- United States

- /

- Insurance

- /

- NasdaqGS:PLMR

Palomar Holdings (PLMR) Is Up 12.3% After Strong Earnings and Risk Management Gains Has The Bull Case Changed?

Reviewed by Sasha Jovanovic

- On November 6, 2025, Palomar Holdings reported third quarter results showing revenue of US$244.66 million and net income of US$51.46 million, both sharply higher than the previous year, with basic earnings per share from continuing operations rising to US$1.93.

- A unique highlight from the announcement was the significant improvement in underwriting efficiency, as reflected by a better combined ratio and a substantial decrease in catastrophe loss ratio, underscoring effective risk management.

- We'll examine how Palomar Holdings' standout revenue and profitability improvements influence its investment narrative going forward.

We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Palomar Holdings Investment Narrative Recap

To be a Palomar Holdings shareholder, you need to believe in the company's ability to expand in specialty insurance while navigating the inherent volatility of catastrophe-exposed property lines. The most recent earnings release highlights strengthened underwriting and sharply improved profitability, which may lessen the immediate concern around earnings volatility from natural disasters, but does not materially change longer-term risks related to catastrophic event exposure or competitive pricing pressure.

Among several corporate actions, the announcement of a US$150 million share repurchase plan stands out. This plan, in the context of Palomar’s rising earnings and cash flows, signals confidence in financial stability and increases flexibility to support shareholder value, though it does not fully offset the sector’s underlying catastrophe and reinsurance cost risks.

Yet, against this backdrop of strong current results, investors should also keep in mind how quickly fortunes can shift when catastrophe claims spike and...

Read the full narrative on Palomar Holdings (it's free!)

Palomar Holdings' outlook projects $1.3 billion in revenue and $268.3 million in earnings by 2028. This scenario assumes a 23.0% annual revenue growth rate and an increase in earnings of $113.4 million from the current $154.9 million.

Uncover how Palomar Holdings' forecasts yield a $153.33 fair value, a 20% upside to its current price.

Exploring Other Perspectives

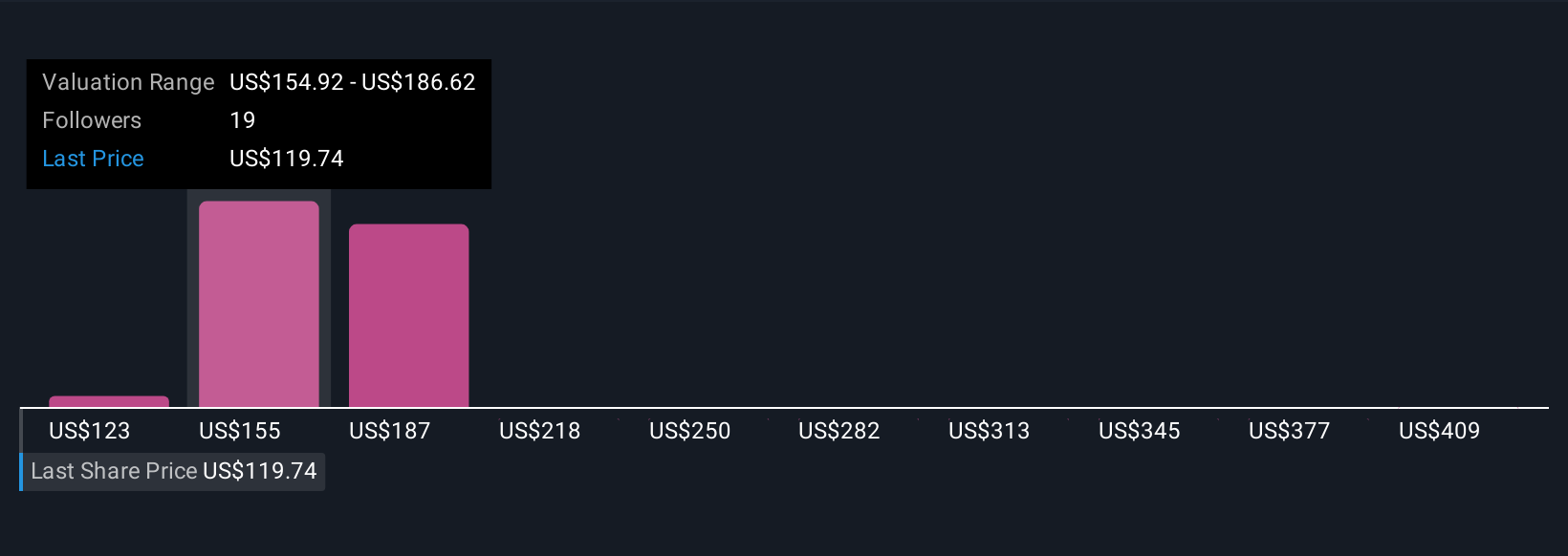

Five Simply Wall St Community members estimate Palomar’s fair value between US$148.30 and US$440.20 per share. While many see future growth potential, the company’s exposure to catastrophe risks adds important context that could influence outcomes if severe losses recur. Explore how other community perspectives might inform your approach.

Explore 5 other fair value estimates on Palomar Holdings - why the stock might be worth just $148.30!

Build Your Own Palomar Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Palomar Holdings research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Palomar Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Palomar Holdings' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PLMR

Palomar Holdings

A specialty insurance company, provides property and casualty insurance to individuals and businesses in the United States.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives