- United States

- /

- Insurance

- /

- NasdaqGS:SKWD

Skyward Specialty Insurance Group (SKWD) Margin Miss Tests Bullish Valuation Narratives

Reviewed by Simply Wall St

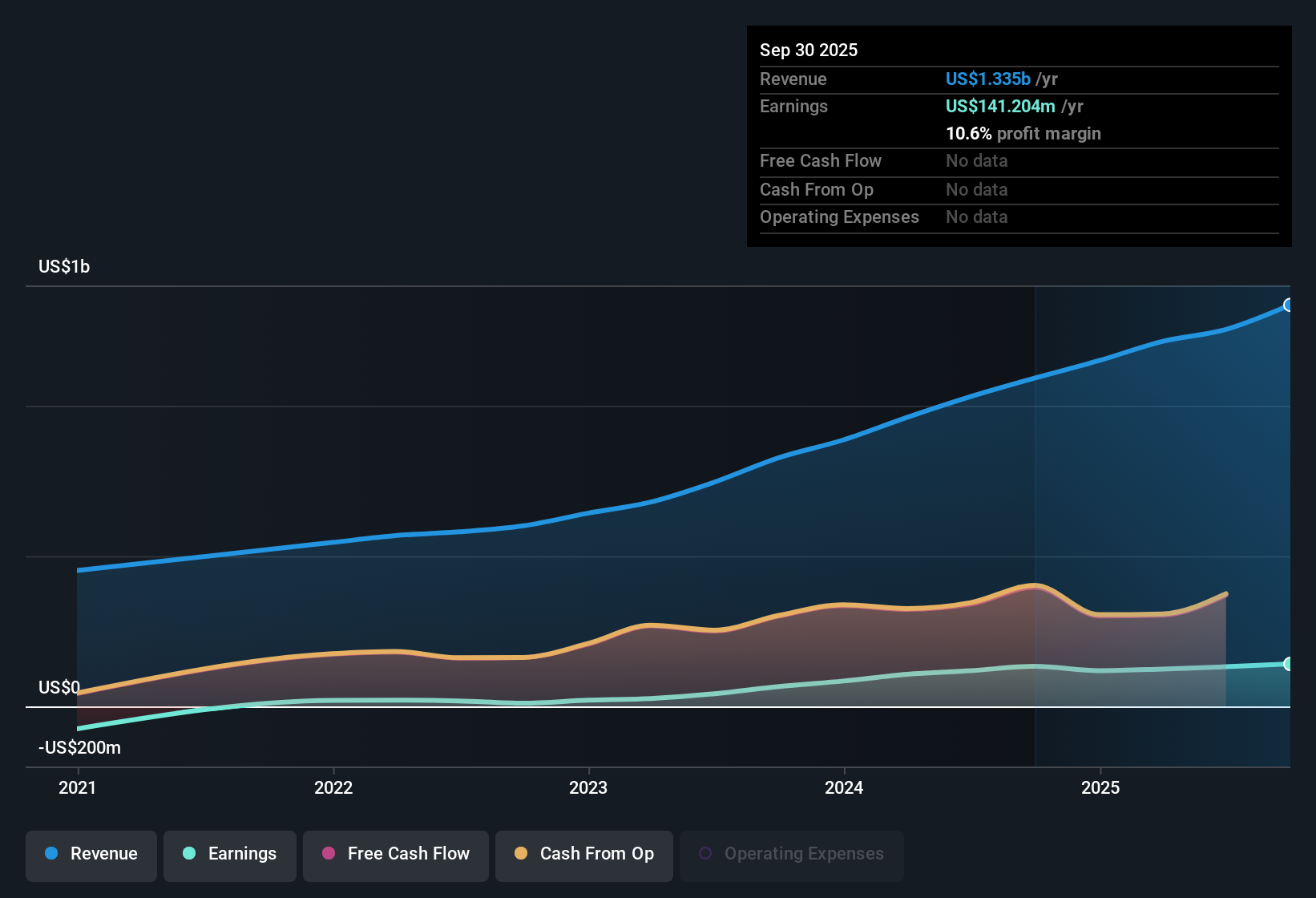

Skyward Specialty Insurance Group (SKWD) posted a net profit margin of 10.6%, down from 12.2% a year ago, while earnings for the past year grew 5.8%, which is substantially below its five-year average growth rate of 58.8% per year. With analysts now forecasting earnings growth of 19.33% and revenue growth of 13.6% per year, both beating broader US market estimates, investors are weighing the mix of decelerating margins against this robust outlook and Skyward’s lower-than-average price-to-earnings multiple.

See our full analysis for Skyward Specialty Insurance Group.Next, we will set these earnings results alongside the current market narratives to see where the numbers confirm consensus views and where they present a challenge to the status quo.

See what the community is saying about Skyward Specialty Insurance Group

PE Ratio Undercuts Peers by a Wide Margin

- Skyward's price-to-earnings ratio sits at 13.1x, lower than the US insurance industry average of 13.2x and far below the peer average of 51.1x. This signals the stock trades at a steep discount compared to similar companies.

- According to the analysts' consensus view, this discount is emphasized by the fact that the current share price of $45.64 is meaningfully under the average analyst price target of $61.60, as well as below the DCF fair value of $110.77.

- Consensus narrative points to attractive relative value based on these valuation gaps even as margins have slowed, suggesting investors may be pricing in future challenges more than the numbers justify.

- This tension highlights how Skyward’s lower valuation could become a tailwind if future growth and margin recovery materialize as forecasted.

See how the numbers stack up against the broader consensus narrative, with all the bullish and bearish views in one place. 📊 Read the full Skyward Specialty Insurance Group Consensus Narrative.

Growth Forecasts Outpace the Market

- Analysts expect Skyward’s earnings to grow at 19.33% per year and revenue to rise 13.6% annually, both ahead of broader US market forecasts (15.7% earnings, 10.3% revenue). This indicates that growth prospects remain a relative strength.

- Digging into the consensus narrative, analysts see investments in technology and AI, along with selective underwriting, as major drivers that set up Skyward to continue outgrowing commoditized rivals.

- An expected increase in profit margins, from 10.5% today to 12.1% in three years, supports the view that tech-enabled cycle management is helping insulate earnings from industry margin pressures.

- These growth drivers, combined with stable premium flows from strategic partnerships, heavily support the bullish case that future profitability can outpace both sector and peer averages despite current margin softness.

Profit Margin Slippage Tests Sustainability

- Net profit margin has slipped to 10.6% from 12.2% last year, a clear sign that while the company remains profitable, margin pressure is mounting.

- Analysts’ consensus narrative calls out eroding tech advantages and volatile investment returns as risks to watch, with several concrete challenges on the horizon.

- Ongoing pressures from softening market conditions and concentrated strategic partnerships could limit growth, and if Skyward’s tech edge is eroded, the competitive moat may narrow and press on future margins.

- Sustained volatility in alternative investments and disciplined underwriting pullbacks may constrain net income, even as top-line growth continues.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Skyward Specialty Insurance Group on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Spot an angle others might have missed? Share your unique perspective and craft your own narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding Skyward Specialty Insurance Group.

See What Else Is Out There

Skyward’s slipping profit margins and mounting pressure on earnings growth highlight a risk that consistency may be difficult to sustain if industry challenges intensify.

If stable performance is your top priority, use stable growth stocks screener (2112 results) to zero in on companies that reliably grow revenue and earnings, even when market headwinds pick up.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SKWD

Skyward Specialty Insurance Group

An insurance holding company, underwrites commercial property and casualty insurance products in the United States.

Very undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives