to investors last year, a normal payout level for most businesses.

When a company paid out less in dividends than it earned in profit, this generally suggests its dividend is affordable. The lower the % of its profit that it pays out, the greater the margin of safety for the dividend if the business enters a downturn.

Click here to see how much of its profit Tiptree paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

When earnings decline, dividend companies become much harder to analyse and own safely. Investors love dividends, so if earnings fall and the dividend is reduced, expect a stock to be sold off heavily at the same time. With that in mind, we're discomforted by Tiptree's 23% per annum decline in earnings in the past five years. When earnings per share fall, the maximum amount of dividends that can be paid also falls.

The main way most investors will assess a company's dividend prospects is by checking the historical rate of dividend growth. Tiptree's dividend payments per share have declined at 11% per year on average over the past 10 years, which is uninspiring. While it's not great that earnings and dividends per share have fallen in recent years, we're encouraged by the fact that management has trimmed the dividend rather than risk over-committing the company in a risky attempt to maintain yields to shareholders.

The Bottom Line

Is Tiptree an attractive dividend stock, or better left on the shelf? We're not overly enthused to see Tiptree's earnings in retreat at the same time as the company is paying out more than half of its earnings as dividends to shareholders. All things considered, we're not optimistic about its dividend prospects, and would be inclined to leave it on the shelf for now.

Although, if you're still interested in Tiptree and want to know more, you'll find it very useful to know what risks this stock faces. To help with this, we've discovered 5 warning signs for Tiptree (1 is potentially serious!) that you ought to be aware of before buying the shares.

Generally, we wouldn't recommend just buying the first dividend stock you see. Here's a curated list of interesting stocks that are strong dividend payers.

Valuation is complex, but we're here to simplify it.

Discover if Tiptree might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:TIPT

Tiptree

Through its subsidiaries, provides specialty insurance products and related services in the United States and Europe.

Excellent balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.